With a market cap of $32.1 billion, Kenvue Inc. (KVUE) is a global consumer health company focused on over-the-counter medicines, personal care, and skin health products. Headquartered in Summit, New Jersey, Kenvue was spun off from Johnson & Johnson (JNJ) in 2023 and owns a portfolio of widely recognized, heritage brands with strong market positions across everyday health categories.

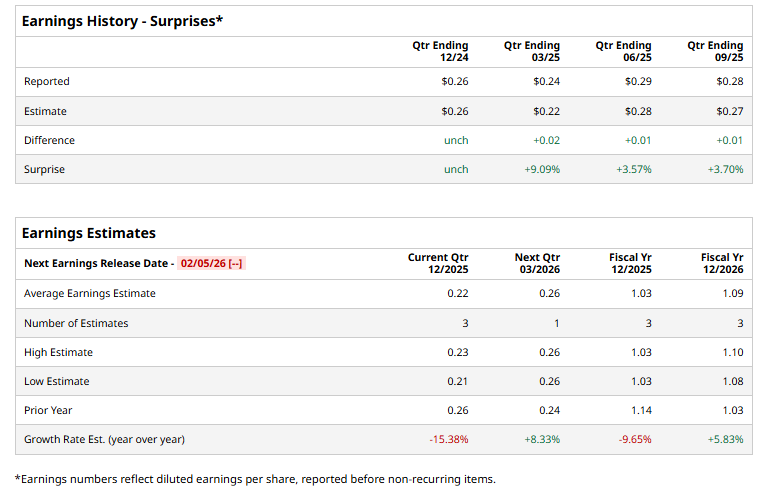

Kenvue is expected to announce its fourth-quarter results soon. Ahead of the event, analysts expect KVUE to report an adjusted EPS of $0.22, down 15.4% from $0.26 reported in the year-ago quarter. On a positive note, the company has a robust earnings surprise history. It has met or surpassed the Street’s bottom-line estimates in each of the past four quarters.

For fiscal 2025, Kenvue is expected to deliver an adjusted EPS of $1.03, down 9.7% from $1.14 reported in 2024. However, in fiscal 2026, its earnings are expected to rebound 5.8% year over year to $1.09 per share.

KVUE stock prices have plummeted 19.5% over the past 52 weeks, struggling to keep pace with the Consumer Staples Select Sector SPDR Fund’s (XLP) 1.4% dip and the S&P 500 Index’s ($SPX) 17% gains during the same time frame.

On Nov. 3, Kenvue shares surged 12.3% after Kimberly-Clark Corporation (KMB) announced an agreement to acquire the company in a cash-and-stock deal valuing Kenvue at approximately $48.7 billion. The acquisition brings together two major consumer brands, creating a broad portfolio of everyday health and personal care products with significant global reach.

Analysts remain cautious about the stock’s prospects. Kenvue has a consensus “Hold” rating overall, a step down from “Moderate Buy” rating three months ago. Of the 12 analysts covering the stock, opinions include two “Strong Buys” and ten “Holds.” Its mean price target of $19 suggests an 11.8% upside potential from current price levels.