/Johnson%20Controls%20International%20plc%20logo%20on%20building-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Valued at a market cap of $68 billion, Johnson Controls International plc (JCI) designs, manufactures, and services a wide range of products and systems, including HVAC equipment, building automation, fire detection and suppression, and security solutions, serving commercial, industrial, and institutional customers. The Cork, Ireland-based company is ready to announce its fiscal Q1 earnings for 2026 in the near future.

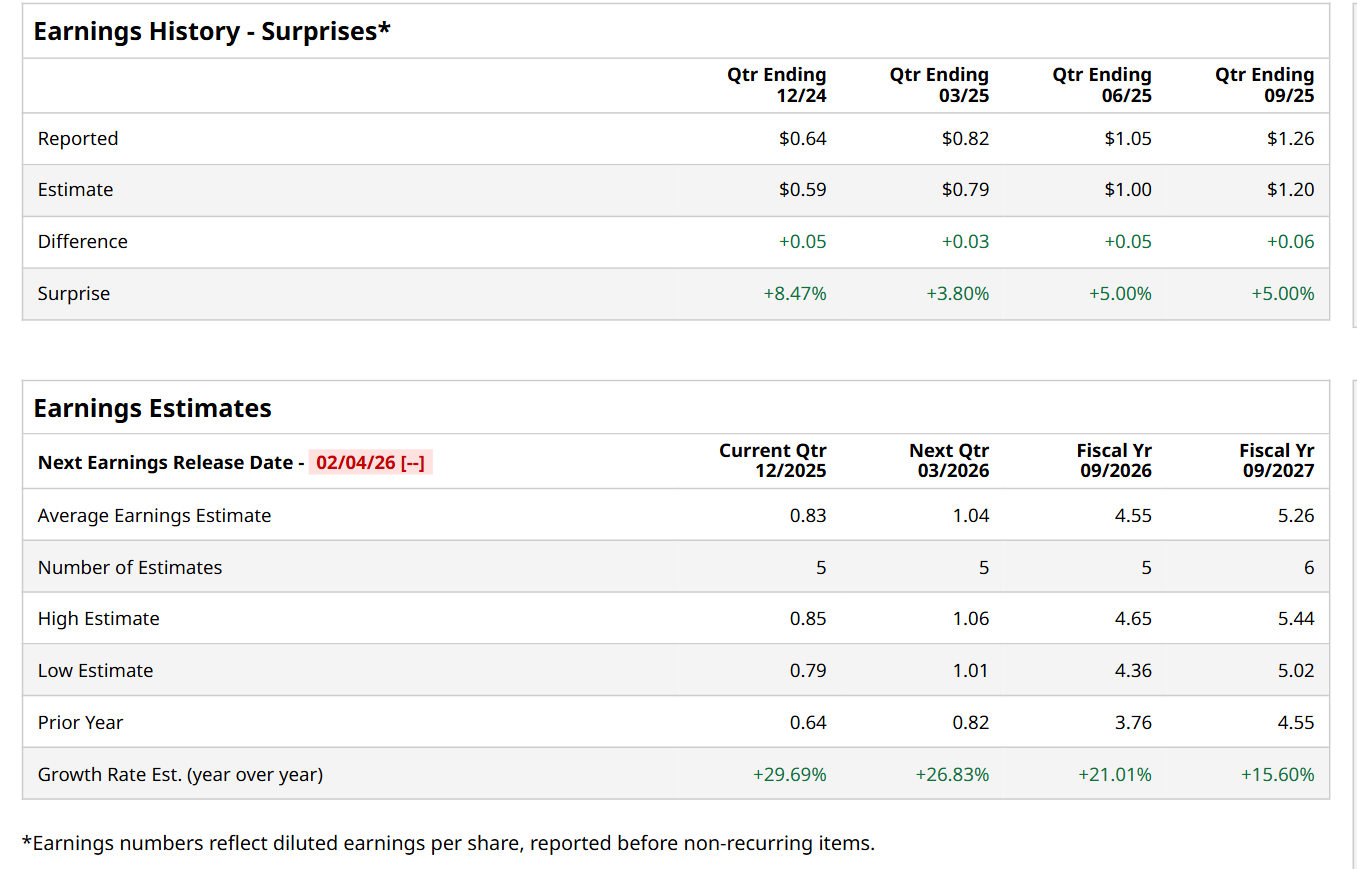

Before this event, analysts expect this industrial company to report a profit of $0.83 per share, up 29.7% from $0.64 per share in the year-ago quarter. The company has topped Wall Street’s bottom-line estimates in each of the last four quarters. In Q4, its EPS of $1.26 exceeded the consensus estimates by 5%.

For fiscal 2026, ending in September, analysts expect JCI to report a profit of $4.55 per share, up 21% from $3.76 per share in fiscal 2025. Furthermore, its EPS is expected to grow 15.6% year-over-year to $5.26 in fiscal 2027.

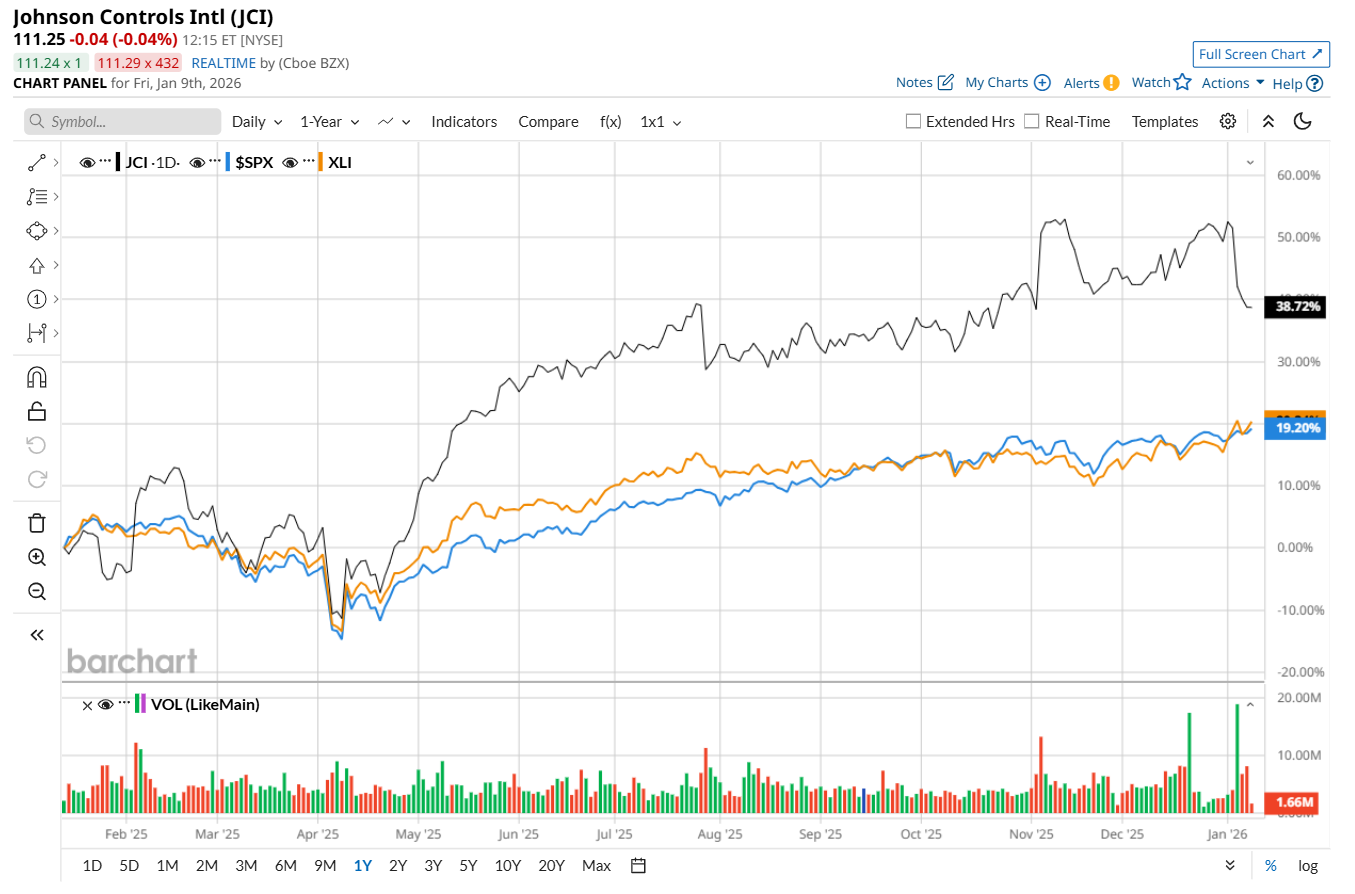

Shares of JCI have soared 39.2% over the past 52 weeks, considerably outperforming both the S&P 500 Index's ($SPX) 17.5% return and the State Street Industrial Select Sector SPDR ETF’s (XLI) 21.7% uptick over the same time period.

On Nov. 5, shares of JCI surged 8.8% after its impressive Q4 earnings release. The company’s total revenue improved 3.1% year-over-year to $6.4 billion, surpassing consensus estimates by 1.6%. Moreover, its adjusted EPS increased 13.5% from the year-ago quarter to $1.26, topping analyst expectations by 5%. Additionally, JCI initiated its fiscal 2026 guidance with projected adjusted earnings of approximately $4.55 per share, which came in above Wall Street's predictions, further bolstering investor confidence.

Wall Street analysts are moderately optimistic about JCI’s stock, with a "Moderate Buy" rating overall. Among 20 analysts covering the stock, 12 recommend "Strong Buy," and eight suggest "Hold.” The mean price target for JCI is $133.16, indicating a 19.4% potential upside from the current levels.