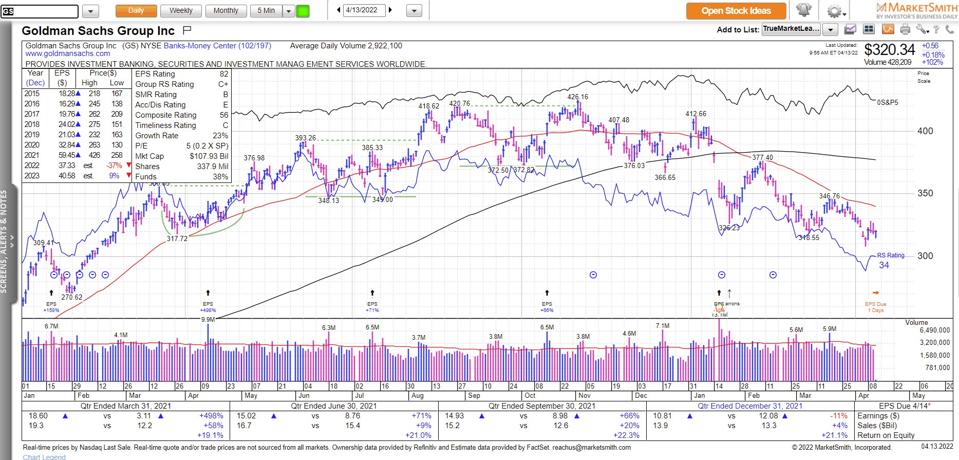

Goldman Sachs Inc. is scheduled to report earnings before Thursday’s open. The stock hit a record high of $426.16/share in 2021 and is currently trading near $320/share. The stock is prone to big moves after reporting earnings and can easily gap up if the numbers are strong. Conversely, if the numbers disappoint, the stock can easily gap down. To help you prepare, here is what the Street is expecting:

Earnings Preview:

The company is expected to report a gain of $8.61/share on $11.81 billion in revenue. Meanwhile, the so-called Whisper number is a gain of $8.54/share. The Whisper number is the Street's unofficial view on earnings.

A Closer Look At The Fundamentals:

The company’s earnings were growing nicely in early 2021 vs early 2020 but the rate of growth slowed considerably in the second half of 2021 and in Q4 2021, earnings were 11% lower compared to Q4 2020. The economy is slowing and that typically is not good for bank stocks. I wouldn’t be surprised to see more weakness from bank stocks in Q1 2022 vs Q1 2021.

A Closer Look At The Technicals:

The stock is 25% below its high and that means it is already in a bear market. A bear market is normally defined by a decline of 20% or more from a recent high. The bulls want to see the stock do two things: First, stop going down. Second, go up. For now, the bears are in control as long as the stock remains below its declining 50 day moving average line (red line above).

Pay Attention To How The Stock Reacts To The News:

From where I sit, the most important trait I look for during earnings season is how the market and a specific company reacts to the news. Remember, always keep your losses small and never argue with the tape.

Disclosure: Goldman Sachs has been featured in FindLeadingStocks.com.