/Emerson%20Electric%20Co_%20sign%20on%20building-by%20SNEHIT%20PHOTO%20via%20Shutterstock.jpg)

With a market cap of $73.4 billion, Emerson Electric Co. (EMR) is a global technology and engineering company, providing innovative solutions across industrial, commercial, and residential markets. Through its diverse business segments, Emerson delivers advanced automation technologies, control systems, and software that help customers enhance productivity, ensure safety, and promote energy efficiency and sustainability worldwide.

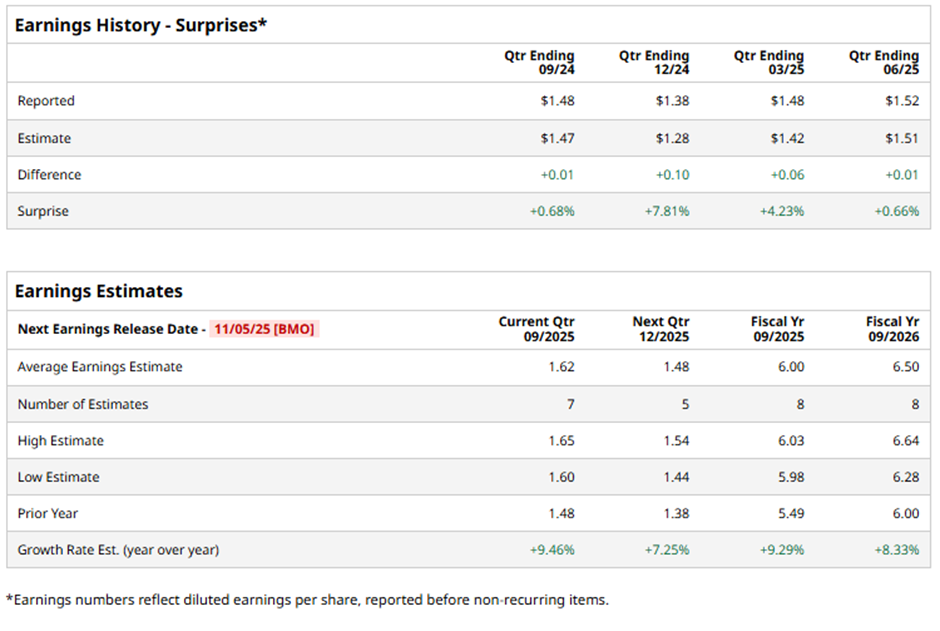

The Saint Louis, Missouri-based company is expected to announce its fiscal Q4 2025 results before the market opens on Wednesday, Nov. 5. Ahead of this event, analysts expect Emerson Electric to report an adjusted EPS of $1.62, up 9.5% from $1.48 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts predict EMR to report an adjusted EPS of $6, a growth of 9.3% from $5.49 in fiscal 2024.

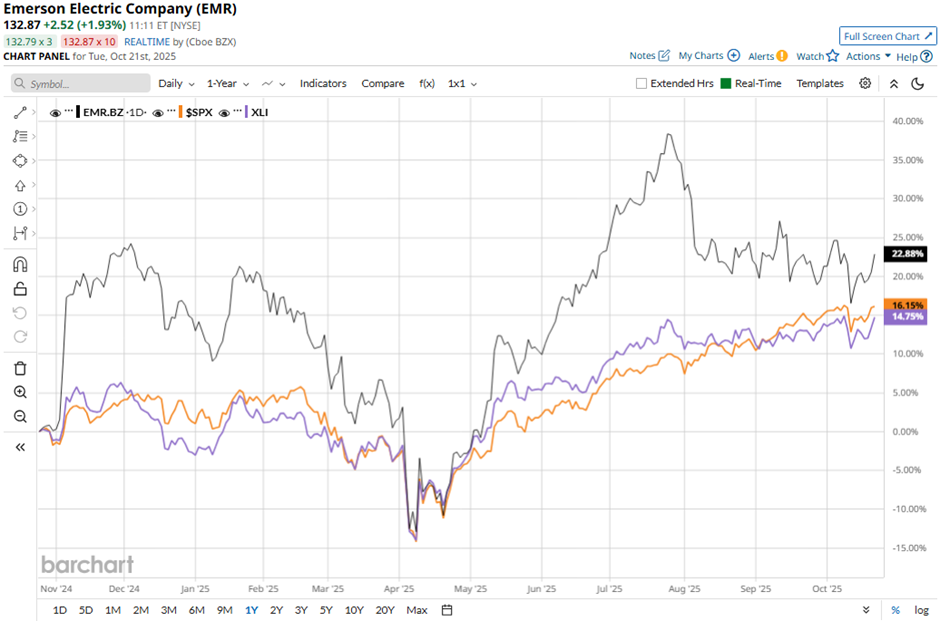

Shares of Emerson Electric have increased 19.5% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 15.1% gain and the Industrial Select Sector SPDR Fund's (XLI) 11.5% return over the same period.

Despite Emerson’s better-than-expected Q3 2025 adjusted EPS of $1.52, shares fell 4.7% on Aug. 6 as net sales of $4.55 billion came in below the consensus. The company also narrowed its full-year sales growth outlook to ~3.5% from 4% earlier, signaling softer demand momentum.

Analysts' consensus view on EMR stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 24 analysts covering the stock, 15 suggest a "Strong Buy," one gives a "Moderate Buy," seven recommend a "Hold," and one "Moderate Sell."

The average analyst price target for Emerson Electric is $151.04, indicating a potential upside of 13.7% from the current levels.