/Caterpillar%20Inc_%20sign%20on%20building-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Headquartered in Irving, Texas, Caterpillar Inc. (CAT) is a leading global industrial firm specializing in construction and mining equipment, diesel and natural-gas engines, industrial gas turbines, and related services. Caterpillar’s scale and market presence are reflected in a market cap of around $268.1 billion. This industrial giant is expected to announce its fiscal fourth-quarter 2025 earnings soon.

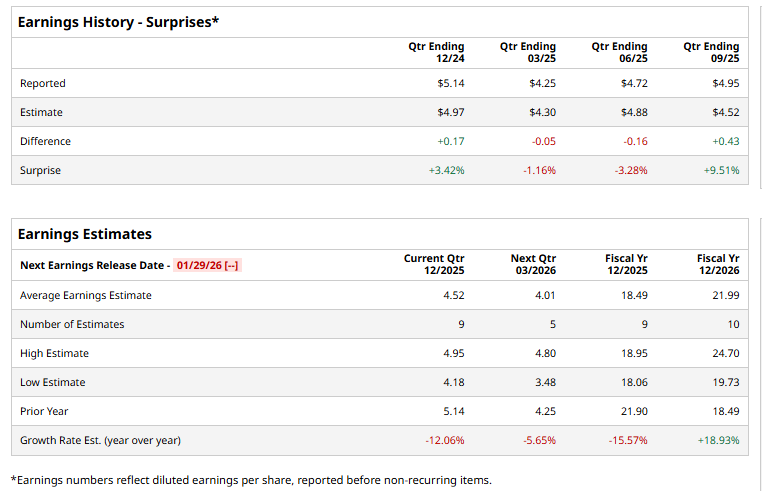

Ahead of this event, analysts expect the company to report a profit of $4.52 per share, down 12.1% from $5.14 per share in the year-ago quarter. The company has missed Wall Street’s bottom-line estimates in two of the past four quarters, while surpassing on two other occasions.

For fiscal 2025, analysts expect CAT to report EPS of $18.49, down 15.6% from $21.90 in fiscal 2024. However, in FY2026, the company’s EPS is expected to rebound, increasing 18.9% annually to $21.99.

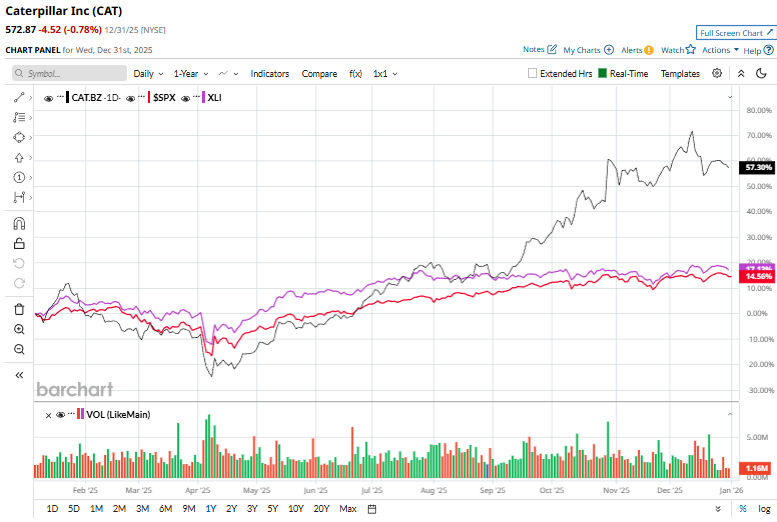

CAT stock has gained 57.8% over the past 52 weeks, significantly outperforming the Industrial Select Sector SPDR Fund’s (XLI) 17.6% surge and the S&P 500 Index’s ($SPX) 16.4% uptick during the same time frame.

Caterpillar shares jumped 3.5% on Dec. 10 after the company’s board approved the continuation of its quarterly dividend at $1.51 per share, payable on Feb. 19, 2026, to shareholders of record as of Jan. 20, 2026. The announcement reinforced Caterpillar’s long-standing shareholder return record, as the company has paid a cash dividend every year since its formation, maintained quarterly payouts since 1933, and increased its annual dividend for 32 consecutive years, earning it a place in the S&P 500 Dividend Aristocrats Index.

Wall Street analysts are moderately bullish about CAT’s stock, with a “Moderate Buy” rating overall. Among 23 analysts covering the stock, 13 recommend “Strong Buy,” nine suggest a “Hold,” and one advises a “Moderate Sell” rating. Its mean average price target of $604.24 implies an upswing potential of 5.5% from the current market prices.