Shares of McDonald’s (MCD) have been trading well over the past few months and investors are hoping that momentum will continue when the burger giant reports earnings before the open on Tuesday.

McDonald’s enjoyed a 22% surge over a one-month period in the fourth quarter. The move was enough to send the stock to new all-time highs — quite the feat in a bear market.

And the stock now has cooled off a bit since hitting its new high in early November.

While the S&P 500 has traded pretty well — helped along by the strong rise in tech stocks — McDonald’s shares have been consolidating.

Let’s look at the major levels to know as earnings are just around the corner.

Earnings Preview for McDonald’s Stock

Chart courtesy of TrendSpider.com

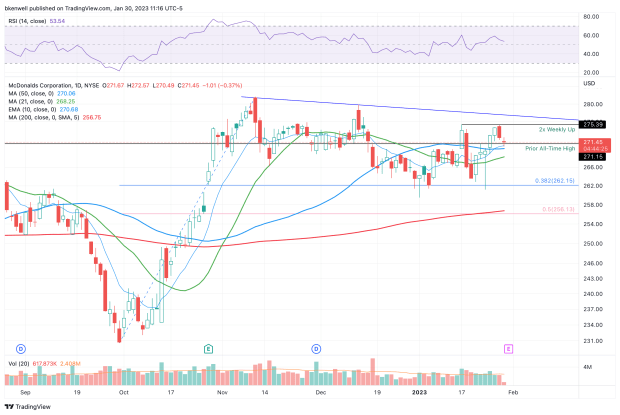

Notice how McDonald’s stock surged from a 52-week low in late-September to a 52-week and all-time high in early November. The shares rallied in four straight weeks and at one point rallied in 18 out of 22 sessions.

Since that rally, we’ve seen the stock put in a really nice consolidation pattern, known as a bull-flag setup.

Further, it’s consolidating above all its major daily moving averages, as well as the prior all-time high at $271.15.

From here, traders’ approach is fairly straightforward.

On a negative reaction, the first main level to watch is $267, which is about 1.5% below current levels. A break of this level puts McDonald’s below its 10-day, 21-day and 50-day moving averages.

Below these measures opens the door down to $262, which was the 38.2% retracement and where recent support has come into play.

If this area cannot support McDonald’s stock, then traders will key on the $256 area, where the stock finds its 50% retracement and the 200-day moving average.

On the upside, the $275.50 area has been weekly resistance in back-to-back weeks. If McDonald’s can clear that mark, it puts a weekly-up rotation in play and opens the door to the December high at $279.90.

Above that puts the stock above downtrend resistance (blue line) and puts the all-time high in play.