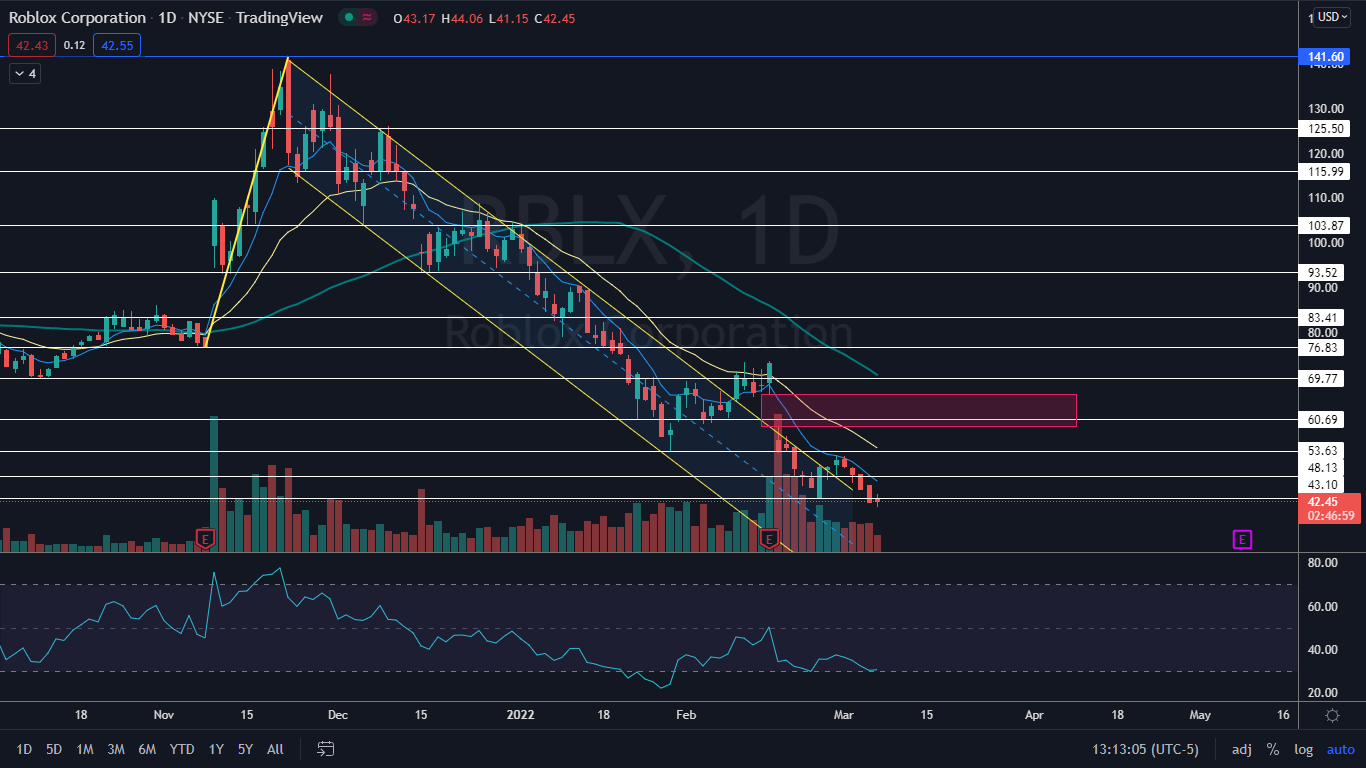

Roblox Corporation (NYSE:RBLX) hit a new all-time low of $41.15 on Monday, adding another almost 1% loss on the day, in addition to the 70.13% the stock has lost since reaching an all-time high of 141.60 on Nov. 22.

On Thursday, Cathie Wood-led Ark Investment Management added 506,738 Roblox shares to its portfolio, which boosted its exposure to the social gaming platform by about 10%. Assuming Ark Investment purchased the shares at the lowest price available that day, which was $45.20, the total purchase price for the shares was $22.9 million. When Roblox hit its low-of-day on Monday, those shares had lost about $1.9 million in value.

Roblox is likely to rebound eventually and because Ark Investment is holding shares as opposed to options, there is time to watch the investment develop. The addition of the shares has also lowered the overall average price in the portfolio’s Roblox position, which may have been the intention.

Options traders don’t appear bullish on Roblox going into the monthly expiry on March 18 because the options activity on Monday skewed heavily toward traders buying and selling puts. At 9:53, one or more institutions bought 12 individual lots of Roblox puts at the ask, with an expiry of March 18 and a strike price of $65. In total, the traders spent $1.44 million on their bearish bet.

The Roblox Chart: On Friday, when Roblox dropped below the previous Feb. 24 all-time low of 43.10, it was on lower-than-average volume, and while there was no support below in the form of price history, this indicated the stock may be running out of sellers. On Monday, when Roblox dropped to another new all-time low, it was also on lower-than-average volume.

Some bullish traders came in and bought the dip when Roblox hit its all-time low, and by early afternoon the stock looked to be printing a doji candlestick on the daily chart. When a doji candlestick is found in a downtrend, it can indicate at least a bounce to the upside is likely to follow.

Roblox is trading in a confirmed downtrend, with the most recent lower high created on Feb. 28 at $48.13 and the most recent lower low formed on Friday. In order to reverse course to the upside, Roblox will need to rise up above the Feb. 28 high-of-day in the short-term.

Roblox has a gap above between $59 and $66.34. Gaps on charts fill about 90% of the time, so it’s likely the stock will rise up to fill the trading range in the future.

Roblox is trading below the eight-day and 21-day exponential moving averages (EMAs), with the eight-day EMA trending below the 21-day, both of which are bearish indicators. The eight-day EMA has been acting as strong resistance, guiding the stock lower since Feb. 16.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

- Bulls want to see big bullish volume come in and push Roblox up above the eight-day EMA, which could give Roblox room to print a higher high and reverse the trend. Roblox has resistance above at $43.10 and $48.13.

- Bears want to see big bearish volume come in and drop Roblox down below Monday’s low-of-day on increasing bearish volume. There is psychological support below at $40.