The Dow Jones Industrial Average moved off its lows on Thursday despite the start of Russia's war on Ukraine. Meanwhile, the Nasdaq erased earlier losses and traded meaningfully higher. Meanwhile, the price of oil jumped to its highest since July 2014, while natural gas prices also spiked.

Stock Market Today

At around 2:10 p.m. ET, the Dow Jones industrials were down 1.6%, trading off session lows in which the index fell more than 2%. The index still remains well below resistance at the 200-day moving average. The Nasdaq composite fluctuated between small gains and losses before moving sharply higher in afternoon trading. The tech-heavy index was up 0.7%, leading the upside.

The S&P 5oo declined 0.7%. After Tuesday's losses, the S&P hit a decline of more than 10% from its Jan. 4 peak. With declines of 10% or more, Wall Street typically considers the index to have gone into a correction. The Russell 2000 traded up 0.4% after reversing earlier losses. Data showed volume was running higher on the Nasdaq and on the NYSE vs. the same time on Wednesday.

U.S. Stock Market Today Overview |

||||

|---|---|---|---|---|

| Index | Symbol | Price | Gain/Loss | % Change |

| Dow Jones | (0DJIA) | 32536.47 | -595.29 | -1.80 |

| S&P 500 | (0S&P5) | 4196.11 | -29.39 | -0.70 |

| Nasdaq | (0NDQC ) | 13120.96 | +83.47 | +0.64 |

| Russell 2000 | 193.39 | +0.41 | +0.21 | |

| IBD 50 | 35.40 | -0.30 | -0.84 | |

Last Update: 1:44 PM ET 2/24/2022 |

||||

The yield on the 10-year Treasury note declined slightly to 1.92%, after recently spiking above 2% on concerning inflation data.

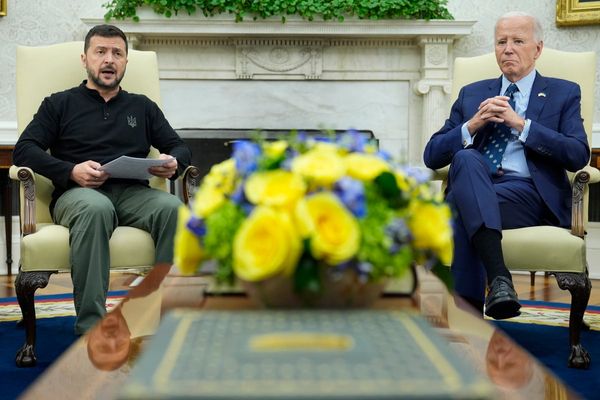

Ongoing geopolitical tensions are contributing to much of the market's volatility. Russian President Vladimir Putin early Thursday announced a "special military operation" designed to bring down the government of Ukraine and demilitarize the country. Western leaders condemned Russia, and promised further sanctions.

President Joe Biden unveiled additional "devastating" sanctions on Russia on Thursday. The sanctions are meant to punish the country for its aggressive invasion of Ukraine.

Meanwhile, the price of U.S. crude oil jumped nearly 8% to $99.47 a barrel, the highest since July 2014. Europe's North Sea benchmark Brent crude briefly topped $105 per barrel.

Dow Jones Today

As for Dow Jones stocks, tech leaders Salesforce.com, Microsoft and Intel were the only stocks trading higher. Salesforce led the upside with a gain of more than 3.4%, as earnings are just around the corner for this enterprise software maker. Salesforce is set to report Q4 earnings Tuesday, March 1, after the market closes.

Elsewhere, Microsoft rose over 1% as shares shimmy back towards the recently lost 200-day and 21-day lines. Dow tech leader Intel also rose over 1% but remains below key moving averages.

On the downside, JPMorgan Chase fell 5% in afternoon trading. Shares gapped lower in heavy volume after hitting resistance at the 21-day line.

The financial sector was among the hardest hit, with the Financial Select Sector SPDR down roughly 3.7%. The ETF gapped down below support at its 200-day line in heavy volume, a bearish sign.

Growth Stocks Making Moves

The Innovator IBD 50 ETF dropped more than 0.5%, hindered by a 7% loss in East West Bancorp. The stock plummeted below its 21-day and 50-day lines and triggered the 7% sell rule from a recent breakout attempt above an 87.87 buy point.

On the upside, a handful of oil and gas stocks outperformed, including Viper Energy Partners and Hess Midstream. Viper's RS line ticked sharply higher as shares became extended from a recent 25.42 breakout point in an 11-week cup base. Hess attempted to gain momentum after finding support at the 10-week line in recent sessions.

Elsewhere, two gold and silver miners also led the upside after trading near buy points on Thursday. Sibanye Stillwater and SSR Mining rose roughly 2% and 1%, respectively, as natural resource stocks have been showing strength.

SSR Mining reported fourth-quarter results early Wednesday, and shares jumped over 9%. The stock scored a brief breakout on Thursday, but shares faded to go nearly 3% below a 20.15 entry point in a three-month cup pattern. Meanwhile, the stock's RS line is hitting a new high, a bullish sign.

Sibanye remains around 10% away from a 19.84 cup entry. The miner is set to report earnings Thursday, March 3.

Follow Rachel Fox on Twitter at @IBD_RFox for more Dow Jones and stock market commentary.