Dow Jones futures will open on Sunday evening, along with S&P 500 futures and Nasdaq futures. The stock market rally attempt continues to survive, but the major indexes lost significant ground for a second straight session as Russia's Ukraine invasion continues to roil markets. The Federal Reserve is set to raise interest rates this coming week with inflation at a 40-year high.

The time to ramp up market exposure is in a power trend. But right now, the market is in a power outage. The major indexes have been below their 21-day and 50-day moving averages for weeks. The 21-day exponential moving average has been well below the 50-day line for a long time, with both falling sharply. All of that reflects the recent and extended market weakness, despite some brief advances.

Dow Jones giant UnitedHealth, Regeneron Pharmaceuticals and Harmony Biosciences are showing relatively positive action. All are near buy points or early entries with their relative strength lines at or near highs.

It's also no coincidence that all three are medical stocks, relatively insulated from Russia's Ukraine war and soaring inflation.

Apple, Tesla Stock Roughed Up

Two stocks that aren't showing positive action? Apple stock and Tesla.

Apple, which until recently had held up reasonably well, tumbled 5.2% to 154.73 last week, its worst weekly loss in just over a year. Shares settled Friday at their worst close since late November, closing in on the 200-day line.

Tesla stock skidded 5.1% last week to 795.35, with all of that coming on Friday. After hitting resistance at its 21-day line, Tesla tumbled back below its 200-day line late in the week. While still comfortably above its late February lows and holding up better than many of its peers, TSLA stock is not doing well.

Tesla is on IBD Leaderboard. UnitedHealth, Regeneron and HRMY stock are on the IBD 50. UNH stock is the subject of the latest New America.

Russia's Ukraine Invasion, Fed In Focus

With earnings season winding down, investors will remain focused on Russia's Ukraine invasion. The stock market, oil prices and more are prone to big moves on Russia-Ukraine headlines that often quickly reverse. Dow Jones futures popped Friday morning as Russian President Vladimir Putin cited a "positive shift" in Ukraine talks, but that optimism quickly faded and turned negative in the regular session.

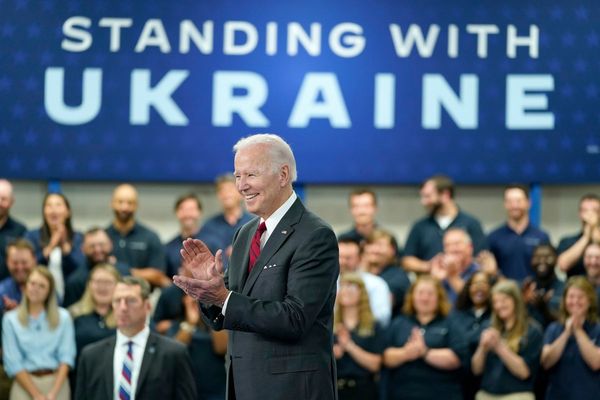

President Joe Biden said the U.S., European Union and the Group Of Seven nations will revoke normal trade relations with Russia, paving the way for new tariffs over the Ukraine invasion.

Fed policymakers meet on March 15-16. After months of forewarning, Fed chief Jerome Powell and his colleagues will almost certainly raise rates by a quarter point on Wednesday afternoon, and signal several more Fed rate hikes.

Dow Jones Futures Today

Dow Jones futures open at 6 p.m. ET on Sunday, along with S&P 500 futures and Nasdaq 100 futures.

Remember that overnight action in Dow futures and elsewhere doesn't necessarily translate into actual trading in the next regular stock market session.

Join IBD experts as they analyze actionable stocks in the stock market rally on IBD Live

Stock Market Rally

The stock market rally had another tough week, with Wednesday's strong gain not having a lasting impact.

The Dow Jones Industrial Average retreated 2% in last week's stock market trading. The S&P 500 index slumped 2.9%. The Nasdaq composite tumbled 3.5%. The small-cap Russell 2000 gave up 1%.

The 10-year Treasury yield shot up 28 basis points to 2%.

U.S. crude oil futures skyrocketed to an 11-year high, but then sold off, ultimately losing 5.5% last week to $109.33 a barrel.

ETFs

Among the best ETFs, the Innovator IBD 50 ETF retreated 2.9% last week, while the Innovator IBD Breakout Opportunities ETF fell 2.2%. The iShares Expanded Tech-Software Sector ETF plunged 5.2%. The VanEck Vectors Semiconductor ETF gave up 3.7%.

Reflecting more-speculative story stocks, ARK Innovation ETF dived 7.6% last week, hitting a fresh 22-month low. The RS line for ARKK is now the lowest since late 2017. ARK Genomics ETF slumped 4.65%. Tesla stock remains the No. 1 holding across Ark Invest ETFs.

SPDR S&P Metals & Mining ETF slipped 1.35% last week. The Global X U.S. Infrastructure Development ETF lost 1%. U.S. Global Jets ETF descended 4.35%. The SPDR S&P Homebuilders ETF sank 3.3%. The Energy Select SPDR ETF rallied 2.2% and the Financial Select SPDR ETF fell 2.15%. The Health Care Select Sector SPDR Fund retreated 2.7%.

Five Best Chinese Stocks To Watch Now

IBD 50 Stocks To Watch

UnitedHealth stock fell 3.2% last week to 482.87, but found support at the 50-day line. UNH stock has a double-bottom base with a handle, giving it a 500.10 buy point.

Regeneron stock rose 3.6% to 642.58 last week, following a slew of tight weekly closes during 2022. On Friday, REGN stock moved intraday above early entries at 636.46 and 645.10, though it closed below the latter as the market sold off into the close. Regeneron has an official buy point of 673.96 from a flat base within a larger consolidation, according to MarketSmith analysis.

Regeneron earnings skyrocketed in 2021, fueled by Covid antiviral treatments. Earnings are expected to tumble in 2022, but remain well above pre-2021 levels. The price-to-earnings ratio for REGN stock is just 8.

Harmony Biosciences stock jumped 9% to 43.86 last week, even as it retreated 3.9% on Friday. HRMY stock briefly cleared a 45.99 cup-base buy point after running up from an early entry. But shares could form a high-ish handle, offering a new entry. After booming earnings growth last year, analysts see Harmony's EPS dipping in 2022 but they expect a strong rebound next year.

Market Rally Analysis

Russia's Ukraine invasion and looming Fed rate hikes aren't a great backdrop for a market advance. But whatever the reason, the technical picture doesn't look good, though the stock market rally attempt continues.

Big sell-offs on Monday and Tuesday brought the major indexes close to their Feb. 24 lows. Wednesday brought a strong rebound, though on significantly lower volume than in the prior two sessions. The major indexes never touched their 10-day moving averages, let alone the 21-day line or other significant resistance levels. Stocks retreated Thursday and especially Friday, capping another big weekly loss.

Wednesday's gain now looks like a blip. The best percentage gains in history tend to come amid corrections and bear markets.

That's why investors should wait for real signs that a market has changed character via a follow-through day to confirm a new uptrend. A follow-through day could still happen any day.

Not all follow-through days work, though, and a FTD at the current levels would have a slew of caveats.

Bitcoin Under Fire In Russia-Ukraine War

Sector Winners, Losers

Energy stocks continue to do well, though many are extended. Some steel and mining plays are around buy points, but are prone to big swings.

There are a number of medical stocks setting up, including UNH stock, Harmony Biosciences and Regeneron. Some transportation, building materials and industrial plays also look interesting — flirting with buy points, setting up, or at least setting up to set up. The relative strength lines are at or near consolidation or all-time highs.

Most of these potential set-ups offer low or relatively modest price-to-earnings ratios, which are definitely in favor in 2022. (That's no guarantee, as Apple stock buckled this week despite a modest P-E ratio of 26.)

Still, these names generally will struggle to make consistent headway — Regeneron's Friday advance excepted — unless the broader market advances, or at least trends sideways.

With interest rates rising once again, growth stocks and especially highly valued growth stocks are struggling mightily. When the market has a big day, aggressive growth stocks tend to lead the way. But they are also leading to the downside on bad market days. And there are more bad days than good days lately.

Tesla stock is a relative leader among EV or aggressive growth generally. But that area of the market is simply out of favor.

Time The Market With IBD's ETF Market Strategy

What To Do Now

There's not too much to do right now. Commodity plays are still acting well, though many are extended. Investors could take some partial profits or let them ride.

If you got ahead of the market and bought stocks, especially growth plays, in Wednesday's one-day pop, you may want to exit those positions.

But it's important to stay engaged and be prepared. Build up your watchlists. There are a lot of potentially interesting stocks.

When the market rally does have a follow-through day, you'll want to be ready. But even then, gradually build up your exposure as the market continues to build strength and overcome key hurdles.

Read The Big Picture every day to stay in sync with the market direction and leading stocks and sectors.

Please follow Ed Carson on Twitter at @IBD_ECarson for stock market updates and more.