Dow Jones futures and S&P 500 futures fell slightly early Tuesday morning, while Nasdaq futures were down solidly but off lows as headlines related toward Russia's moves vs. Ukraine remained in focus.

Futures plunged over the long weekend Russian President Vladimir Putin on Monday recognized two separatist regions of Ukraine as independent, sending in Russian troops. The U.S. and other Western leaders condemned the move, promising limited sanctions at least initially. Germany halted approval of the Nord Stream 2 gas pipeline from Russia.

The stock market rally suffered significant damage last week, with the major indexes below key support and starting to move toward their Jan. 24 lows. Ukraine invasion fears are weighing heavily on the market rally, which is already dealing with inflation and other big headwinds. Investors should take a defensive posture with minimal exposure.

Putin Recognizes Separatist Regions

Putin, in a televised address, recognized the independence of the separatist Donetsk and Luhansk provinces, later ordering Russian troops in those areas as "peacekeepers." That violates the 2015 Minsk accords following the last Russian-Ukrainian conflict. The move is widely seen as effectively annexing those parts of eastern Ukraine, while allowing Putin to claim he's not invading "Ukraine."

On Tuesday however, Russia says its recognition of independence for Donetsk and Luhansk includes territory now held by Ukrainian forces.

Putin may feel he can recognize the separatist regions and effectively annex them — at least the parts already under rebel control — with minimal sanctions, after annexing Crimea in 2014. The move also could split the West's unity in the Ukraine crisis.

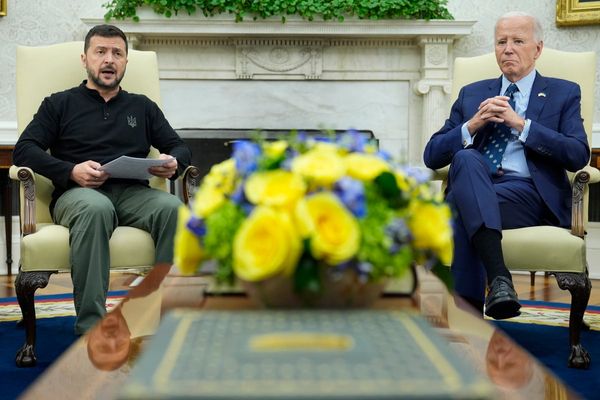

U.S., NATO and European leaders all condemned the move, but what actions will they take? Biden will impose sanctions on the Donetsk and Luhansk provinces, a relatively modest step, but said more would come. White House said these initial steps were separate from "swift and severe economic measures" should "Russia further invade Ukraine."

The U.K. and EU also say they will take new limited measures in response to Putin's actions. German Chancellor Olaf Scholz said that the Nord Stream 2 gas pipeline, which bypassed Ukraine, won't be certified at this time. He ordered a new assessment of Germany's energy supplies. "The situation has fundamentally changed."

Will Putin continue with a broader Ukraine invasion, which would involve a major land war in Europe and definitely trigger major sanctions? If nothing else, expect Russian troops to remain mobilized, if only to pressure Ukraine and the West to accept the latest carveout.

The U.S. is pulling its remaining State Department personnel out of Ukraine for Poland. It has reportedly urged Ukrainian President Volodymyr Zelensky to leave the capital Kyiv for the western city of Lviv for his own safety.

Putin, in his emotional address of grievances and justifications, said Ukraine was the creation of communist Russia and that it was "madness" that various republics were allowed to leave as Soviet Union broke apart. Those comments show that Putin sees Ukraine and the Baltic states of Latvia, Estonia and Lithuania as illegitimate.

The Baltic states are part of NATO. Biden has said that while U.S. troops won't fight for Ukraine, America stands fully behind all NATO nations.

Russia Claims Ukraine Incursion

Russia claimed Monday that its army destroyed two Ukrainian APCs that allegedly crossed into Russian territory, killing five Ukrainian soldiers and taking one prisoner. Ukraine denied that it crossed the border.

Cease-fire violations between Ukraine and pro-Russian separatists have surged in the past few days. Separatist leaders have ordered a full military mobilization and civilian evacuation, claiming Ukraine is close to launching its own offensive. Local, pro-Russia media has claimed explosions in rebel-held parts of eastern Ukraine. Ukraine's military has said Russia is shelling rebel-held areas as a false flag operation.

All of these events and reports offer a pretext for Russia to stay mobilized and justify a new Ukraine invasion.

Five Stocks Near Buy Points Amid Weak Market

Dow Jones Futures Today

Dow Jones futures fell 0.3% vs. fair value. S&P 500 futures lost 0.2% and Nasdaq 100 futures sank 0.6%. Dow and S&P 500 futures had tumbled more than 1% overnight, with Nasdaq futures down well over 2%.

U.S. markets were closed Monday, but other exchanges were open. Russia's benchmark stock index dived 10.5% on Monday while the ruble tumbled. The Moex index lost 1% Tuesday morning.

The 10-year Treasury yield rose 2 basis points to 1.95% after tumbling overnight.

U.S. crude oil futures jumped 3%. Brent crude is nearing $100 a barrel.

A Marathon Petroleum refinery near New Orleans suffered explosions Monday. That could limit supplies of gasoline and diesel and push up fuel costs even more. MPC stock was still up slightly early Tuesday.

Remember that overnight action in Dow futures and elsewhere doesn't necessarily translate into actual trading in the next regular stock market session.

Five Stocks That Don't Suck

Apple stock, O'Reilly Automotive, Commercial Metals, Union Pacific and Nutrien are five stocks holding up near buy points with relative strength lines at or near highs.

Apple dwarfs all of these names, but it's the only one trading below its 50-day moving average.

The RS line, the blue line in the charts provided, tracks a stock's performance vs. the S&P 500 index. It's an easy way to spot leading stocks in any kind of market. In a weak or choppy market, stocks with RS lines at highs could be leaders in the next rally.

Nvidia, Tesla Just Hanging On

Meanwhile, Nvidia stock and Tesla rebounded from near their 200-day moving averages on Friday. This is an area where Tesla stock and Nvidia found support before in late January. Can these big former winners continue to do so? It'll likely depend on the market rally's next moves. But as megacap stocks, Tesla and NVDA stock will have something to say about the overall market direction.

Trump's Truth Social On Apple App Store

Donald Trump's Truth Social site debuted in Apple's App Store at midnight Monday. That's a big step toward the social media return of former President Trump. Facebook and Twitter banned Trump in the wake of the Jan. 6, 2021, storming of Capitol Hill.

Some users reportedly struggled to set up accounts after downloading the Truth Social app. Truth Social is set to be fully operational at the end of March. Analysts say Truth Social will be sure to attract a lot of users to start, but profitability could be difficult.

Truth Social is part of Trump Media & Technology Group, which is going public via a SPAC merger with Digital World Acquisition Corp..

DWAC stock, which has done well in 2022, soared in Tuesday's premarket.

Dow Jones giant Home Depot reported better-than-expected earnings early Tuesday and raised its dividend by 15%. HD stock fell modestly early Tuesday.

Mosaic and Palo Alto Networks are among those due after the close.

Tesla stock and Nvidia are on IBD Leaderboard. ORLY stock is on the IBD 50. Commercial Metals was Friday's IBD Stock Of The Day. UNP stock was Thursday's.

The video embedded in this article discussed the week's market action in detail, while also analyzing CMC stock, Union Pacific and new SwingTrader stock Dollar Tree.

Join IBD experts as they analyze actionable stocks in the stock market rally on IBD Live

Coronavirus News

Coronavirus cases worldwide reached 426.93 million. Covid-19 deaths topped 5.91 million.

Coronavirus cases in the U.S. have hit 80.14 million, with deaths above 960,000.

New coronavirus cases have tumbled in the U.S. and worldwide, with hospitalizations and deaths also down. Covid restrictions are being scaled back or removed in many states and countries around the world. One exception is Hong Kong, which is seeing its first real spike of the pandemic.

Stock Market Rally

The stock market rally tried to bounce last week but faded badly late in the week.

The Dow Jones Industrial Average fell 1.9% in last week's stock market trading. The S&P 500 index gave up 1.6%. The Nasdaq composite sank 1.8%. The small-cap Russell 2000 retreated nearly 1%.

The 10-year Treasury yield fell 2 basis points to 1.93%, but that's after hitting a 30-month high of 2.065% intraday Wednesday. Russia war fears sent investors into safe havens, while Fed minutes from the January policy meeting didn't offer any new hawkish surprises.

Crude oil prices fell more than 2% to $91.07 a barrel, but held above the $90 mark.

ETFs

Among the best ETFs, the Innovator IBD 50 ETF fell 1% last week, while the Innovator IBD Breakout Opportunities ETF slumped 3%. The iShares Expanded Tech-Software Sector ETF tumbled 5.4%. The VanEck Vectors Semiconductor ETF closed flat, but fell sharply on Thursday-Friday. Nvidia stock is a major SMH component.

SPDR S&P Metals & Mining ETF rose 2.1% last week. The Global X U.S. Infrastructure Development ETF gained 1.3%. U.S. Global Jets ETF ascended 1.8%. SPDR S&P Homebuilders ETF dipped 0.5%. The Energy Select SPDR ETF gave up 3.35% and the Financial Select SPDR ETF sank 2.3%. The Health Care Select Sector SPDR Fund pulled back 2.1%.

Reflecting more-speculative story stocks, ARK Innovation ETF plunged 9.9% last week, hitting a fresh 20-month low on Friday. ARK Genomics ETF tumbled 6.6%. Tesla stock remains the No. 1 holding across ARK Invest's ETFs.

Five Best Chinese Stocks To Watch Now

Apple Stock

Apple stock dipped 0.8% to 167.30 last week. During the late January market sell-off, the iPhone giant never came close to its 200-day line. AAPL stock now has a cup-with-handle base with a 176.75 buy point, according to MarketSmith analysis.

Commercial Metals Stock

Commercial Metals stock rose 3.1% to 36.75 last week. It's slightly above its 50-day moving average, working on a 38.82 buy point. CMC stock could be starting to form a handle, with a potential lower entry of 37.59. Investors already could use that as an early entry.

Union Pacific Stock

Union Pacific jumped 5.2% to 251.19 last week. UNP stock is trading just below a 256.11 buy point in a very shallow flat base. Investors arguably could buy it now or just shy of 255.

O'Reilly Stock

ORLY stock edged up 1.3 to 676.96 last week, its fourth straight modest weekly gain. O'Reilly stock has reclaimed the 50-day line, offering an early entry in a shallow cup base. The official buy point is 710.96.

Auto parts retailers often do well in tough markets. The business can thrive in difficult economic times. Right now, with new-car prices scarce and used-car prices soaring, many Americans may keep their old cars longer. That's good news for O'Reilly and its rivals.

Nutrien Stock

NTR stock had a wild week, tumbling to undercut the 50-day line briefly before quickly rebounding to record high before pulling back slightly. But, ultimately, Nutrien stock dipped 0.7% to 75.78. That's just below a 77.45 buy point.

On Wednesday night, the fertilizer maker reported a 929% EPS surge with revenue up 79%. Other fertilizer stocks also are doing well, despite some big intraday and daily swings. That includes MOS stock, which reports late Tuesday.

Tesla Vs. BYD: Which Booming EV Giant Is The Better Buy?

Tesla Stock

Tesla stock edged down 0.35% to 856.98 last week, but closed low in its range and nearly tested its 200-day line again on Friday. TSLA stock has been hitting resistance at its falling 21-day line for the past few weeks, while the 50-day line is racing lower. Holding the 200-day line, and its Jan. 28 low of 792.01, is key for the EV giant. On the upside, Tesla stock has a 1,208.10 buy point, and doesn't really have an early entry.

Meanwhile, BYD on Saturday launched the Yuan Plus in China, with pre-sales starting in Australia, a new market for the Chinese EV and battery giant. BYD recently signaled it'll sell 1.5 million EV and hybrids in 2022.

Nvidia Stock

Nvidia stock fell 1.3% to 236.42 for the week, but after hitting resistance at its 10-week line, the chip giant tested its 40-week again and nearly touched its 200-day line. As with Tesla, NVDA stock pared Friday's losses slightly.

Nvidia earnings and guidance late Wednesday topped views, but investors focused on forecasts for unchanged profit margins.

If Nvidia stock can rally above its 50-day line and its Feb. 10 high of 269.25, also breaking a steep downtrend, that would offer a very aggressive entry. NVDA stock would still have a long way to reach its Nov. 22 peak of 346.47.

Market Rally Analysis

The stock market rally, already under pressure, sold off again late last week. The Dow Jones, S&P 500 index and Nasdaq composite broke below their recent ranges and are heading toward their Jan. 24 lows. The S&P 500 and Nasdaq composite are now below their Jan. 31 follow-through day lows, with the odds high that they break to new lows. Undercutting the Jan. 24 lows would mark the end of the market rally.

In late 2018, the stock market correction or bear market had two failed follow-through days, finally bottoming on Christmas Eve.

The ailing market rally has retreated sharply over the last several days, so arguably it's due for a bounce. But it doesn't have to happen right away, and one or two good days wouldn't be that meaningful.

New losers are still far outstripping new winners, while market breadth also weakened once again after briefly improving in early February.

In the very short run, the stock market will continue to focus on Russia-Ukraine news.

Futures currently indicate a sharp decline at Tuesday's open after a long weekend, with the indexes getting close to their Jan. 24 lows. But all of those moves could quickly reverse with the next headline.

Beyond the Russia-Ukraine crisis, inflation and Fed rate hikes hang over the market. JPMorgan economists now expect quarter-point rate hikes at nine consecutive Fed meetings, with many other Wall Street analysts betting on at least seven. One question is whether the Fed will start the rate-hike cycle in March with a 50-point hike.

On a somewhat related note, supply-chain woes have been a constant refrain in recent weeks. General Electric, Applied Materials and Roku were among the many companies that cited supply-chain issues continuing to restrict production and more.

Getting supply chain issues resolved would not only bolster corporate profits and economic growth, but also likely curb inflation. With Covid cases plunging and restrictions quickly ebbing, there may be a light at the end of the tunnel, but it could be a long way off.

Time The Market With IBD's ETF Market Strategy

What To Do Now

Rather than try to guess how Russia, the Federal Reserve and supply chains play out — and how financial markets will react — focus on what the market is doing now. Right now, the major indexes and leading stocks — outside of a few pockets of strength — are simply not healthy.

Don't get lured in by one or two good market days. The major indexes have a lot of work to do. In any case, there are only a handful of stocks setting up right now. At some point, there will be a strong market rally with a slew of quality stocks flashing buy signals and moving higher from there.

When that happens, you want to be ready. Keep your watchlists fresh and stay engaged with the market.

Read The Big Picture every day to stay in sync with the market direction and leading stocks and sectors.

Please follow Ed Carson on Twitter at @IBD_ECarson for stock market updates and more.