Dow Jones futures rose slightly early Wednesday, along with S&P 500 futures and Nasdaq futures, as Treasury yields reversed lower from big overnight gains. The House voted to oust Speaker Kevin McCarthy, raising the prospect of more political chaos.

The stock market sold off Tuesday as Treasury yields continued to surge, fueled by a jump in job openings. Billionaire investor Ray Dalio said the 10-year Treasury yield could soon rise to 5%. That followed similar comments in recent days from activist investor Bill Ackman and Blackrock CEO Larry Fink.

Meanwhile, political dysfunction in Congress may also be unnerving investors.

The Dow Jones fell 431 points, now negative for the year. The S&P 500 undercut its Sept. 27 low, ending its market rally attempt. The Nasdaq rally attempt is hanging on by a thread. Market breadth was abysmal once again.

Nvidia, Celsius Holdings, Booking Holdings Super Micro Computer and Palantir Technologies all hit resistance at the 50-day line.

Nvidia stock still looks relatively normal. SMCI stock, Booking Holdings, Celsius and Palantir suffered more technical damage. Palantir did bounce late Tuesday on reports that it's near a big contract.

Many other leaders are breaking key levels. Stocks that briefly buck the trend, such as Super Micro and PLTR stock, often soon fall back.

The bottom line: It's a market correction, with the major indexes and leading stocks looking terrible.

Nvidia and BKNG stock are on IBD Leaderboard. Nvidia, Booking Holdings and CELH stock are on the IBD 50. Super Micro and Nvidia stock are on the IBD Big Cap 20.

Dow Jones Futures Today

Dow Jones futures were 0.1% above fair value, reversing from modest losses overnight. S&P 500 futures climbed 0.15% and Nasdaq 100 futures rose 0.2%. Apple weighed slightly on the major indexes, thanks to a KeyBanc downgrade.

The 10-year Treasury yield fell a few basis points to 4.77% after hitting 4.88% overnight. Dow futures have improved as the 10-year bond yield slashed gains, but investors are following every tick.

Crude oil futures fell nearly 2%.

Remember that overnight action in Dow futures and elsewhere doesn't necessarily translate into actual trading in the next regular stock market session.

10-Year Treasury Yield To 5%?

The 10-year Treasury yield surged 12 basis points on Tuesday to 4.8%, a fresh 16-year high. The 10-year bond yield soared 11 basis points Monday.

Ray Dalio told CNBC Tuesday that the 10-year Treasury bond yield will likely hit 5%, citing higher-for-longer inflation and "abnormal" Treasury debt issuance as among reasons. Ackman and Fink made similar comments late last week about the benchmark Treasury yield.

There's a growing risk that something will "break" with yields rising so quickly. Several regional banks failed earlier this year due to soaring rates. What could be next?

Speaker McCarthy Ousted

The House ousted Kevin McCarthy as speaker Tuesday afternoon, the first time the chamber has kicked out its leader in a no-confidence vote.

Rep. Matt Gaetz on Monday filed a "motion to vacate" the speakership. Gaetz and a few other GOP lawmakers, leveraging the wafer-thin Republican majority, were enough to bring McCarthy down with Democratic votes.

McCarthy says he will not run again. Republicans say the House will vote on the new speaker next Wednesday, but it's unclear who could win a majority, or if that person could govern. The turmoil certainly raises the risk of a government shutdown in mid-November.

Join IBD experts as they analyze leading stocks and the market on IBD Live

Stock Market

The stock market sold off Tuesday as job openings unexpectedly jumped in August, sending Treasury yields screaming higher again.

The Dow Jones Industrial Average fell 1.3% in Tuesday's stock market trading, testing the 33,000 level and hitting a fresh four-month low. The S&P 500 index tumbled 1.4%, undercutting the Sept. 27 low and nearing its 200-day moving average. The Nasdaq composite skidded to a four-month closing low, but not yet undercutting its Sept. 27 intraday low. The small-cap Russell 2000 slumped 1.9% to a five-month low, not far from 2023 closing lows.

Losers led winners by more than 3-to-1 on the Nasdaq and over 5-to-1 on the NYSE.

The Invesco S&P 500 Equal Weight ETF declined 1.2% to a five-month low, starting to approach 2023 lows.

The Nasdaq market rally attempt is still on as long as the composite doesn't undercut its Sept. 27 intraday low, but the signs aren't looking good. It's hard to see stocks ending their slide, even in the short run, until the 10-year Treasury bond yield pulls back.

U.S. crude oil prices rose 0.5% to $89.23 a barrel. Gasoline futures sank 2.2% to a five-month low, signaling that prices at the pump will fall further from recent 2023 highs.

Aside from the Nasdaq's rally low, the S&P 500's 200-day line is the next obvious support level. That roughly coincides with the S&P 500's 4,200 level and spring highs.

The 200-Day Average: The Last Line Of Support?

ETFs

Among growth ETFs, the Innovator IBD 50 ETF slumped 2.3%. The iShares Expanded Tech-Software Sector ETF skidded 2.5%. The VanEck Vectors Semiconductor ETF gave up 2.2%. Nvidia stock is the No. 1 holding across Ark Invest's ETFs.

Reflecting more-speculative story stocks, ARK Innovation ETF shed 2.7% and ARK Genomics ETF fell 1.6%.

SPDR S&P Metals & Mining ETF declined 1.3%. SPDR S&P Homebuilders ETF stepped down 2.6%. The Energy Select SPDR ETF edged down 0.1% and the Health Care Select Sector SPDR Fund sank 0.9%

The Industrial Select Sector SPDR Fund dropped 0.7%.

The Financial Select SPDR ETF dropped 1.6%. The SPDR S&P Regional Banking ETF fell back 2%

Five Best Chinese Stocks To Watch Now

Key Stocks

Nvidia stock fell 2.8% to 435.17, ending a four-day win streak and backing off from the 50-day line but just below the 21-day line. NVDA stock could have a base after this week.

CELH stock sold off 7.4% to 161.12, tumbling from near the 50-day and undercutting recent lows in heavy volume. The energy drink maker could have been a short Tuesday morning. Shares sold off hard in late September to below the 50-day, then wedged higher just below that key level in light trade.

BKNG stock retreated 2.7% to 3,010.79, now clearly below the 50-day. Shares just undercut the low of a flat base. Booking Holdings still has a 3,251.71 buy point, according to MarketSmith analysis.

SMCI stock fell 6.5% to 269.97, back below the 50-day in heavy volume. Super Micro stock had rallied for six straight sessions. Monday's move above the 50-day offered an aggressive entry. Shares could still bounce back with a decent market.

PLTR stock slumped 6.2% to 14.90, below the 50-day. The AI play moved above the 50-day on Friday, thanks to a three-day run in decent volume. On Friday morning, Palantir stock looked like an early entry, but it closed near session lows. PLTR could bounce back, using Friday's high as a new early entry. The official buy point is 20.24.

PLTR stock rose modestly overnight on reports that Palantir could win a contract to overhaul the U.K.'s long-ailing National Health Service.

Time The Market With IBD's ETF Market Strategy

What To Do Now

Right now, investors should be mostly or entirely in cash. Very few stocks are looking good, and often that doesn't last more than a day.

But don't ignore the market. Conditions could quickly change. If the 10-year Treasury yield pulled back substantially, stocks would likely respond favorably.

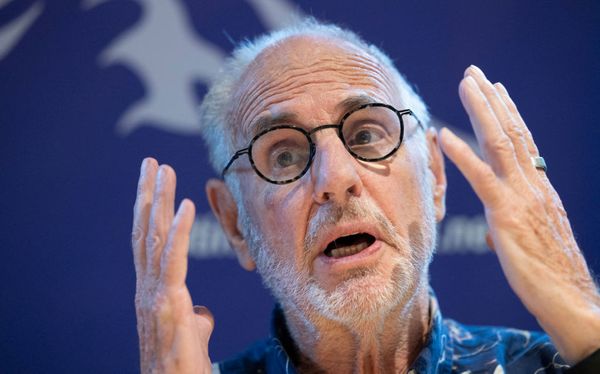

Investors need "patient attention," as market wizard David Ryan said. Ryan stressed that point on Tuesday's IBD Live. The three-time U.S. Investing Championship winner said that 80% of investing should be patiently watching the market and stocks, with only 20% taking action.

Wait for positive market signals and look for stocks setting up on the long or short side. On the long side, not many charts are healthy, so focus on stocks showing strong relative strength.

Look but don't touch.

Arista Networks and Google parent Alphabet are holding above their 50-day lines, while Meta Platforms continues to trade around those levels, but will that last? Duolingo and Costco Wholesale broke out recently with surging relative strength lines, but both reversed below buy points Tuesday.

Read The Big Picture every day to stay in sync with the market direction and leading stocks and sectors.

Please follow Ed Carson on X/Twitter at @IBD_ECarson and Threads at @edcarson1971 for stock market updates and more.