The mixed bag in retail continues, as the dollar stores reported earnings on Thursday.

Both Dollar General (DG) and Dollar Tree (DLTR) are moving lower after reporting quarterly results.

Dollar General stock is down 1% and was down as much as 4.8% this morning, while Dollar Tree is down considerably more, currently lower by about 10%.

It follows a post-earnings fade from Macy’s (M) after an initial rally and a deep pullback in Nordstrom (JWN) yesterday. Walmart (WMT) has given up almost all its post-earnings gains, while Target (TGT) remains lower as well.

In all, it hasn’t been a great reporting period for retail.

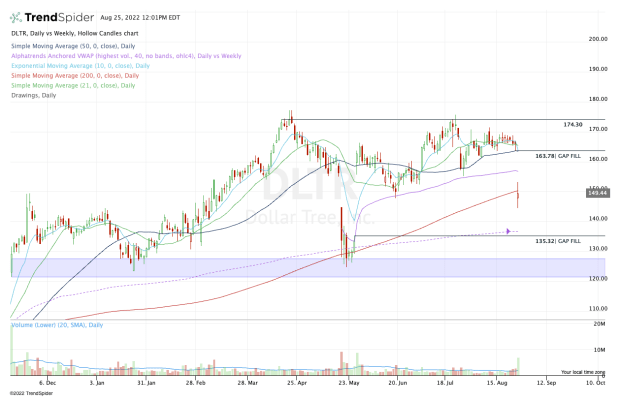

Trading Dollar Tree Stock on Earnings

Chart courtesy of TrendSpider.com

Dollar Tree is certainly receiving the brunt of today’s selloff in dollar store stocks.

The company reported in-line earnings results, missed on revenue estimates, and provided third-quarter and full-year revenue guidance that came up short of consensus expectations.

That clearly does not bode well for the company. On the chart, Dollar Tree stock gapped down on the news, opening below the 200-day moving average. It has failed to reclaim this measure so far in the session.

If Dollar Tree does reclaim this level and takes out the post-earnings high of $153.17, the bulls will want to see the stock test its daily VWAP measure, then push up to the gap-fill level at $163.78.

On the downside, keep an eye on two key areas.

First is the $135 area. In this zone, we have another gap-fill level at $135.32 from May. It’s also where we find the weekly VWAP measure.

If Dollar Tree stock breaks below this level, investors may turn their attention to the $120 to $125 zone, which has been significant support since November. Before that, the $115 to $120 area was significant resistance.

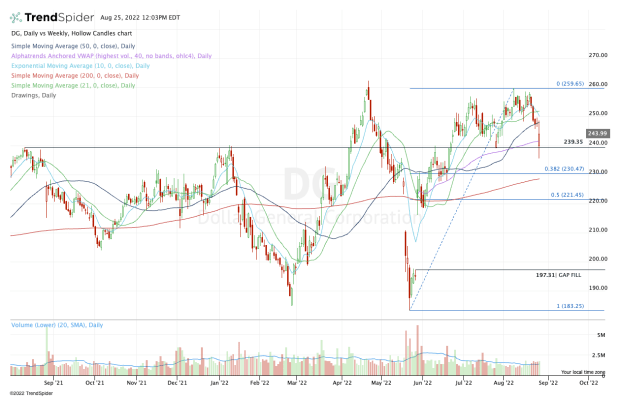

Trading Dollar General Stock

Chart courtesy of TrendSpider.com

Dollar General stock beat on earnings and revenue expectations, while raising its full-year outlook.

The company raised its full-year revenue estimates (to above Street expectations), while also boosting its same-store sales forecasts. But its earnings outlook was slightly below consensus.

All that aside, the stock is still struggling on the day. For now, Dollar General stock is holding the key $140 level, as well as the daily VWAP measure.

The bulls would love to see this stock reclaim the $250 level and thus reclaim the 10-day and 50-day moving averages. If it can do that, $260 resistance is back in play and potentially more.

On the downside, a break of today’s low near $235.50 could usher in a test of the 200-day and the 38.2% retracement.

For now though, it’s clear which company — and which stock — has the momentum and that's Dollar General. Keep an eye on the $240 level. It's important.