The two largest coins were seen trading marginally higher on Tuesday evening as the global cryptocurrency market cap rose 0.3% to $921.2 billion at 9:10 p.m. EDT.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | 0.2% | -5.5% | $19,083.49 |

| Ethereum (CRYPTO: ETH) | 0.5% | -5.15% | $1,285.06 |

| Dogecoin (CRYPTO: DOGE) | 3% | -8.2% | $0.06 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| TerraClassicUSD (USTC) | +40% | $0.06 |

| Huobi Token (HT) | +15.1% | $5.94 |

| Helium (HNT) | +6.2% | $4.55 |

See Also: Best Crypto Debit Cards

Why It Matters: Dogecoin eclipsed the intraday gains of Bitcoin and Ethereum. All three were seen trading in the green on Tuesday evening, along with U.S. stock futures, which rose marginally ahead of the release of key inflation data and minutes from the last policy meeting of the U.S. Federal Reserve.

Tesla Inc (NASDAQ: TSLA) CEO Elon Musk said Tuesday that The Boring Company would accept Dogecoin payments for its “Burnt Hair” perfume. Musk, who reactivated an agreement to purchase Twitter, is a well-known DOGE bull.

On Tuesday, it was reported that Google is partnering with Coinbase to allow its customers to pay for cloud services in cryptocurrencies from early next year. Additionally, Google will tap Coinbase Prime for institutional cryptocurrency services like secure custody and reporting.

OANDA senior market analyst Edward Moya said in a note that the macro backdrop “keeps getting uglier” amid escalation in the Russia-Ukraine conflict and growing fears of recessions.

“Cryptos remain stuck in a trading range as basically everyone on Wall Street awaits one last major decline with U.S. stocks. Bitcoin remains anchored but long-term fundamentals remain supportive for a major rally once stagflation risks have eased,” said Moya. “Bitcoin is holding onto the $19,000 level but if the selloff on Wall Street intensifies, bearish momentum could target just ahead of the $18,150 support level.”

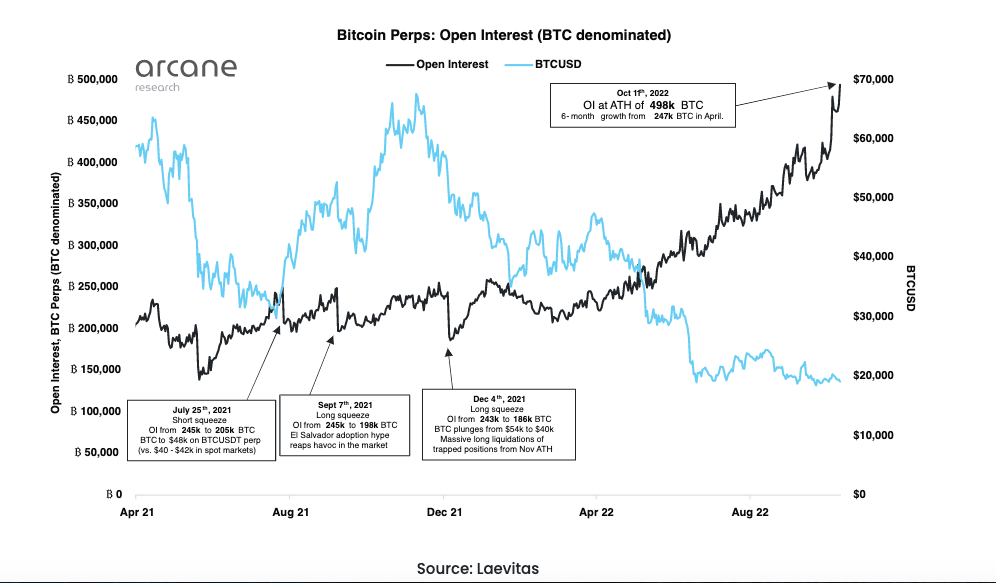

Arcane Research, which provides curated cryptocurrency market reports, said investors should be careful amid “ballooning” leverage.

Arcane analyst Vetie Lunde said in a blog that “Leverage is going full-on parabolic in the crypto derivatives market, as BTC remains in a very directionless state.”

The analyst said the current open interest was “well blown above any levels that may be assessed as sustainable.”

Bitcoin Open Interest — Courtesy Arcane Via Laevitas

On Bitcoin, the analyst said that once the Federal Reserve has reached an “appropriate restrictive interest rate level” and inflation simmers down, the apex cryptocurrency may again “find room to see a substantial recovery.”

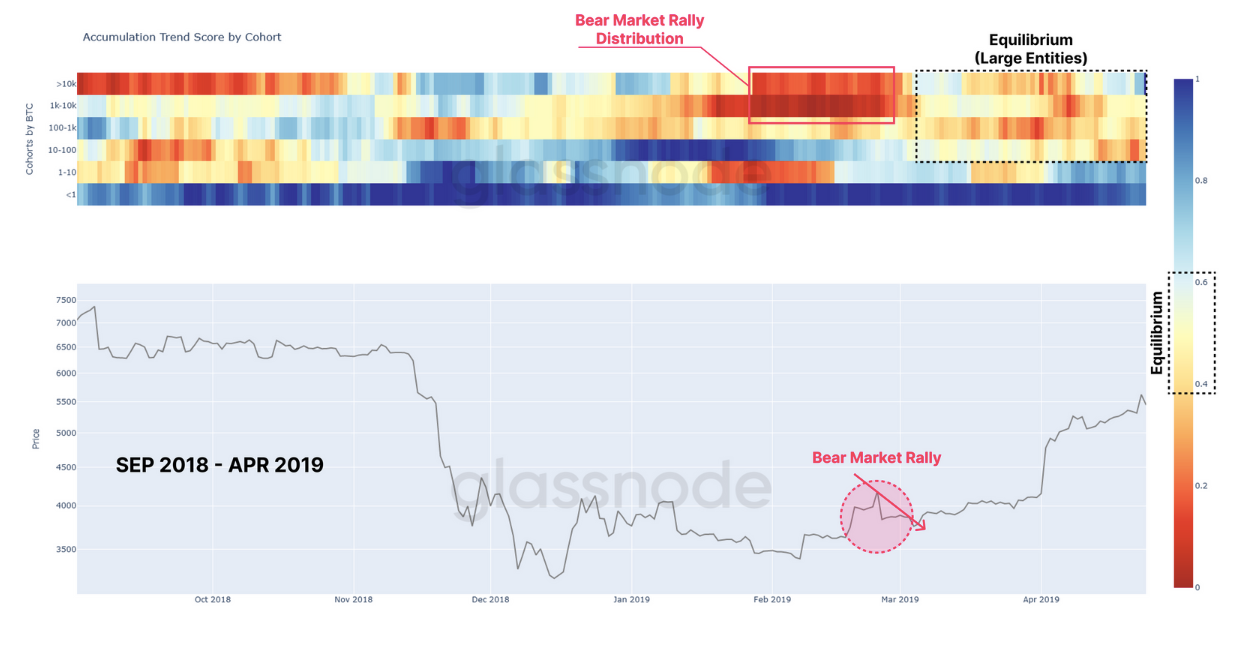

A note by Glassnode said that there may be “several months” ahead before a full recovery can be seen in Bitcoin prices, despite the apex coin showing some relative strength of late amid a volatile traditional market setup.

“In many ways, many on-chain metrics, market structure, and investor behavior patterns are dotting of the i's, and crossing the t's for a textbook bear market floor,” said the on-chain analysis firm.

Glassnode said it had noticed “relative neutrality” across small to medium-address cohorts when it came to the accumulation of Bitcoin. It said the Accumulation Trend Scores for whales holding 1000-10,000 BTC, however, highlights aggressive accumulation since late September.

Whales that hold over 10,000 BTC are biased towards weak distribution over recent months, according to Glassnode.

Accumulation Trend Score By Cohort — Courtesy Glassnode

The company said that large entities particularly the 1,000-10,000 BTC wallets contributed to a distribution event during a rally off lows in March 2019, while small-retail level participants with less than 1,000 BTC maintained heavy accumulation throughout 2018 and 2019.

Meanwhile, the percentage of discussions related to Bitcoin among the top 100 assets is just at 12.8%, tweeted Santiment.

The percentage of discussions related to #Bitcoin, among top 100 assets, is at just 12.8%. This is the lowest week in 7 months. And for a 10th straight week, the crowd is #bearish toward $BTC. Both are historically favorable of price bottoms occurring. https://t.co/lH9LiRSeuJ pic.twitter.com/7ZfvhXuzve

— Santiment (@santimentfeed) October 11, 2022

“This is the lowest week in 7 months. And for a 10th straight week, the crowd is [bearish] toward [Bitcoin]. Both are historically favorable of price bottoms occurring,” said the market intelligence platform.

Read Next: Elon Musk's Purchase Of Twitter Will Be A 'Win-Win-Win,' Says Dogecoin Creator