Berkshire Hathaway (BRK.B) chairman and legendary value investor Warren Buffett is among the best investors of all time. Many investors track the Oracle of Omaha’s moves that are publicly disclosed via quarterly 13F filings, as well as the knowledge that the nonagenarian has shared through his annual letter and the various interviews that he has given over the years.

In one of these interviews with the Financial Times in 2019, Buffett joked that his “nightmare” would be a scenario wherein he finds stocks expensive, while Berkshire Hathaway shares are fairly valued.

That year, the conglomerate was a net buyer of stocks (total buys minus total sales) of only $4 billion – a steep markdown from the previous year. when it was a net buyer to the tune of $24 billion. Buffett was also frugal with buybacks, as Berkshire repurchased around $5 billion in shares and ended the year with a record cash pile of $128 billion.

Warren Buffett on Berkshire’s Buyback Policy

In his letter accompanying the 2019 annual report, Buffett neatly summed up his repurchase thesis when he said that the company would buy back shares only when he and vice chair Charlie Munger “believe that it is selling for less than it is worth” - and second, after the repurchases, Berkshire “is left with ample cash.”

At the end of September, Berkshire had over $157 billion cash on its balance sheet – a more than “ample” amount, and a record for the company. However, Buffett and Munger spent only $1.1 billion on repurchases, which was preceded by a $1.4 billion buyback in Q2 – so it would be a safe assumption that the duo doesn’t think that Berkshire shares are trading at less than what they consider is their fair intrinsic value.

For context. Berkshire's current price-to-book multiple is around 1.47x. Until 2018, Berkshire used to repurchase shares only as long they were up to 1.2x of the book value - but subsequently, the company made the policy flexible, giving more discretion to Buffett to buy back the shares.

Incidentally, Berkshire was on a buyback spree between 2020 and 2021, and repurchased over $50 billion worth of its shares between these two years. While the company toned down the repurchases in 2022, it went overboard in deploying that cash in other companies, and also acquired Alleghany Corp. for $11.6 billion.

Warren Buffett Is on a Stock-Selling Spree

Meanwhile, Buffett does not seem to have found many profitable investing opportunities in 2023 – another of the conditions for the “nightmare” scenario that he talked about four years back.

In Q3 2023, Berkshire was a net seller of stocks to the tune of almost $5.3 billion. The previous two quarters were no different, as the conglomerate net sold stocks worth $8 billion and $10.4 billion in Q2 and Q1, respectively, bringing the YTD total to almost $24 billion.

Is Buffett Bracing for a Stock Market Crash?

The last time Buffett found it that tough to deploy the conglomerate’s burgeoning cash pile was in 2019, when he was quite frugal with both the repurchases as well as investing in stocks of publicly traded companies.

U.S. stocks indeed crashed in the first quarter of 2020, but that was due to the COVID-19 pandemic – even as equity valuations were arguably already stretched heading into the year. Buffett found solace in Berkshire shares in 2020 and 2021, as the stock's relative underperformance helped him repurchase a record number of shares at lower prices, thereby adding value for shareholders.

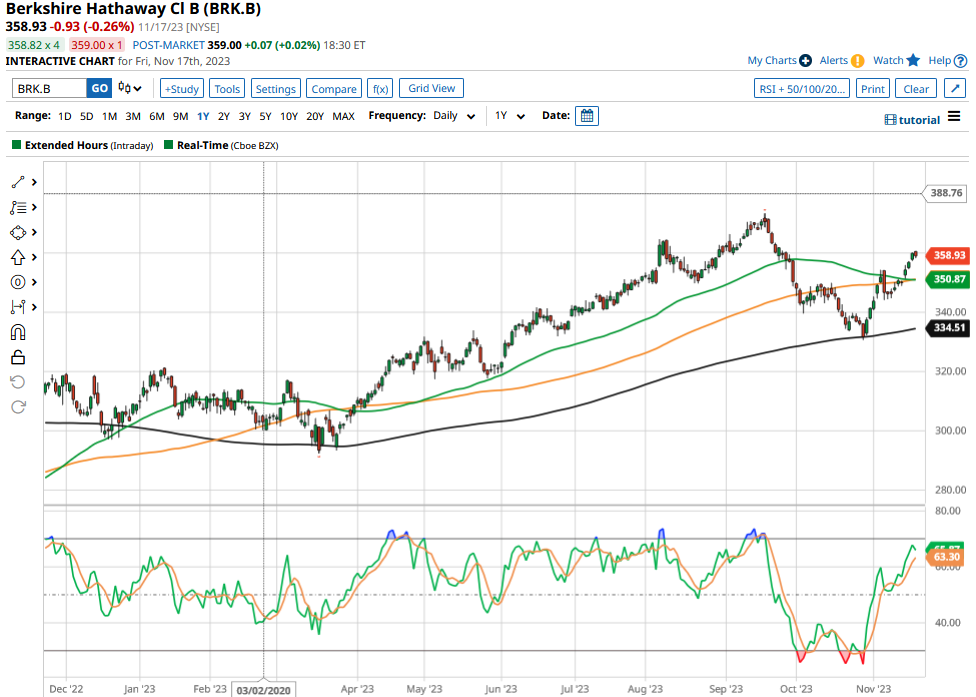

But looking at Buffett’s more recent moves, the value investor does not seem to be able to find many compelling opportunities in the market, including Berkshire’s own shares - which are up around 17% this year, slightly underperforming the S&P 500 Index ($SPX).

Berkshire Hathaway Stock Has Underperformed

To be sure, Berkshire’s recent performance vis-à-vis the S&P 500 hasn’t been terribly impressive. Berkshire Hathaway shares have routinely lagged the SPX in recent years (accounting for dividends), including a 20% underperformance in 2019 – which was Buffett’s sixth-worst underperformance since 1965, when he took control of the company.

Berkshire's underperformance this decade can be somewhat attributed to Buffett’s reluctance around tech stocks - which he has said multiple times are outside his circle of competence, but have been the key driver of the market rally over the period.

While Buffett not finding value in listed stocks - including Berkshire shares - might be his own personal “nightmare” scenario, it should also ring alarm bells for other investors. That's particularly true amid fears of a U.S. recession, as well as concerns over financial stability amid the country’s soaring debt pile, which has already sparked credit rating downgrades from leading rating agencies.

On the date of publication, Mohit Oberoi had a position in: BRK.B . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.