When it comes to showing off your home at its best, grey skies, less natural light and soggy leaves across the garden can make the job tough. But despite that, towards the year end large numbers of Brits commit to hoisting for-sale signs over their properties.

While the final three months of the year generally have the lowest number of new homes coming to market, it is far from quiet. In October there were 140,817 new instructions, a 2.6 per cent rise on the five-year average for that month, figures from real estate data company TwentyCi show.

Favourable conditions for sellers recently include encouraging demand, and average UK house prices reaching a new record high last month, £299,862 according to lender Halifax.

Meanwhile although some consumers may have been disappointed that there was no interest rates cut announced by the Bank of England last week, many borrowing terms remain attractive. Justin Moy, managing director of broker EHF Mortgages comments: “The cost of fixed rate mortgages has improved substantially over the last few weeks in an attempt to kick start the property market, whilst buyers have had one eye on the impending Budget.”

For those undecided on whether to start the for-sale process soon there is plenty to consider - including whether the Autumn Budget on 26 November will impact house prices and market sentiment, forecasts for prices in your area, and seasonal factors.

Economic statements and the impact on prices

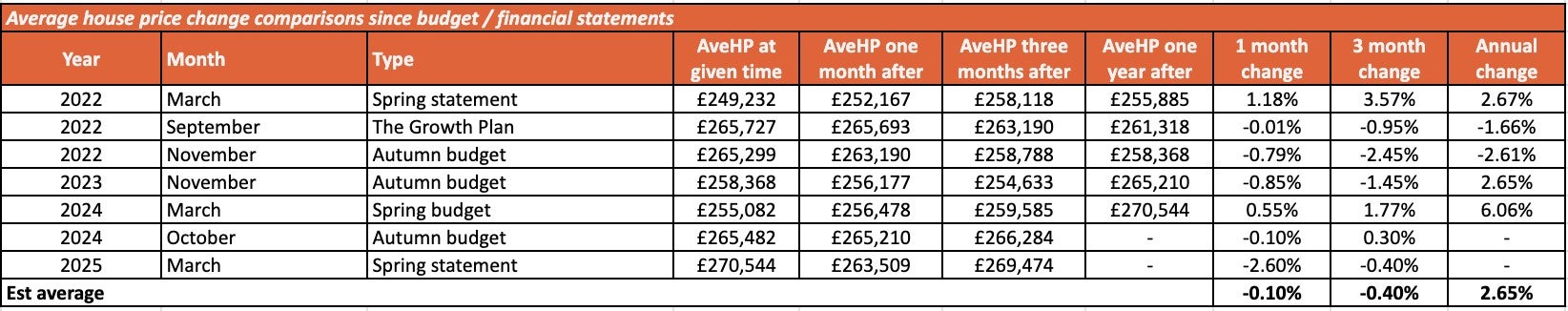

Analysis shared with The Independent by estate agency Springbok Properties shows that major fiscal events such as Autumn Statements and Government growth plans can actually often trigger short-term price declines in the housing market.

The company analysed the last seven major economic statements, comparing the rate of house price growth in the month immediately following each announcement, three months after, and a year later.

It found on average, house prices have fallen by 0.1 per cent in the month following the last seven major economic statements (see table below). However, the long-term picture remains more positive, with house prices rising by an average of 2.65 per cent over the year following these announcements, once the market has had time to stabilise.

The table below shows data from Springbok Properties giving house price impact after the past seven major fiscal statements. You can click to enlarge it.

Shepherd Ncube, chief executive of Springbok Properties, says: “For those who need to sell, the challenge is that waiting for certainty [around Budgets] could mean selling for less. For those who can afford to wait, history suggests the market does recover once the dust settles, but not everyone has that luxury.”

How could demand look post-Budget?

The housing market will soon find out what could hurt or help sales, including if there is any truth to rumours of a potential “mansion tax” on properties valued over £2m.

When the contents of Chancellor Rachel Reeves’ red box are revealed it “may help clear up some of the uncertainty that’s been hanging over the market”, says Aneisha Beveridge, head of research at estate agent Hamptons.

She adds: “If last year is anything to go by, we saw activity pick up after the Budget, with Q1 emerging as the optimum time to sell - a pattern we may well see repeated.”

Laura Dam Villena, head of residential agency at real estate advisors Cluttons comments: “Some buyers are showing active interest in properties but will wait until the Budget announcements before they place an offer on a property. As the Budget is so close to Christmas, this may mean that sellers and buyers alike wait until the New Year, at which point we could expect a jump in activity.”

Property consultancy Savills’ recent forecast expects both demand and price growth will be fairly slow for the rest of this year and into early 2026, with UK average house price growth of 2 per cent next year.

It forecasts Yorkshire and The Humber and the North East having the strongest regional rise, with gains of 3.5 per cent predicted. London is expected to be weakest, with a flat performance.

Seasonal trends

Lighting and Christmas decorations may make photography more tricky over the festive period, and bad weather and busy calendars could make viewings more difficult.

But for those choosing to sell soon there can be advantages.

Nick Leeming, chairman of estate agency chain Jackson-Stops says: “Buyers who are actively searching at this time of year tend to be highly motivated, often part of the ‘must move’ market.”

He adds: “It’s also no secret that all the key property sites see their highest levels of traffic between Christmas and New Year, when potential vendors and buyers are looking to make future plans. Sellers can really benefit from this surge in online activity.”

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

Seven ways to stop your credit score derailing your mortgage application

Five expert tips to help celebrate Christmas on a budget

Six big changes to expect from Reeves’ Budget and how they’ll impact your finances

The taxes Rachel Reeves could raise after income tax hike abandoned

How financial imposter syndrome could be draining your finances