President Donald Trump celebrated his 79th birthday last June; that means he has been eligible to claim Social Security benefits since 2008, when he turned 62.

As he was born in 1946, his full retirement age (FRA) was 66, a milestone he hit in 2012. Trump turned 70 in 2016 — the same year he launched his first bid for the presidency. At that age, he would have been eligible to claim his maximum benefit by earning delayed retirement credits.

It takes some detective work to determine whether our senators or representatives are claiming Social Security benefits. No one in any of the three branches — judicial, executive or legislative — is required to release their 1040 tax forms. And while they must file financial disclosure forms, those don't reveal whether the filer reported taxable Social Security benefits.

Moreover, when historic returns are available, they don't reveal much because benefits only became taxable in 1984.

Do presidents have to pay Social Security taxes?

If you're wondering whether presidents pay Social Security taxes on their income, the answer is yes, starting in 1984. The Social Security Act of 1983 brought members of Congress, the president and vice president, federal judges and most political appointees under the Social Security program.

The wages paid to Presidents Ronald Reagan, George H.W. Bush, Clinton, George W. Bush, Barack Obama, Donald Trump and Joe Biden were subject to FICA (payroll) taxes.

One of the best resources for presidential tax return records is the Tax Analyst’s Tax History Project, which includes presidential tax returns dating back to Woodrow Wilson.

So, does Trump claim Social Security benefits?

In short, no. According to his most recently available tax return, tax year 2020, he doesn’t claim Social Security benefits. The first lady won't be eligible to claim Social Security until 2032, when she turns 62.

Let’s take a look at which politicians claim Social Security benefits.

President Donald Trump and Melania Trump did not claim benefits as of 2020

President Trump didn't release his tax returns; the House Ways and Means Committee released his returns for 2015 through 2020 on December 20, 2022, after voting along party lines.

While none of these returns show any Social Security income, they do provide other information. On their 2020 federal tax return (PDF), both Donald and Melania Trump checked "Yes" to add $3 to the Presidential Election Campaign fund. They showed $915,171 in itemized deductions and $13,468,593 in tax overpayments. They elected to receive a $5,468,593 refund and apply the remaining $8 million to their 2021 estimated taxes.

Joe and Jill Biden have claimed benefits since 2008

Before running for the Senate in 1972, former President Biden worked at a few law firms, started one of his own, and managed properties on the side.

Joe Biden was born in 1942, and he and his '42 cohort were eligible for full retirement benefits at age 65 and 10 months in 2008. That's also the first year the Bidens' joint tax return shows Social Security income of $6,534. In 2023, the couple reported $64,254 in Social Security income.

The Bidens' tax returns from 1998 through 2023 are publicly available.

The Bushes and the Obamas

President Bush and President Obama were too young to receive Social Security benefits for most of their tenure in office.

George W. Bush took office in 2001 at age 55. He left office after serving two terms in 2009, at the age of 62. While it's possible he began claiming benefits in 2008 at age 62, the last tax return on record is for 2007, a year before he became eligible for reduced benefits. Laura Bush is a few months younger than her husband and turned 62 in November 2007. As with her husband, we have no relevant tax returns to establish whether she began receiving Social Security.

Barack Obama succeeded George W. Bush and also served two consecutive terms as president from 2009 until 2017. He entered office at the age of 47 and left office at the age of 56. Former First Lady Michelle Obama was even younger; she came to the White House at age 45 and left at age 53. Michelle Obama only recently became eligible to collect reduced benefits when she turned 62 this past January.

On the other hand, although Barack Obama is still a few years shy of his full retirement age, he became eligible for benefits in 2023 upon turning 62. As they left politics almost a decade ago, there are no current tax returns to examine to determine if or when the Obamas filed for retiree benefits.

Hillary and Bill Clinton did not claim benefits as of 2015

Hillary Clinton was the First Lady from 1993 to 2001. She and her husband, President Bill Clinton, were too young to collect Social Security while in the White House.

However, the tax returns from Hillary Clinton's 2016 presidential campaign provide insight into the Clintons' finances. As of 2015, neither Hillary nor Bill Clinton collects Social Security benefits.

Hillary Clinton turned 62 in 2009 and hit her FRA of 66 in 2013. Bill Clinton became eligible for reduced benefits at 62 in 2008 and reached his full retirement age of 66 in 2012. The Clintons' joint tax returns from 2008 through 2015, when they were eligible to collect benefits, show no Social Security income.

George H.W. and Barbara Bush did not claim benefits as of 1991

George H.W. Bush became the 41st president after two terms as vice president for Ronald Reagan. Bush was eligible to start receiving reduced benefits at age 62 in 1986. He reached his full retirement age in 1989, a year after he was elected president. There are only three joint tax returns for the Bushes, from years 1989, 1990 and 1991, available for inspection. Those returns show no Social Security income.

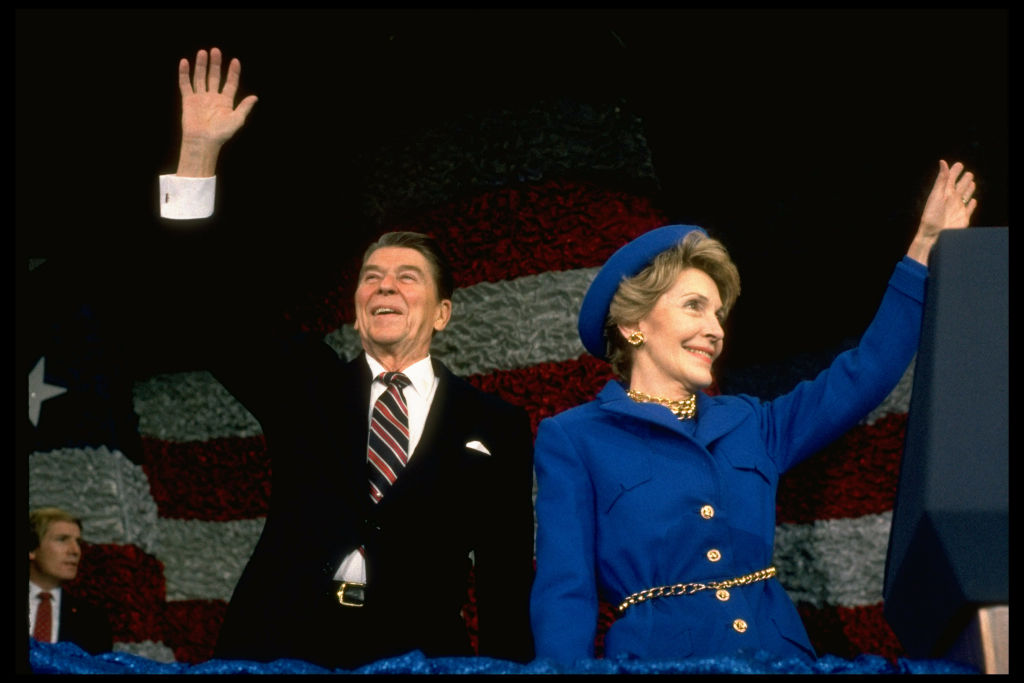

Ronald and Nancy Reagan did not claim benefits as of 1987

Former President Reagan took office in 1981, the same year he would turn 70. He could have begun claiming Social Security benefits in 1973 at age 62. His full retirement age was 65, which he hit in 1976.

Until benefits became taxable in 1984, there was no definitive way to determine whether someone collected benefits outside of a personal statement or admission. The only relevant tax returns available for review are those for 1985, 1986 and 1987. None of these (joint income) returns shows any Social Security income.

The clock is ticking on the Social Security trust fund

Social Security has often been called the "third rail of politics" because past attempts to tinker with benefits have been met with immediate and vocal pushback.

What are the politicians afraid of? Older Americans vote in larger numbers than any other group. In 2024, 72.1% of those ages 65 to 75 and 71.2% of those age 75 and older voted, according to the Census Bureau. These two groups turn out to vote in higher numbers than other demographic groups. Less than half of those aged 18 to 24 voted in the 2024 election cycle.

The Social Security and Medicare trust funds are on track to become insolvent in the next decade.

If nothing changes, Social Security’s Old-Age & Survivors Insurance (OASI) Trust Fund will be depleted by 2033, at which point benefits would be reduced by 23%. The insolvency date for the Medicare Trust Fund has been moved by three years to 2033. When the trust fund is depleted, program tax income is expected to be sufficient to pay 89% of projected benefits.

It's estimated that future beneficiaries will need to save almost $150,000 to offset the shortfall if benefits are reduced.