Docusign (DOCU) shares are plunging on June 10, hurt by a worse-than-expected inflation report and particularly by the company's earnings.

The company reported disappointing results and its outlook didn’t do much to soften the blow. Management is looking at muted revenue growth for the rest of the year.

Further, the company cut its billings outlook to a range of $2.47 billion to $2.48 billion from a range of $2.71 billion to $2.73 previously.

Bulls had been hoping that Docusign stock could rally on its results, given the stock’s decline and the recent rebound in growth and tech stocks.

Perhaps if the market was trading better on the day, the losses would be more manageable. But today’s action in Docusign might have been ugly regardless of the market’s performance.

Trading Docusign Stock

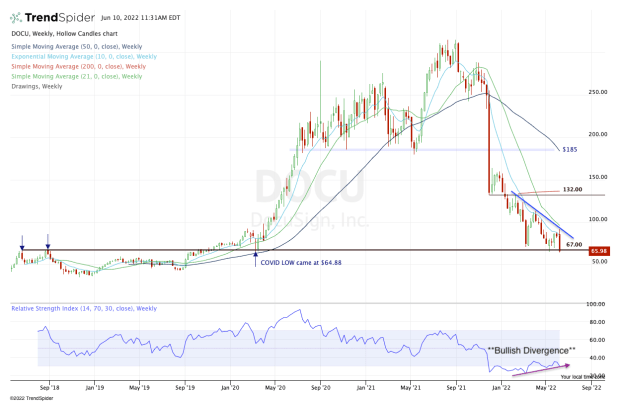

Chart courtesy of TrendSpider.com

On the weekly chart above, noteworthy is how pivotal the $65 area is for Docusign stock.

This level was major resistance in 2018 and 2019 and became support during the covid-19 selloff.

Despite the market getting wrecked in March 2020, this area held firm. That said, Docusign’s business soared during the pandemic.

In any regard, the stock now sits on this pivotal level. It needs to hold as support; otherwise, there are no meaningful support levels to lean on should it break.

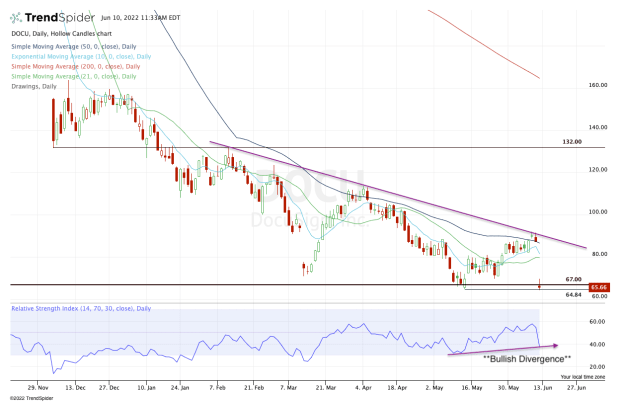

A look at the daily chart shows a zoomed-in look at the situation.

Chart courtesy of TrendSpider.com

Docusign stock narrowly undercut the May low at $64.84 before bouncing. If it can hold up above $64, then bulls might be able to muster up a bounce out of this one.

But they will likely need the broad market to work in their favor. If the Nasdaq and growth stocks continue lower, Docusign will find it tough to fight off that kind of pressure.

If the stock moves above today’s high near $70, perhaps we could see a further rally to the upside. Specifically, the bulls might get a rally back up to the 10-day and 21-day moving averages, currently near $80.

That’s a pretty big move and to get there Docusign stock will likely need a bounce in the overall market as well.

On the downside, below $64 to $65 and the stock has no technical support.