Shares of DocuSign (NASDAQ:DOCU) opened 23.78% lower at $66.5 on Friday after the e-signature software maker reported Q1 2023 adjusted earnings per share (EPS) that were below consensus estimates.

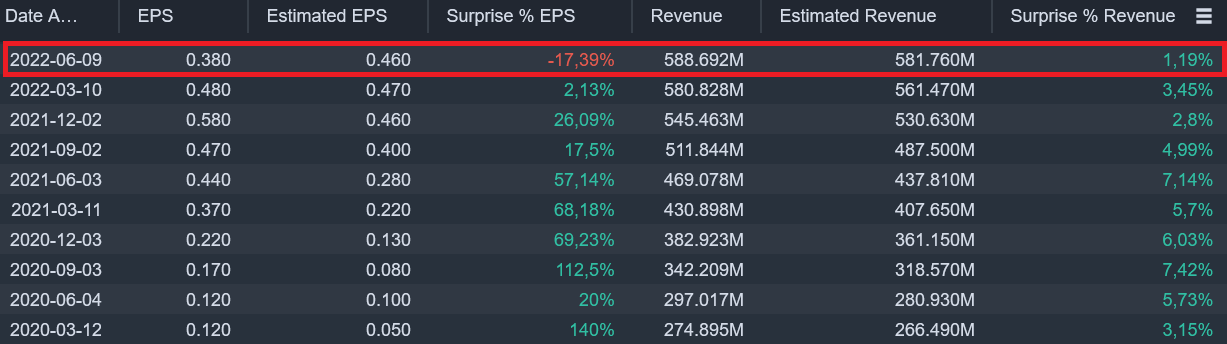

DOCU reported first-quarter adjusted EPS of 38 cents, missing the consensus projection of 46 cents per share. The company generated $588.7 million in the first three months of the fiscal year, while analysts were looking for $581.8 million, and up 25% from the year-ago period. DocuSign said its net loss extended to $27.4 million from $8.3 million in the year-ago quarter.

Source: Earnings Calendar Benzinga Pro (14-day free trial)

The company said it will slow down hiring to “balance growth and profitability,” said Chief Executive Dan Springer, but will not be cutting jobs.

CFO Cynthia Gaylor said macroeconomic challenges also weighed on the company’s operations, with multiple deals getting stalled and delayed due to economic uncertainty after Russia’s invasion of Ukraine. Gaylor also said DocuSign saw a slowdown in its expansion rate, which gauges the pace of customer spending.

Looking ahead, DocuSign expects revenue in the range of $600 million to $604 million, while analysts were estimating $601.7 million. For the full fiscal 2023, the e-signature company expects to generate $2.47 billion to $2.48 billion in revenue, compared to the analyst estimates of $2.479 billion, according to Refinitiv.

Microsoft Partnership

Earlier this week, DocuSign announced an expansion of its strategic partnership with Microsoft (NASDAQ:MSFT) to develop new integrations and capabilities and innovate the way people collaborate and reach agreements.

Following the coronavirus pandemic, companies and organizations rushed to shift to digital in order to stay relevant and keep competing in their respective markets. To accelerate these digital transformation efforts, Microsoft and DocuSign teamed up to develop innovative integrations and solutions that allow clients to organize and sign agreements in the cloud, from anywhere in the world

"Microsoft is critical to our vision of streamlining the agreement process for our customers, wherever they get work done. With so much of the world getting work done in Microsoft's applications and cloud services, we are thrilled to be deepening our relationship with Microsoft to jointly deliver on the promise of the anywhere economy," said Dan Springer, CEO, DocuSign.

The announced partnership expansion will deepen the current relationship between DocuSign and Microsoft, which is a customer of the e-signature company. It will add new integrations across Microsoft 365, Dynamics 365, and Power Platform to enhance the automation of contract processes.

Some of the new integrations and capabilities that will be added as a part of the latest partnership expansion include DocuSign eSignature for Microsoft Teams, Microsoft 365, Microsoft Word, and Microsoft Dynamics 365; and DocuSign CLM for Microsoft Word.

Wrap Up

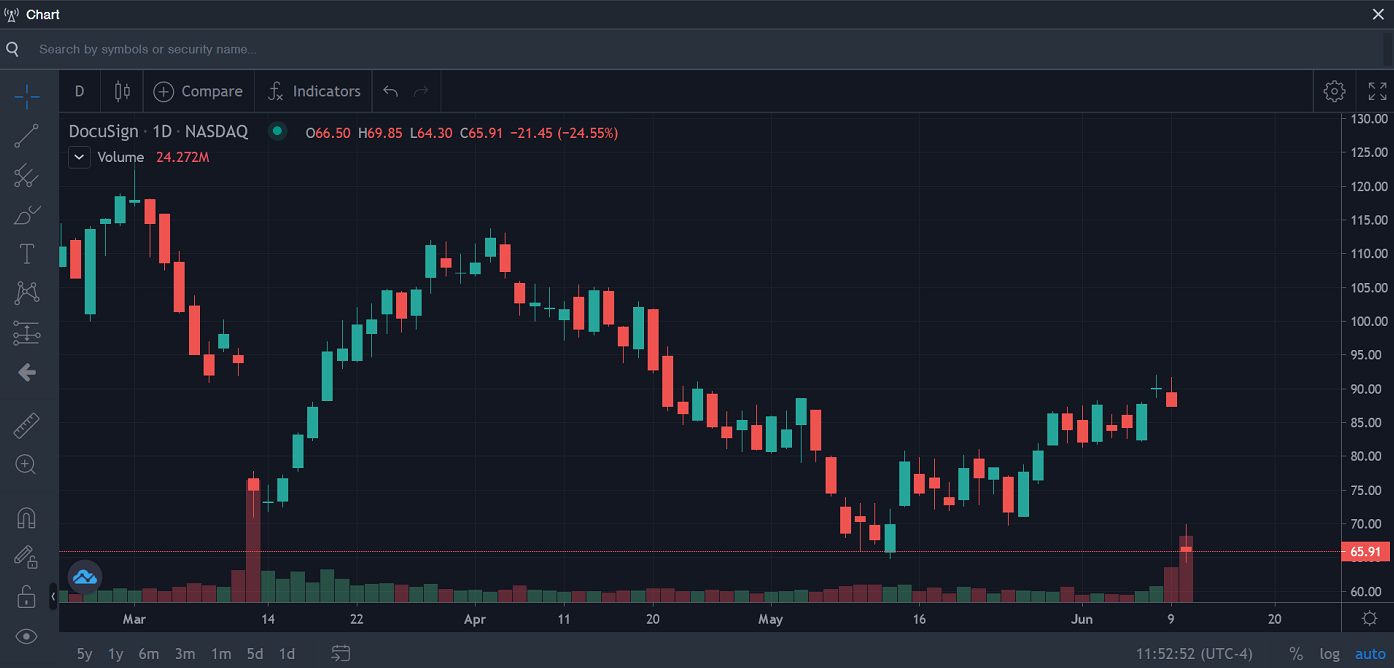

DocuSign shares were down nearly 25% in pre-market trading Friday after the tech company delivered a disappointing set of results and guided down for the second quarter. The price per share bounced from $66.50 at the open to $69.85 intraday, but then fell to the lowest price level since December 2019 and closed at $65.93.

DocuSign shares are currently down 69.52% from the all-time highs of August 2021.

The final major support level is the all-time-low from November 2018 at $35.06.

Source: Earnings Calendar Benzinga Pro (14-day free trial)

Alexander Voigt is the Chief Executive Officer and founder of daytradingz.com. He does not hold any positions in the mentioned stocks.