/W_R_%20Berkley%20Corp_%20phone%20and%20data-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Valued at a market cap of $26.5 billion, W. R. Berkley Corporation (WRB) is an insurance company and one of the largest commercial lines property and casualty insurers, based in Greenwich, Connecticut.

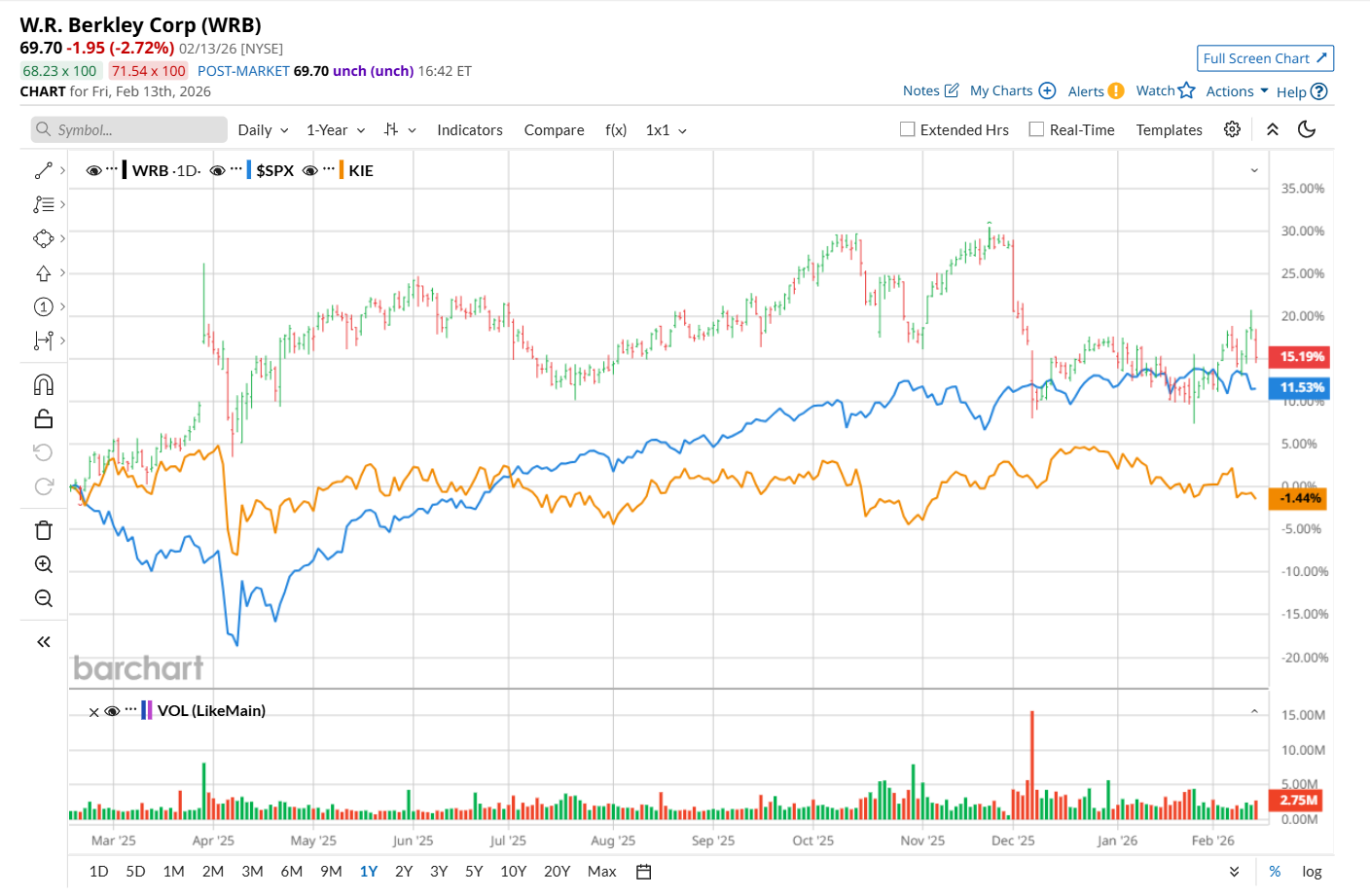

This insurance company has outpaced the broader market over the past 52 weeks. Shares of WRB have surged 13.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 11.8%. Meanwhile, on a YTD basis, the stock is down marginally, in line with SPX.

Zooming in further, WRB has outperformed the State Street SPDR S&P Insurance ETF (KIE), which declined 1.5% over the past 52 weeks and 4.5% on a YTD basis.

On Jan. 26, WRB delivered weaker-than-expected Q4 results, yet its shares surged marginally in the subsequent trading session. Due to higher net premiums written, the company’s total revenue increased 1.5% year-over-year to $3.7 billion, but missed consensus estimates by a slight margin. Meanwhile, on the earnings front, its operating income per share improved 10.8% from the year-ago quarter to $1.13, missing analyst expectations by a penny.

For fiscal 2026, ending in December, analysts expect WRB’s EPS to grow 5.5% year over year to $4.57. The company’s earnings surprise history is mixed. It exceeded or met the consensus estimates in three of the last four quarters, while missing on another occasion.

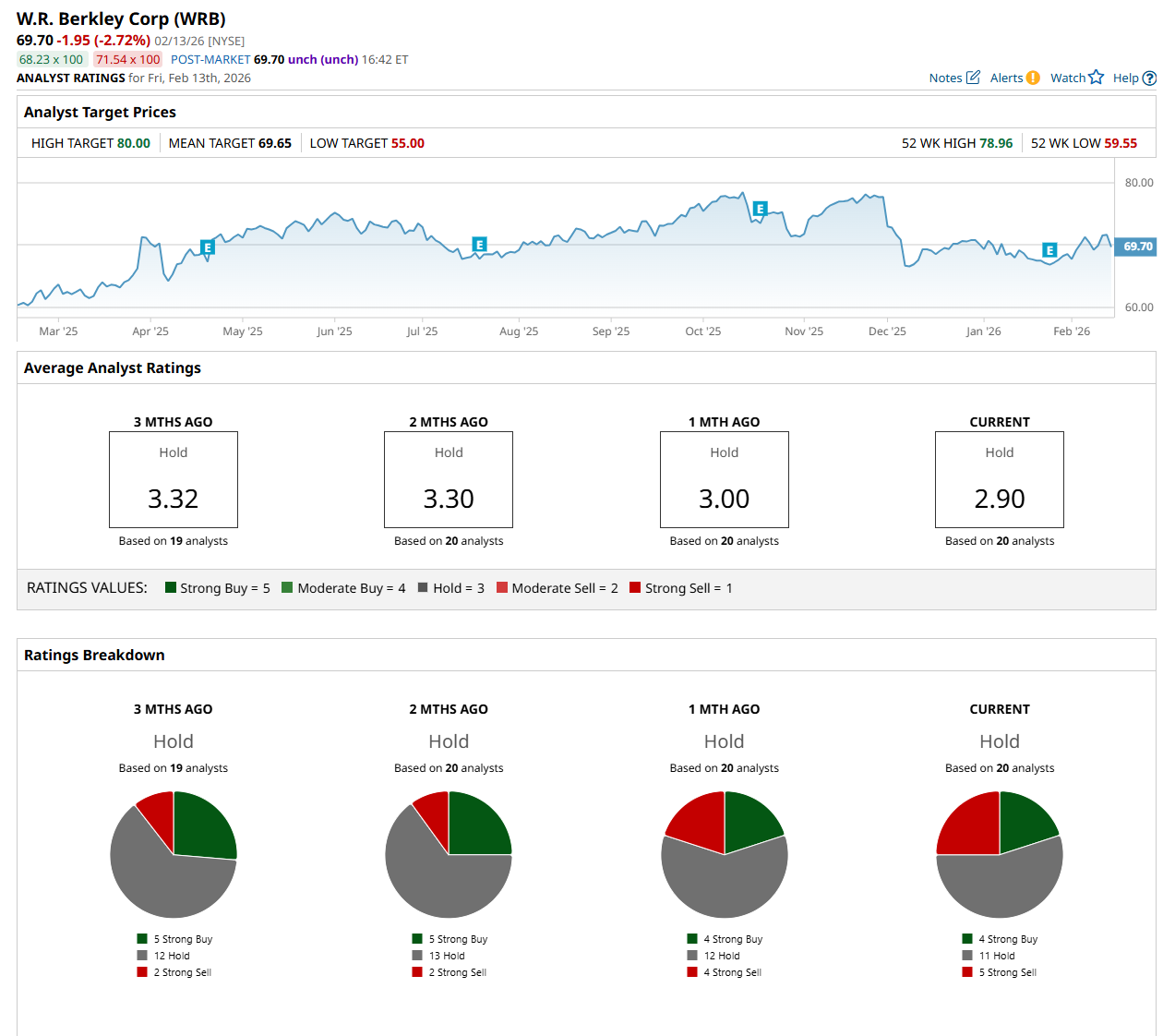

Among the 20 analysts covering the stock, the consensus rating is a "Hold,” which is based on four “Strong Buy,” 11 “Hold,” and five "Strong Sell” ratings.

The configuration is more bearish than a month ago, with four analysts suggesting a “Strong Sell” rating.

On Feb. 2, Cantor Fitzgerald analyst Ryan Tunis maintained an "Overweight" rating on WRB but lowered its price target to $75, indicating a 7.6% potential upside from the current levels.

While the company is trading above its mean price target of $69.65, its Street-high price target of $80 suggests a 14.8% potential upside from the current levels.