/S%26P%20Global%20Inc%20logo%20and%20chart-by%20IgorGolovniov%20via%20Shutterstock.jpg)

New York-based S&P Global Inc. (SPGI) is a powerhouse of financial information, analytics, and credit ratings. Valued at $149.5 billion by market cap, the company provides credit ratings, benchmarks, analytics, and workflow solutions in the global capital, commodity, and automotive markets.

Best known as the company behind the S&P 500 Index, it plays a central role in global capital markets by offering essential data and insights that help investors, companies, and governments make informed decisions.

Shares of this leading credit rating agency have underperformed the broader market over the past year. SPGI has dipped 1.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.1%. The trend has continued in 2025, with the stock marginally in the red while the SPX has climbed 16.4% year-to-date.

Drilling down further, the stock has also trailed sector peers. The iShares U.S. Broker-Dealers & Securities Exchanges ETF (IAI) has gained about 17.5% over the past year and 22.8% on a YTD basis, outshining the stock’s losses over the same time frame.

On Oct. 30, S&P Global delivered solid third-quarter results that pushed its shares up 3.9%. Its revenue rose 9% year over year to $3.89 billion, and adjusted EPS came in at $4.73, both topping market expectations. The company raised its full-year guidance, anticipating 7-8% revenue growth and continued margin expansion, reflecting confidence in its data, analytics and ratings franchises.

For the current fiscal year, ending in December, analysts expect SPGI’s EPS to grow 13.1% to $17.76 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

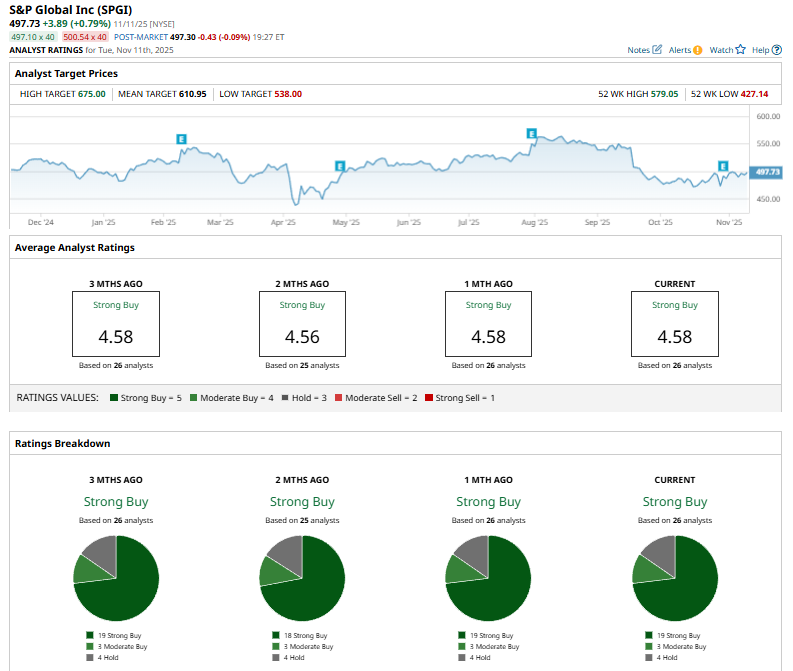

Among the 26 analysts covering SPGI stock, the consensus is a “Strong Buy.” That’s based on 19 “Strong Buy” ratings, three “Moderate Buys,” and four “Hold.”

This configuration is bullish than two months ago, with 18 analysts suggesting a “Strong Buy.”

JPMorgan Chase & Co. (JPM) trimmed its price target on SPGI to $615 from $635 on Oct. 31 but reiterated an “Overweight” rating, noting the company delivered a Q3 2025 earnings beat and raised its full-year guidance.

The mean price target of $610.95 represents a 22.7% premium to SPGI’s current price levels. The Street-high price target of $675 suggests an upside potential of 35.6%.