Valued at a market cap of $27.5 billion, Kenvue Inc. (KVUE) is a leading consumer health company that manages some of the world’s most trusted brands, including Tylenol, Neutrogena, Listerine, Aveeno, Band-Aid, and Johnson’s Baby. The Summit, New Jersey-based company, focuses on science-backed, insight-driven “everyday care” solutions.

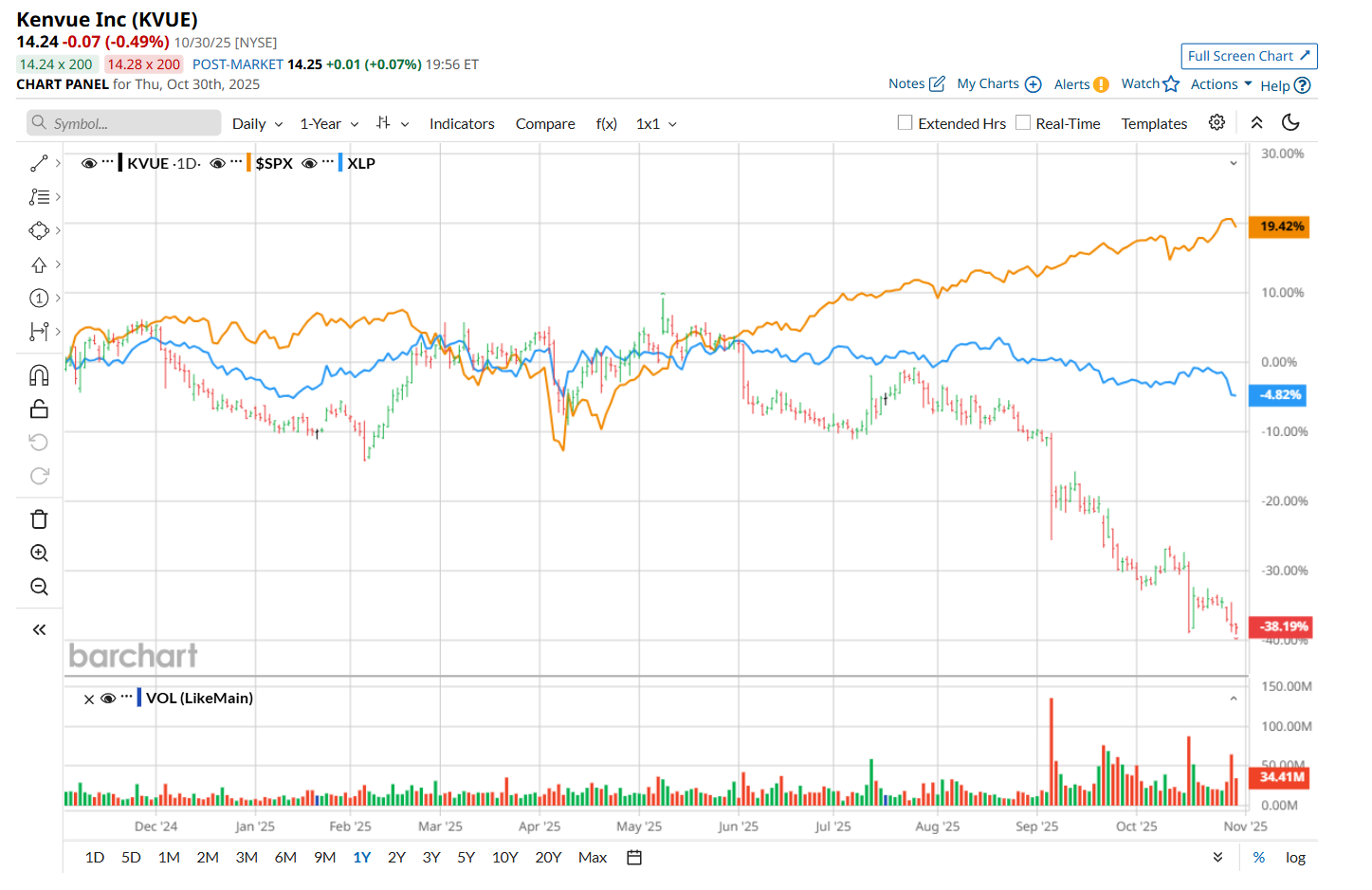

This household & personal products company has significantly underperformed the broader market over the past 52 weeks. Shares of Kenvue have declined 37.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 17.4%. Moreover, on a YTD basis, the stock is down 33.3%, compared to SPX’s 16% rise.

Narrowing the focus, Kenvue has also lagged behind the Consumer Staples Select Sector SPDR Fund’s (XLP) 4.7% drop over the past 52 weeks and 2.7% fall on a YTD basis.

Shares of Kenvue gained 1.5% after its mixed Q2 earnings release on Aug. 7. Due to a 4.2% decline in organic sales, driven by weaker volumes across all three of its reportable segments, the company’s net sales dropped 4% year-over-year to $3.8 billion, missing consensus estimates by a slight margin. However, on the brighter side, while its adjusted EPS of $0.29 also decreased 9.4% from the same period last year, it topped analyst expectations by a penny.

For the current fiscal year, ending in December, analysts expect Kenvue’s EPS to decline 13.2% year over year to $0.99. The company’s earnings surprise history is promising. It exceeded or met the consensus estimates in each of the last four quarters.

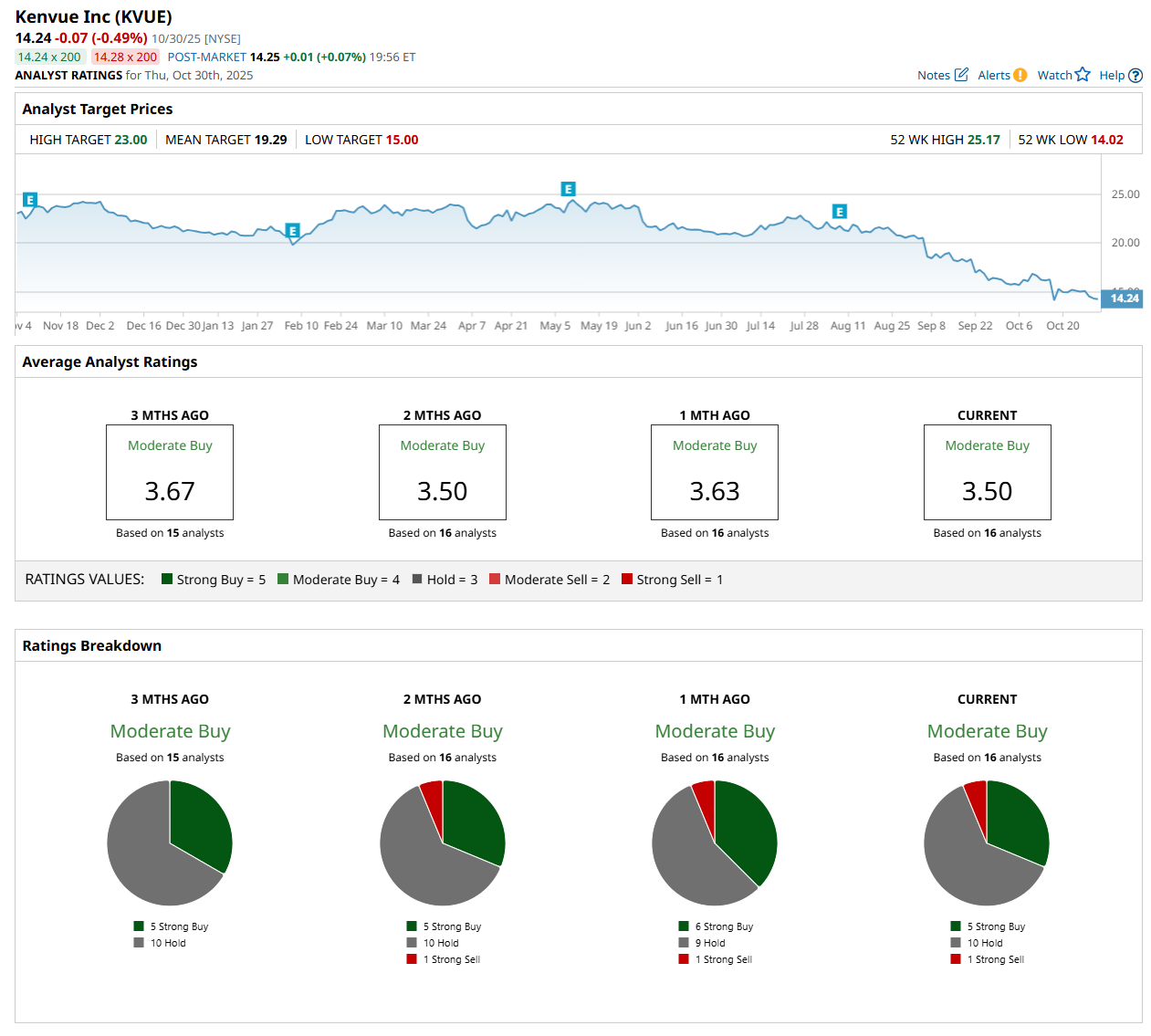

Among the 16 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on five “Strong Buy,” 10 “Hold,” and one “Strong Sell” rating.

This configuration is slightly less bullish than a month ago, with six analysts suggesting a "Strong Buy” rating.

On Oct. 29, Canaccord Genuity lowered its rating on Kenvue to “Hold” and cut its price target to $15, indicating a 5.3% potential upside from the current levels.

The mean price target of $19.29 represents a 35.5% premium from Kenvue’s current price levels, while the Street-high price target of $23 suggests an upside potential of 61.5%.