/Expeditors%20International%20Of%20Washington%2C%20Inc_%20logo%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

Bellevue, Washington-based Expeditors International of Washington, Inc. (EXPD) is a global logistics and freight-forwarding company that provides air and ocean freight consolidation, customs brokerage, warehousing, and supply chain solutions. Valued at a market cap of $18.6 billion, the company is known for its emphasis on customer service, technology-driven operations, and disciplined cost management.

Shares of this freight and logistics company have outpaced the broader market over the past 52 weeks. EXPD has rallied 15.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.6%. Moreover, on a YTD basis, the stock is up 25%, compared to SPX’s 14.6% uptick.

Zooming in further, EXPD has also outperformed the Pacer Industrials and Logistics ETF (SHPP), which has gained 3.1% over the past 52 weeks and 7.8% on a YTD basis.

On Nov. 4, shares of EXPD surged 10.8% after its impressive Q3 earnings release. While the company’s revenue declined 3.5% year-over-year to $2.9 billion, it topped the consensus estimates by 7.8%. However, despite the fall in revenue, its EPS increased marginally from the year-ago quarter to $1.64 and came in 17.1% ahead of analyst estimates. During the quarter, airfreight tonnage grew on exports, particularly from North and South Asia, while ocean container volume decreased from the prior-year quarter.

For the current fiscal year, ending in December, analysts expect EXPD’s EPS to grow 2.3% year over year to $5.85. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

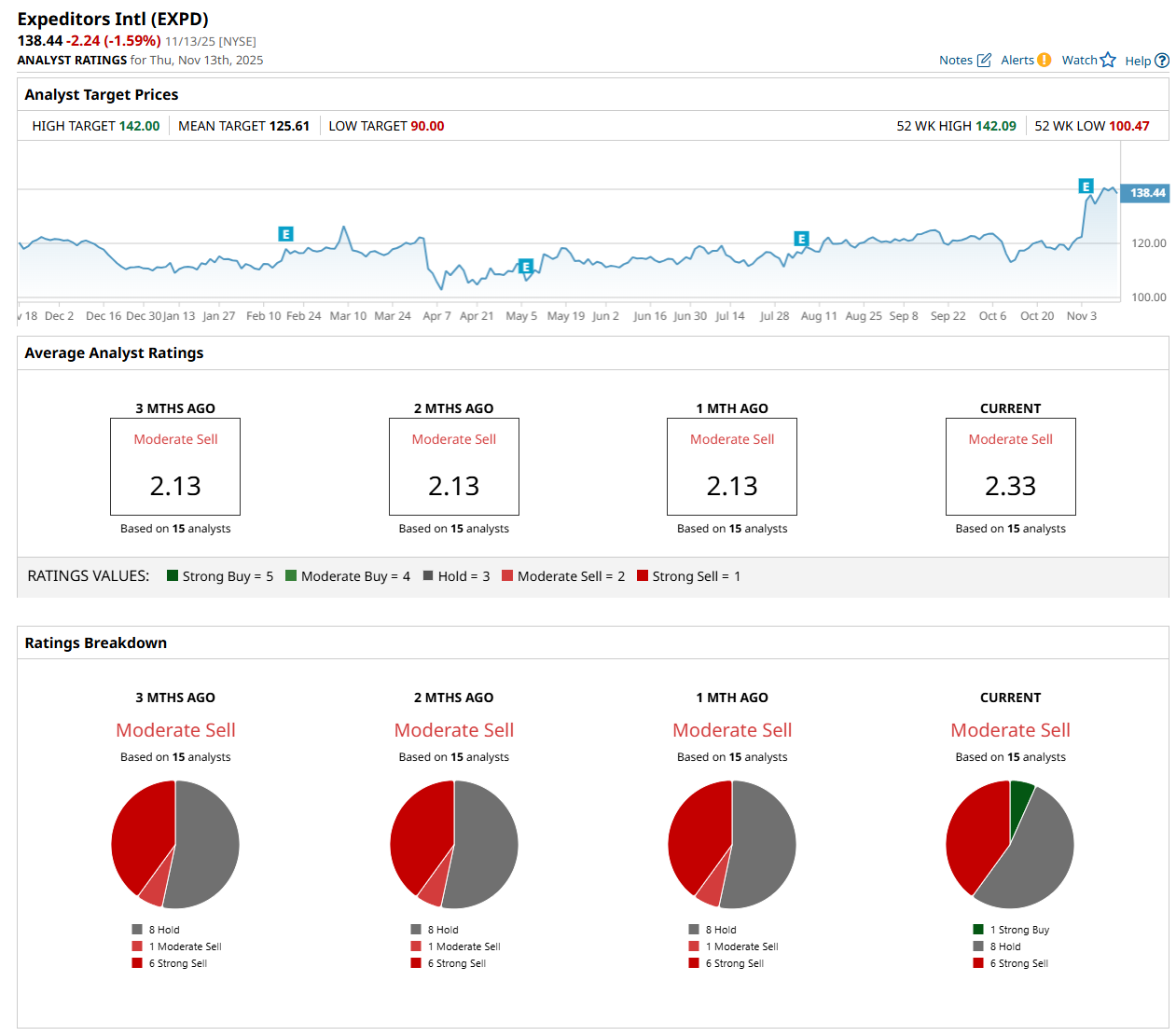

Among the 15 analysts covering the stock, the consensus rating is a "Moderate Sell,” which is based on one “Strong Buy,” eight "Hold,” and six "Strong Sell” ratings.

This configuration is slightly less bearish than a month ago, with no analyst suggesting a “Strong Buy” rating.

On Nov. 6, Stifel Financial Corp. (SF) maintained a "Hold" rating on EXPD and raised its price target to $130.

While the company is trading above its mean price target of $125.61, its Street-high price target of $142 suggests a 2.6% potential upside from the current levels.