/Capital%20One%20Financial%20Corp_%20bank%20location-by%20Heather%20Shimmin%20via%20iStock.jpg)

Capital One Financial Corporation (COF) is a Virginia-based bank holding company and diversified financial services provider. Founded in 1994 as a spin-off from Signet Bank, it has grown into one of the largest consumer banks in the United States, with a strong national footprint in credit cards and digital banking. With a market cap of $139.8 billion, Capital One operates through Credit Card, Consumer Banking, and Commercial Banking segments.

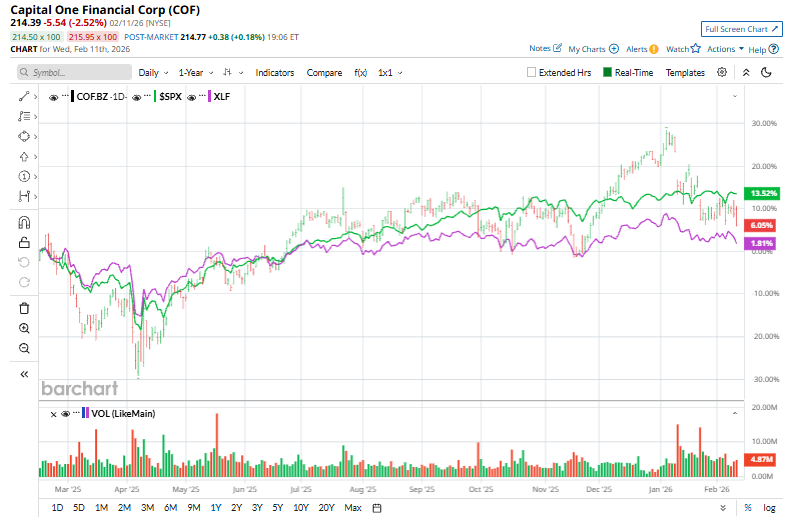

Capital One has underperformed the broader market over the past year. COF stock prices have soared 7.6% on a over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 14.4% gains. On a YTD basis, COF shares have plunged 11.5%, trailing SPX’s 1.4% rise.

Narrowing the focus, Capital One has also outpaced the State Street Financial Select Sector SPDR Fund (XLF), which has risen 2.3% over the past year and plunged 3.7% on a YTD basis

On Jan. 22, shares of Capital One declined 6.2% after the company reported Q4 2025 results that missed profit expectations. Adjusted EPS came in at $3.86, below the $4.14 consensus estimate, while the efficiency ratio rose to 60%, significantly higher than the 52.5% analysts had projected, signaling expense pressure. Although revenue of $15.58 billion modestly exceeded forecasts, weaker profitability drove the negative market reaction.

For the current year ending in December, analysts expect COF to deliver an adjusted EPS of $20.21, up 3.1% year-over-year. Further, the company has a mixed earnings surprise history. It has surpassed the Street’s bottom-line estimates in three of the past four quarters, while missing on another occasion.

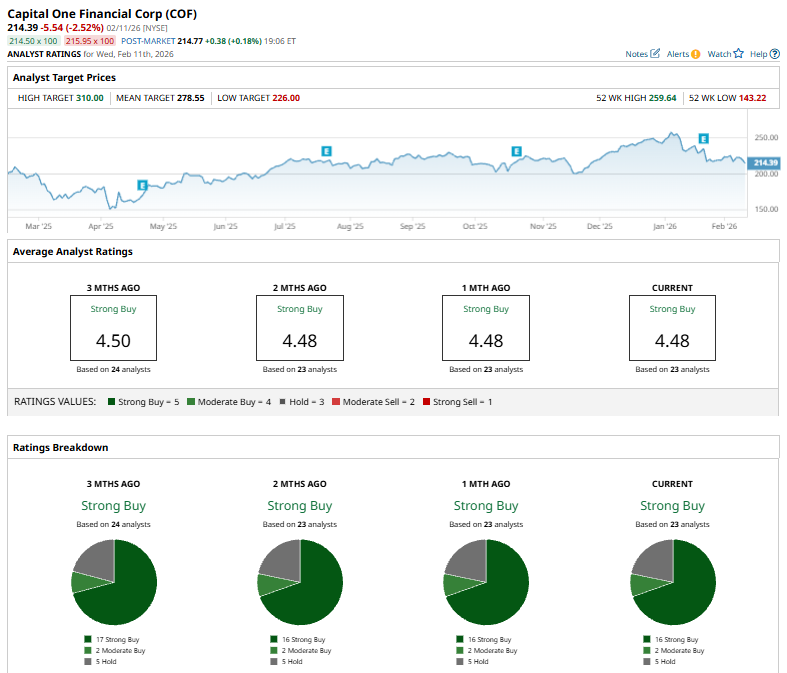

Among the 23 analysts covering the COF stock, the consensus rating is a “Strong Buy.” That’s based on 16 “Strong Buys,” two “Moderate Buys,” and five “Holds.”

This configuration is slightly bearish than three months ago, when 17 analysts gave “Strong Buy” recommendations.

On Jan. 26, Truist Securities cut its price target on Capital One to $275 from $290 while maintaining a “Buy” rating. The firm slightly lowered its estimates following Q4 2025 results, citing elevated expenses and dilution tied to the $5.15 billion Brex acquisition, and noted that investors are now focused on whether expense pressures have peaked.

COF’s mean price target of $278.55 represents a 29.9% premium to current price levels. Meanwhile, the street-high target of $310 suggests a robust 44.6% upside potential.