Valued at $76.5 billion by market cap, Apollo Global Management, Inc. (APO) is a prominent alternative asset manager. Founded in 1990 and based in New York, Apollo specializes in private credit, private equity, and real assets.

Apollo Asset Management has struggled to keep pace with the broader market, delivering a stark contrast to the recent equity rally. APO stock has plunged 21.5% over the past 52 weeks and 10.6% over the past six months, compared to the S&P 500 Index’s ($SPX) 15% surge and 9.2% rally, respectively.

The underperformance extends to its sector peers as well, with Apollo trailing the iShares U.S. Financials ETF (IYF), which has gained 7.4% over the past year and 2.6% over the past six months.

On Jan. 7, Apollo announced that its managed funds and affiliates led a $3.5 billion capital solution for Valor Compute Infrastructure (VCI) to support a $5.4 billion acquisition and lease of advanced data center infrastructure, including NVIDIA GB200 GPUs, for a subsidiary of xAI. Structured as a triple-net lease, the deal will help power one of the world’s most advanced AI compute clusters for training and developing Grok. Backed byNVIDIA Corporation (NVDA) as an anchor investor, the transaction highlights Apollo’s push into AI infrastructure, which it views as a downside-protected, high-growth investment area. The announcement was well received by the market, with Apollo’s shares climbing 1.3% in the next trading session.

For FY2025, which ended in December, analysts expect Apollo Global Management to deliver adjusted EPS of $7.40, representing 12.3% increase year-over-year. However, the firm's track record of meeting expectations has been inconsistent. It has missed the Street's earnings estimates two times over the past four quarters, and exceeded in two other occasions.

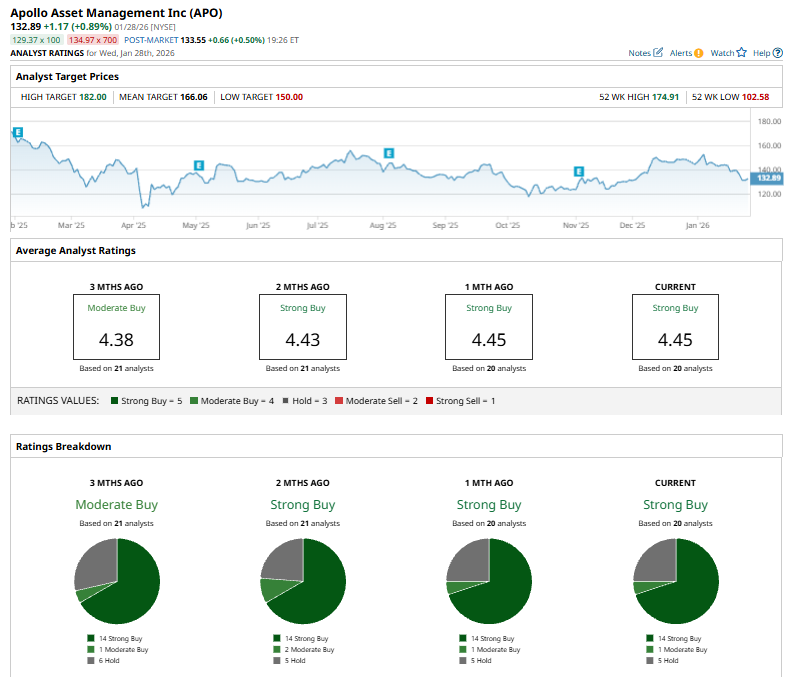

Analysts remain very optimistic about the stock’s long-term prospects. APO holds a consensus “Strong Buy” rating overall. Of the 20 analysts covering the stock, opinions include 14 “Strong Buys,” one “Moderate Buy,” and five “Holds.”

On Jan. 13, UBS analyst Michael Brown reaffirmed a “Buy” rating on Apollo Asset Management while trimming the firm’s price target to $182 from $186, reflecting a slightly more cautious outlook despite continued confidence in the company’s long-term performance.

APO’s mean price target of $166.06 indicates a 14% premium to current price levels.