Disney (DIS) stock is getting hammered on Thursday, down nearly 9% at last glance and trending near session lows.

The decline sent the shares to multimonth lows as investors were underwhelmed by the entertainment giant's earnings report.

Disney reported in-line earnings results, a slump of almost 14% vs. the year-earlier quarter. Revenue, up 7.5%, topped analysts’ expectations.

Don't Miss: Boeing Stock Must Clear One Level to Return to 2023 Highs

Investors were also disappointed with Disney’s streaming-services results, which lost 4 million subscribers in the quarter. This even as it still boasts more than 157 million paid subscribers.

Put another way, the company remains a work in progress.

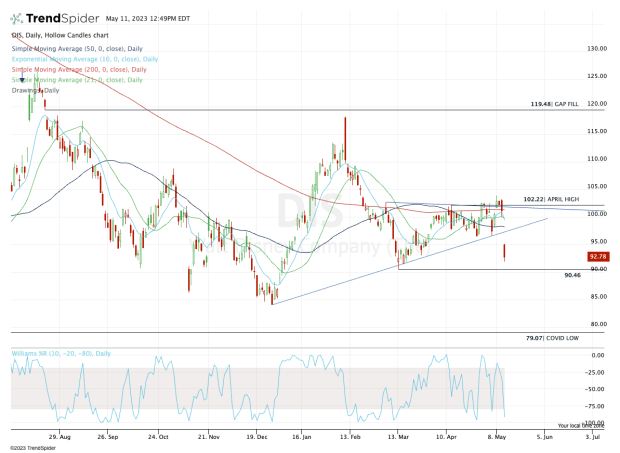

Disney stock is now tumbling and investors are wondering where support could come into play. Let’s have a look at the chart.

Trading Disney Stock on Earnings

Chart courtesy of TrendSpider.com

With the decline on Thursday, Disney stock is knifing through the April low near $96.50 and is below uptrend support (blue line).

It also means it failed to break out over the $102 area, which looked quite promising just earlier this week.

While Disney is a great long-term business with a promising future, one can see why the shares are struggling -- especially if investors think a recession is on the horizon.

With the shares now breaking to the downside, investors have to ask where support might come into play.

Don't Miss: Alphabet Stock Teeters on a Breakout. Here's the Trade.

Keep an eye on the $90 to $91 area. This level was solid support in mid-March, and if the stock declines to this zone, it may be worth a closer look.

If this level holds, a bounce into the $96s could follow. Above that and the gap-fill level is at $100.

Otherwise, a break of $90 puts one of the downside gaps in play, near $87. That’s followed by the 52-week low near $84 and finally, the $79 to $80 zone, which contains a big support level and the 2020 low.

If Disney stock gets to this level, long-term investors may consider accumulating a position.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.