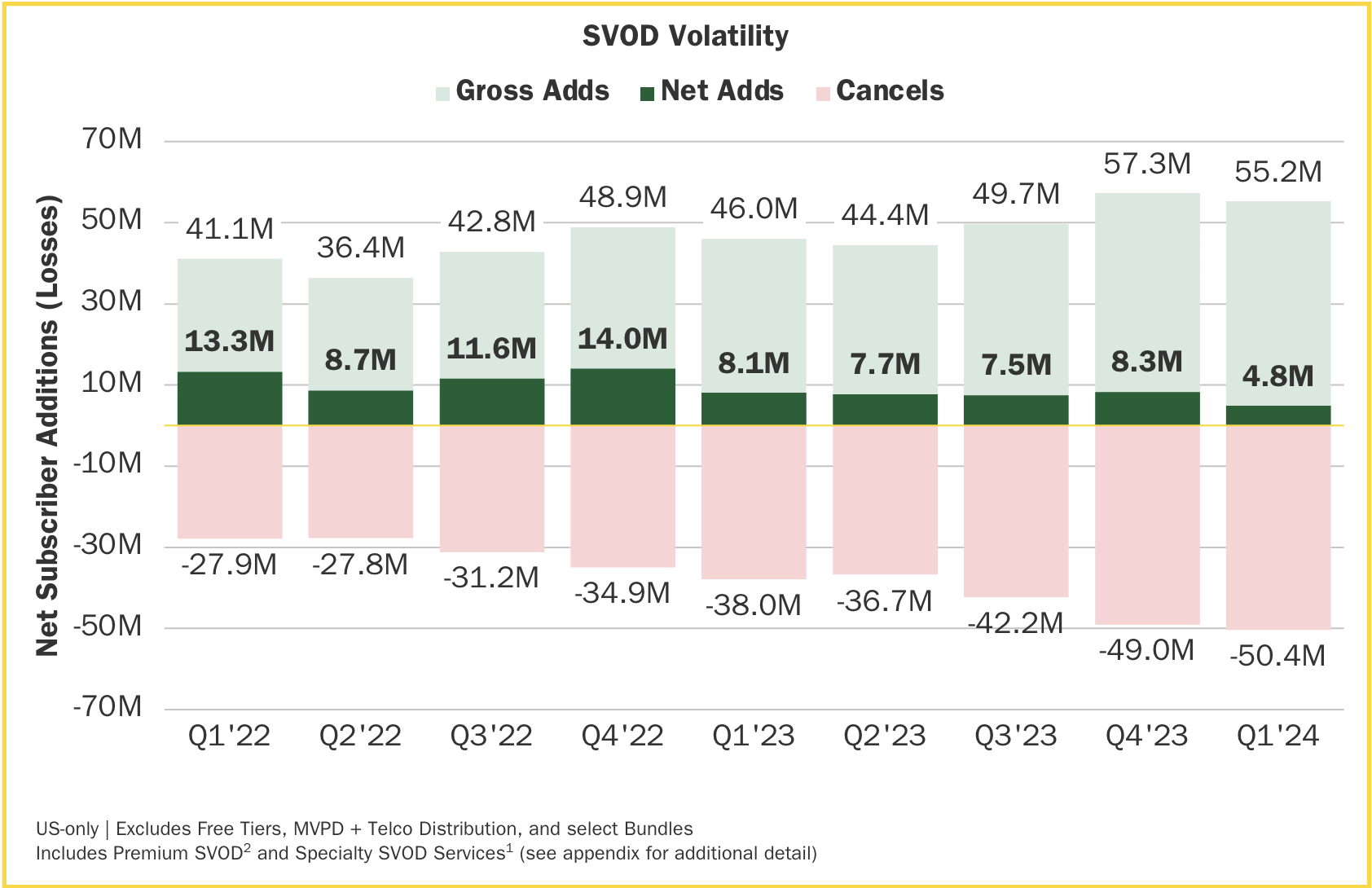

While U.S. subscription video services tacked on a whopping 55.2 million gross subscriber additions in the first quarter, 9.2 million more versus the same period last year, cancellations soared to 50.4 million, 12.4 million over the first quarter of 2023.

In its latest State of Subscriptions report, available here, research company Antenna found SVOD volatility to be higher than ever in Q1.

Relatedly, for the exception of Netflix, churn remained high for these subscription video services, as well, the report shows.

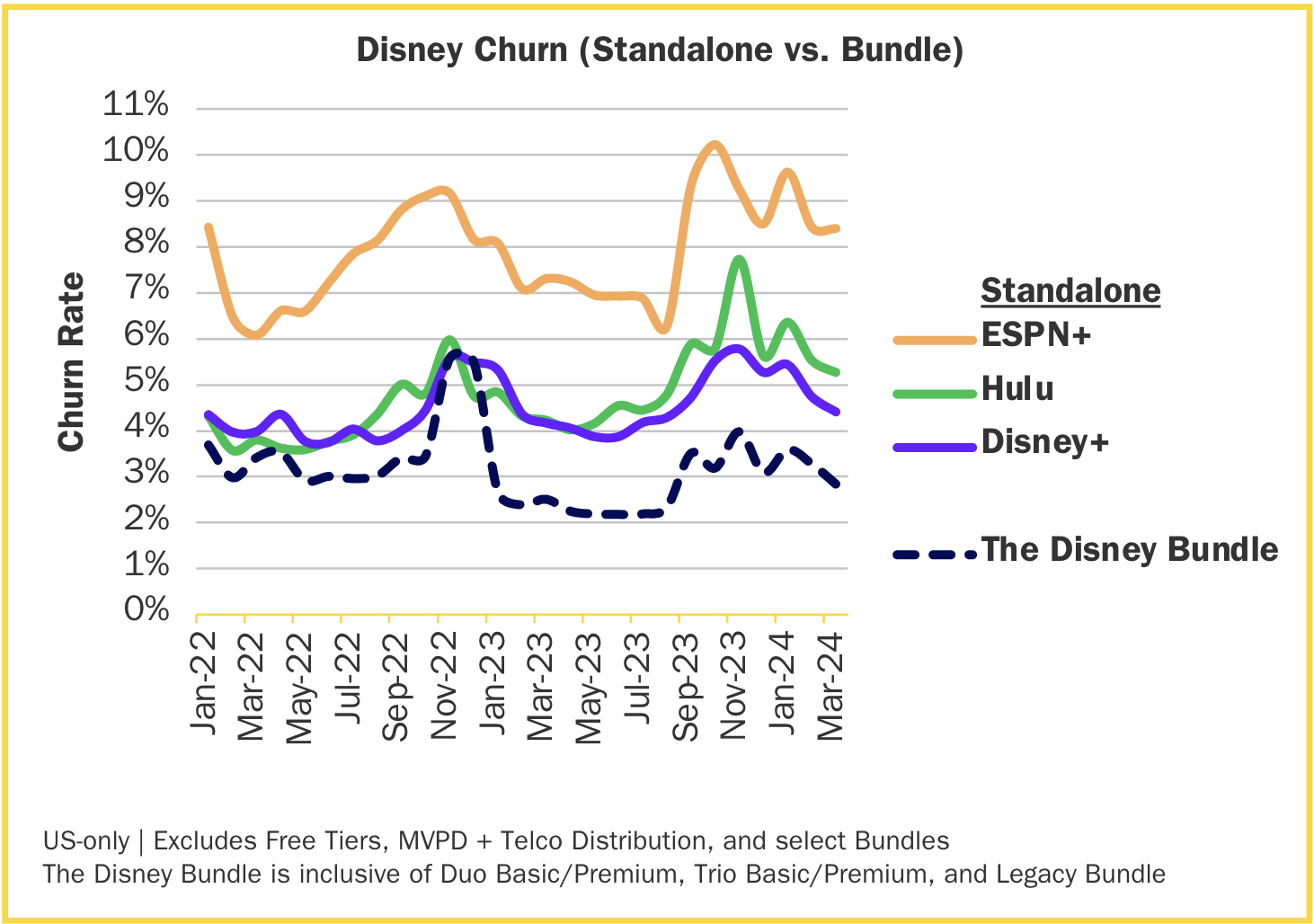

Notably, Antenna -- which explains its methodology in the back pages of its 33-page study -- found an elegant way of showing how bundles mitigate churn.

Check out this chart, which shows that churn for the trio of Disney trio of Disney Plus, Hulu and ESPN Plus is reduced by 2-6 basis points when these services are sold in the Disney Bundle.

Likewise, churn for Apple TV Plus is reduced to only a fraction when the video service is packaged along with music, games and other Apple offerings in the Apple One bundle.

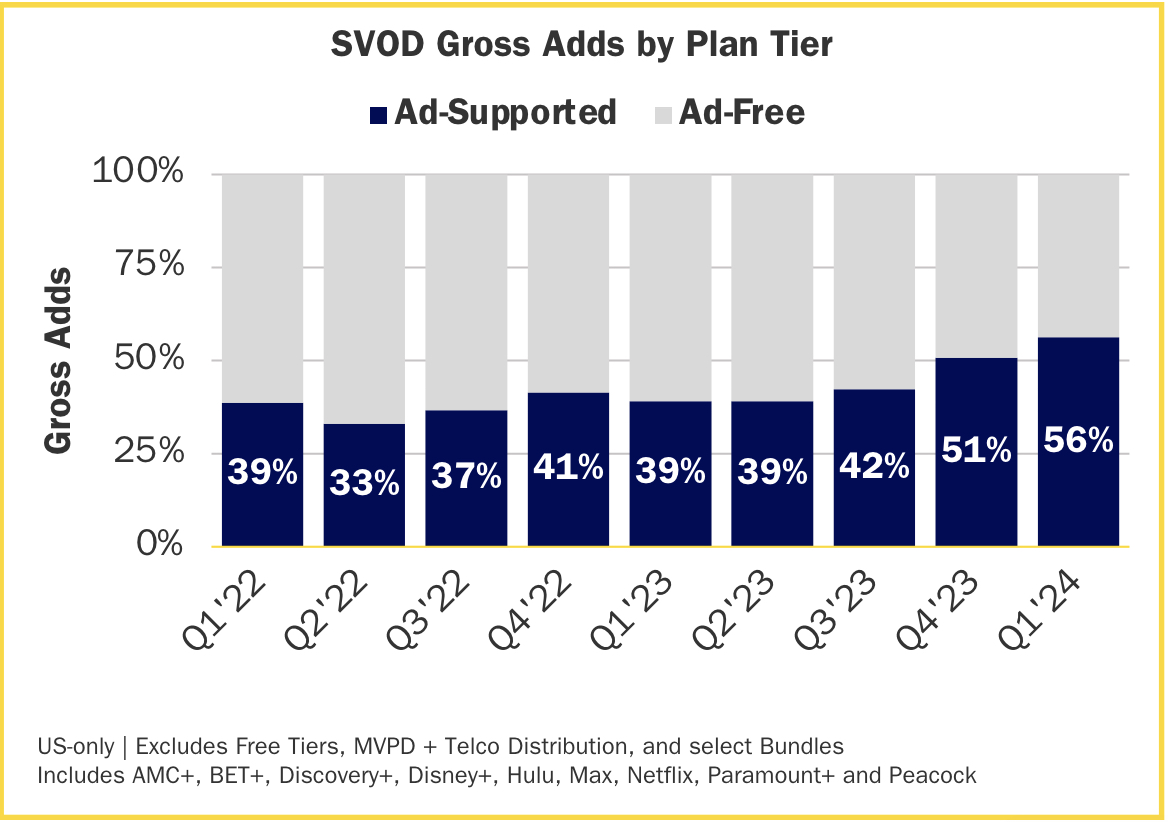

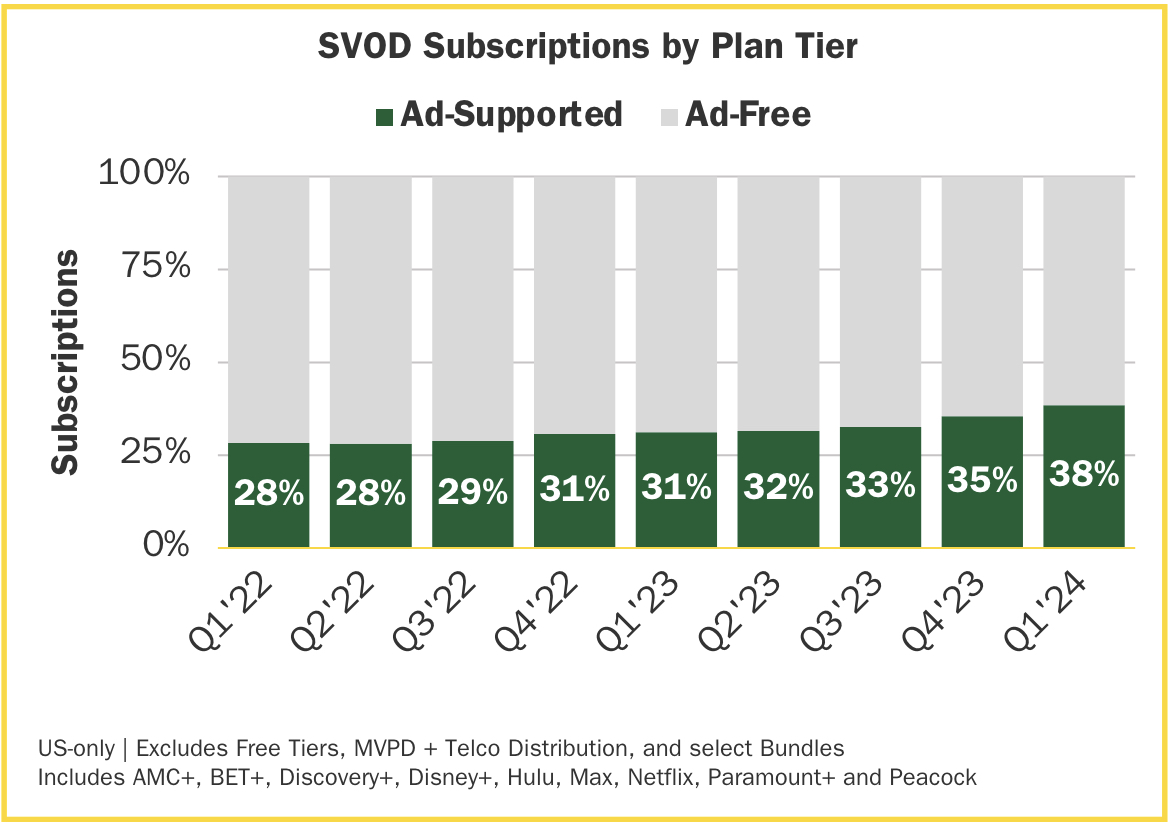

Among other trend lines for the U.S. subscription video business, Antenna also reports that premium SVOD tiers partially supported by advertising controlled 56% of domestic subscriber adds in the first quarter.

Antenna found that 38% of all U.S. premium SVOD subscribers in Q1 were signed up for ad-supported tiers, versus 31% in the same period of 2023.

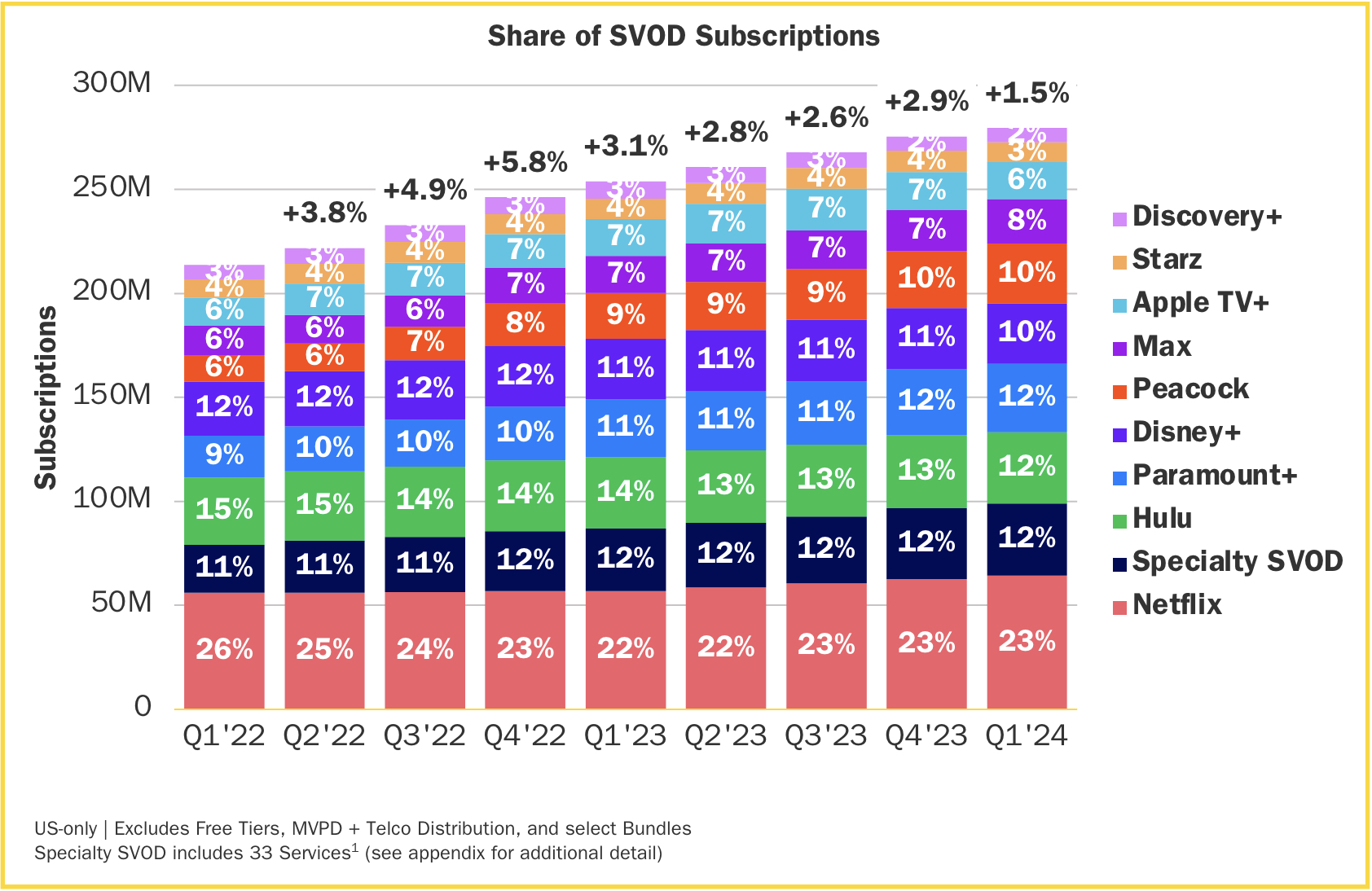

Domestic customer expansion, meanwhile, continued to decelerate in Q1, dropping to 1.5%, less than half of what it was in the first three months of 2023.

Over the last eight quarters, the only premium SVOD service to show dramatic growth (or decline) in market share has been Peacock, whch controlled 10% of U.S. SVOD subscribers in Q1 vs. just 6% two years ago.