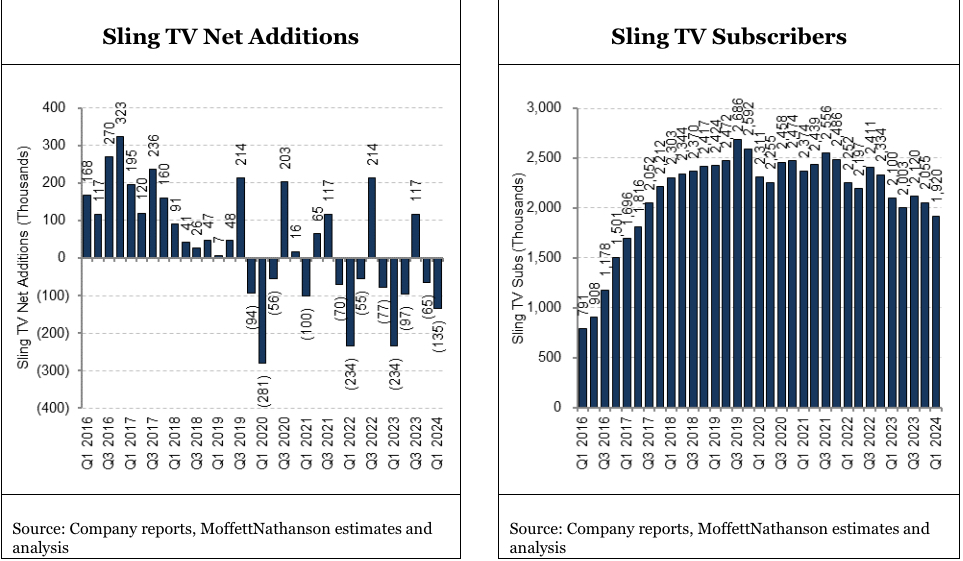

Launched in February 2015 as the first virtual MVPD, Sling TV surpassed 2 million subscribers in the third quarter of 2017 and peaked in Q3 2019, with 2.686 million customers.

Since then? Downhill pretty much all the way.

Parent company EchoStar this week reported the loss of 135,000 Sling TV customers in the first quarter, dropping the base to 1.92 million. It's the first time since that fateful Q3 of 2017 that Sling has been below 2 million customers. Sling TV is now shrinking at an annual rate of 8.6%

In the larger drama of Charlie Ergen’s EchoStar empire trying to complete the buildout of a national 5G wireless network and avoid bankruptcy, Sling TV remains only a bit player.

Also read: Ergen’s EchoStar Concedes ‘Substantial Doubt’ About Its Future

But the subscriber attrition works against the very dynamic which might save EchoStar and its Dish Network subsidiary — cash flow.

With Dish satellite TV also dropping 213,000 customers in Q1 and shrinking at an annual rate of 11.8%, “the Dish Network business is a melting ice cube. On a hot day,” equity analyst Craig Moffett wrote.

Dish's pay TV revenue fell 8.3% in the first quarter.

“With just 6.3M remaining satellite subscribers and 1.9M Sling TV subscribers, Dish’s pay TV business simply isn’t large enough to be the cash generation engine that keeps the larger enterprise afloat,” Moffett added.

Sling TV is the cheapest of the major full-service vMVPDs, and it hasn't raised prices since October 2022. Google’s YouTube TV has added more than 3 million customers over the last two years, but the rest of U.S. vMVPD market has stopped growing.

Disney reported this week that Hulu Plus Live TV lost 100,000 customers from January through March and has only grown by 100,000 subscribers in the last year. Fubo's base is up nearly 20% year over year, but it also lost 100,000 customers in the first quarter.