Dish Network reported Monday what was in the words of equity analyst Craig Moffett, an "astonishingly bad" third quarter, losing $139 million in the three-month period on increased EBITDA losses in wireless and accelerated cord-cutting in pay TV.

Oh, and another member from the senior management team stepped down — President and CEO Erik Carlson. (Dish tried to minimize the relevance of the departure by the 28-year company veteran.)

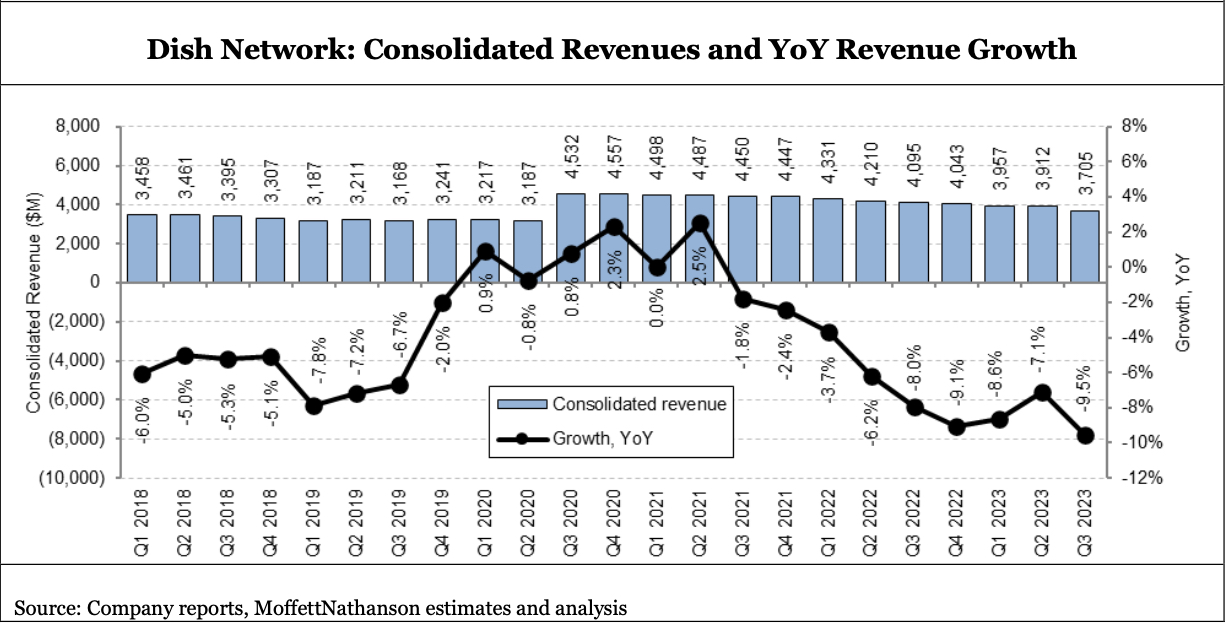

Monday’s Q3 results, touted in this earnings release, put Dish’s adjusted EBITDA down 58% from a year ago. The company is burning cash at a $2 billion annual rate. Revenue declined nearly 10% year over year to $3.7 billion.

With a $106 million EBITDA loss for its Boost wireless business, as well as $299 million in EBITDA red ink for its new 5G unit, Dish is now on pace to lose $1.6 billion on its wireless business this year.

“Their internal projections suggest that their wireless business is going to turn strongly EBITDA positive next year even as it invests in launching and growing an all-new brand, Boost Infinite,” Moffett wrote in a morning note to investors titled, “Dish Network Q3 2023 Earnings: The Wheels Falling Off.”

“In a decade, at least according to those internal estimates, they will be running a $40 billion-per-year wireless business,” the analyst added. “Those projections struck many as absurd. After today’s results, calling them ‘absurd’ might be kind.”

Dish’s legacy pay TV operations were supposed to fund its transition into wireless. Sling TV subscriptions perked up a bit, but were offset by sustained satellite TV losses. The company lost a combined 64,000 pay TV souls in Q3, with cord-cutting accelerating to 11.7%. Even worse, revenue from pay TV declined by 8.8%.

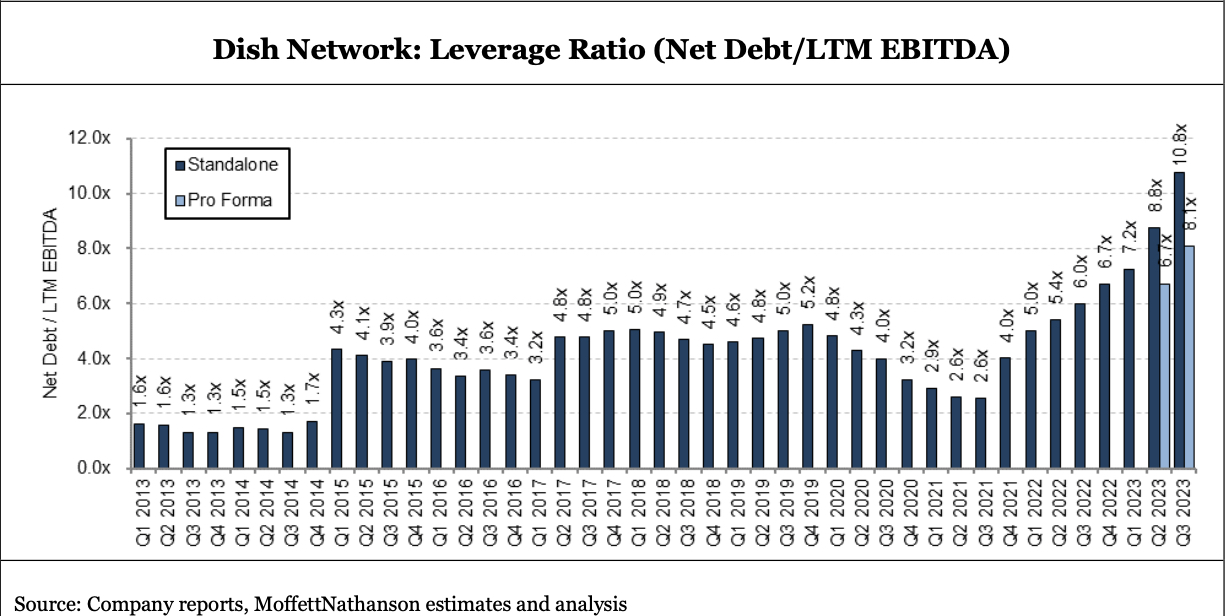

As the search term “Dish bankruptcy” starts to seriously trend, there are a couple of trend lines to observe. One is Dish’s debt situation.

Dish's leverage, Moffett noted, “is soaring because their EBITDA is cratering. And their EBITDA is cratering because their revenue is in free fall.”