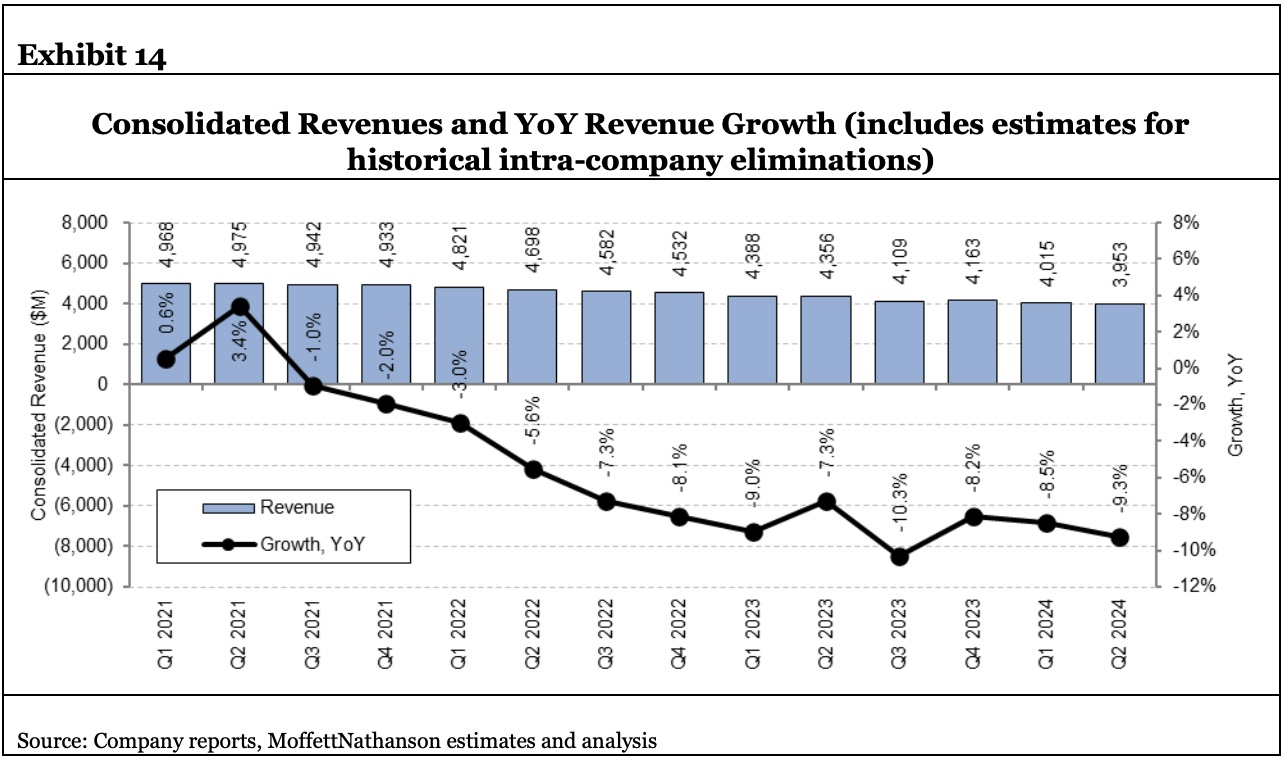

Revenue for Dish Network and Sling TV was collectively down a record 10% year-over-year, according to parent company EchoStar’s second quarterly earnings report.

EchoStar posted $2.67 billion in pay TV revenues, down from $2.97 billion a year ago.

Also read: EchoStar Posts Q2 Loss as It Sheds 104,000 Pay TV Subscribers

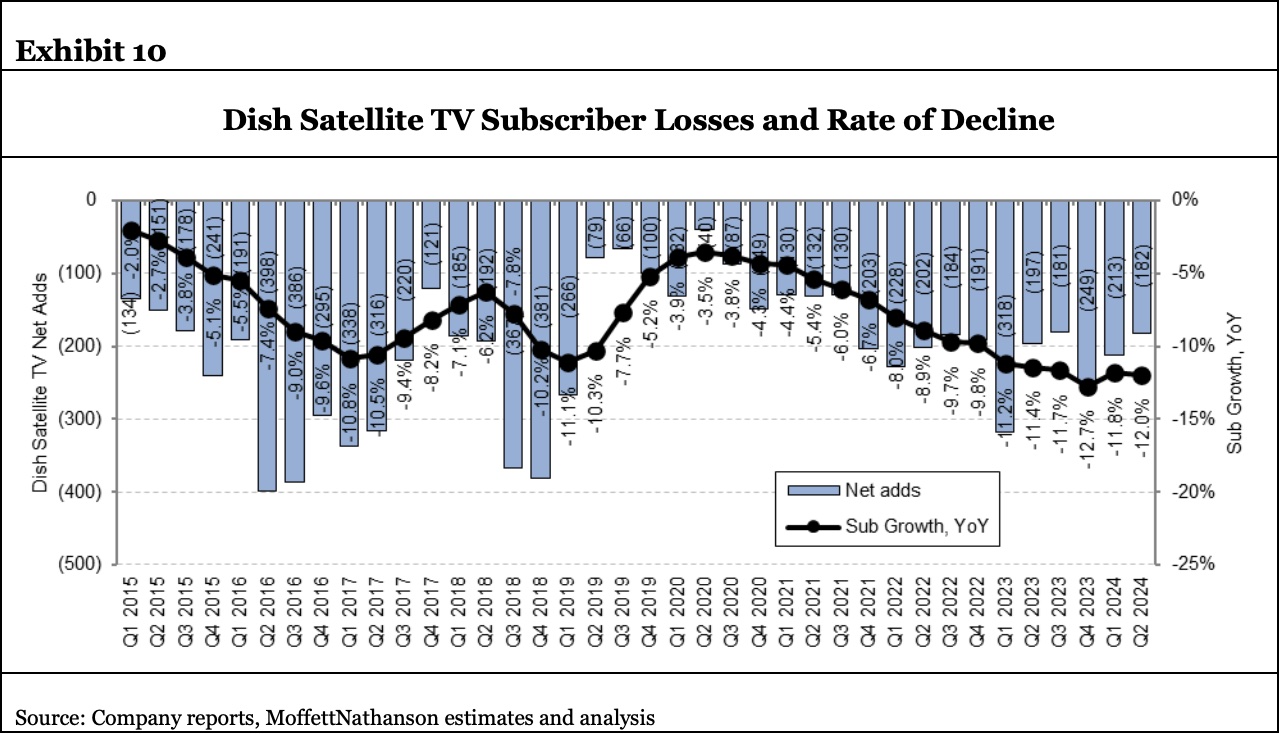

That’s due in part to 182,000 Dish subscribers, who decided from April through June to discontinue their service, putting the company in what equity-research firm MoffettNathanson called “free fall.”

At the close of the quarter, the subscriber base for Dish’s core satellite-TV business was shrinking at a 12% rate, worse than the 11.8% decline at the end of last quarter.

Also Read: EchoStar Posts Q2 Loss as It Sheds 104,000 Pay TV Subscribers

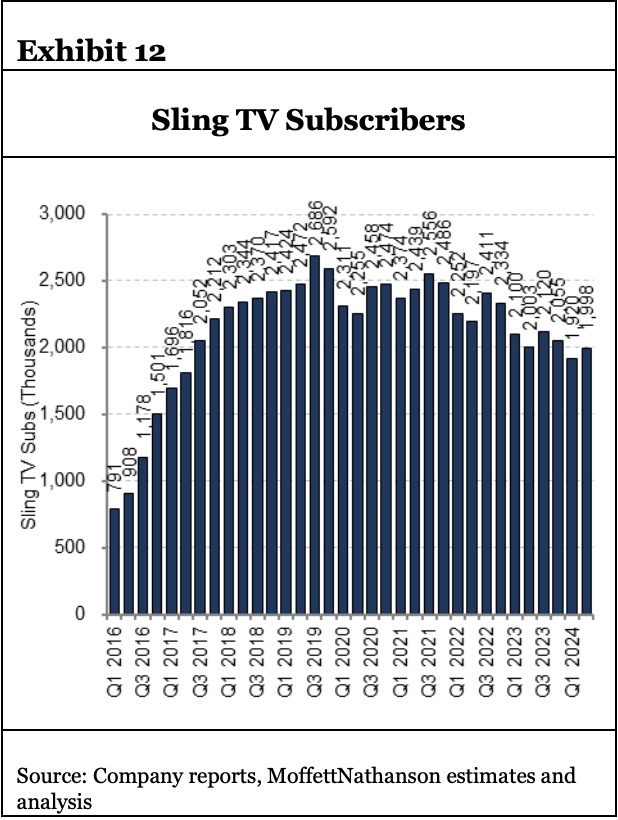

Sling TV at least, reported a gain of 78,000 subscribers during Q2.

As it stands, EchoStar has roughly 8.07 million remaining pay TV subscribers, including 6.07 million Dish TV customers and 2 million Sling TV subscribers.

EchoStar and its high-profile chairman, Charlie Ergen, are investing billions of dollars trying to complete a national 5G wireless network just as its core revenue engine runs out of steam.

“We’ve made our view clear. We see EchoStar’s odds of success as a wireless operator to be vanishingly small,” MoffettNathanson analyst Craig Moffett said in a report issued today about EchoStar’s Q2 results. “We believe EchoStar is instead highly likely to go bankrupt, quite possibly by the end of the year.”

EchoStar has cut costs to compensate for its declining revenue, but pay TV EBITDA for the quarter still dropped $753 million, an 8% decrease year-over-year.

“Dish’s pay TV business simply isn’t large enough to be the cash generation engine that keeps the larger enterprise afloat,” Moffett wrote.

In the 12th straight quarter of decline, consolidated EBITDA fell to just $442 million, down 29% year-over-year.