If the biggest event on TV is the Super Bowl, the biggest event over Super Bowl weekend used to be DirecTV’s “Super Saturday Night.”

The satellite-TV company would erect a temporary stadium where, during the day, celebrities and NFL legends would play beach football. In Indianapolis in 2012, teams featured Joe Montana, Deion Sanders, Peyton Manning, Cam Newton, Jordin and Phillippi Sparks, Neil Patrick Harris and David Arquette. (Active NFL players stopped participating after rookie Patriots running back Robert Edwards tore up his knee in a similar game before the 1999 Pro Bowl in Hawaii.)

In the evening, the sand would be carted off to make room for concerts that featured the biggest names in music. Katy Perry appeared in 2012. In other years, DirecTV had Beyoncé and Jay-Z, Kanye West and Rihanna, Jennifer Lopez, Foo Fighters and even Taylor Swift, before she met Travis Kelce.

“It was exciting to be part of the largest video platform in the country with a distinct brand, exclusive sports and original content,” Daniel York, who was chief content officer and executive VP for DirecTV from 2012 to 2015, told Broadcasting+Cable.

“It was exciting that the Saturday night before every Super Bowl the DirecTV Super Saturday night was the event of Super Bowl weekend to go to,” said York, now CEO of Cox Media Group.

Launched 30 years ago on June 17, 1994, DirecTV rose to become the country’s top pay TV distributor, revolutionizing the industry, in part because of its exclusive rights to NFL Sunday Ticket, which enabled fans to watch the out-of-market games that weren’t on broadcast or cable television.

The company is marking its anniversary with DirecTV Day. Employees will be engaged in more than 30 volunteer events and other activities that will benefit charitable organizations including Ronald McDonald House Charities, DirecTV’s national strategic charity partner.

The company will also be hosting employee celebrations around the country with food trucks, barbecues, raffles and other activities.

Over the course of its colorful history, DirecTV has gone through a number of ownership changes, being part of Hughes Electronics, General Motors, News Corp. and AT&T.

Now, while the entire pay TV industry has been losing subscribers to cord-cutting as viewers turn to streaming, DirecTV has been among the hardest hit. From a peak of 21 million subscribers, it is now estimated to have less than 9 million subscribers, according to Leichtman Research Group. It also gave up NFL Sunday Ticket.

DirecTV chief operating officer Michael Wittrock thinks the company can bounce back.

“I've been around this company for almost two decades and I've been in the industry for 31 years,“ Wittrock said. “I believe we can get back to growth.”

Analysts aren’t so sure there’s a place for direct broadcast satellite as streaming takes over the TV business.

Remember Pagers?

“The end game is the end,” said MoffettNathanson principal and senior analyst Craig Moffett, who has examined the industry for decades.

“There are some technologies that eventually go away,“ Moffett said, pointing to pagers. “It is the natural order of things.

“People talked about how the pager business was never going away because doctors and nurses will always rely on pagers,” he said. Smartphones buried the pager.

Moffett said that the “death knell” for the satellite business was the emergence of video-on-demand for cable.

“It’s obvious that a pure broadcast platform isn’t long for this world,” Moffett said. He recalled that in 2012, DirecTV issued 30-year bonds. “Who in their right mind thinks that satellite TV is still going to exist in 30 years. That’s utterly insane.”

Direct broadcast satellite was a hot technology when it started.

Stanley S. Hubbard recalls that when the Federal Communications Commission began accepting licenses for DBS, his father, founder of Hubbard Broadcasting, jumped into the bidding in the first round.

A Tower in the Sky

“The broadcasting business was all about the tower. The tallest tower has the best signal,” Hubbard said. With satellite broadcasting, his dad exclaimed: “Holy cow! You mean you could put a tower 22,300 feet up and cover the whole country with one tower? That’s a no-brainer.”

There were a number of companies bidding on satellite licenses. Hubbard’s United States Satellite Broadcasting (USSB) got a license in round one. Hughes, which would start DirecTV, got a license in round two and Dish Network founder Charlie Ergen scored in round three.

Hughes announced a partnership with NBC, Cablevision Systems’ Chuck Dolan and Rupert Murdoch’s News Corp. called Sky Cable, but it fell apart.

USSB decided to work with Hughes and DirecTV because DirecTV had more transponders and consumers were more likely to point their dishes in that direction, said Hubbard, who was CEO of USSB.

The two satellite companies offered differentiated products, with Hughes offering many basic cable channels and USSB focusing on premium networks, making deals with Showtime and HBO.

USSB and Hughes worked together to create a set-top box that could receive both companies’ signals. Hubbard said the money USSB contributed persuaded General Motors, which had acquired Hughes, to go ahead and build the system.

“At one point, I got a call from [Hughes DBS head] Eddy Hartenstein saying they’ve got a name for their business, but it conflicted with a copyright that we hold for a new service we had in D.C. called TV Direct,” Hubbard said. “Hughes wanted to name its service DirecTV. We said, ‘No problem, we’ll sign it over to you.’ It was just part of the goodwill of the business.”

Hubbard needed investors to launch its satellite business. One of its early investors was Paul Allen, co-founder of Microsoft and later an owner of Charter Communications.

Hubbard remembers Allen sitting in his father’s office in Minneapolis.

“He wanted to look us in the eye, but he also wanted to look at the guts of the system,” Hubbard said. “We had a prototype of the RCA receiver box [being made by Thomson of France]. Well, Allen says ‘Can I look inside?’ We said sure.”

Allen pulled a screwdriver out of his own pocket, unscrewed the bottom of the box and started staring at the circuitry. After about three minutes, Allen looked up and said he couldn’t see how the audio was going to work.

The Hubbards’ chief engineer, Ray Conover, said that component wasn’t in the box yet, but explained how it would work, Hubbard said. “Allen put his head back down for another minute or two and when he looked up he said, ‘That’s a nice design.‘ ”

Cowboy Maloney’s

DirecTV was launched on June 17, 1994. The first digital satellite system was bought by LeMoyne Martin at Cowboy Maloney’s Electric City in Jackson, Mississippi.

Up to that point, cable systems were basically local monopolies with closed systems.

“To be able to get two providers was a game-changer in the marketplace, particularly for the premium services,” Hubbard said.

DirecTV had 1 million subscribers by November 1995.

Partly because Hubbard was in the broadcast business, USSB and DirecTV kept the channels numbers one to 99 open for the day when satellite could carry local broadcast signals — something that came to pass in 1999 after spot-beam satellite transponders were deployed.

Hubbard sold USSB to DirecTV in 1998 for $1.3 billion, giving DirecTV more than 7 million subscribers.

“I still remember the day we announced the merger. One of the first phone calls I got was from [legendary boxing promoter] Don King,” Hubbard said.

USSB had been distributing King’s pay-per-view fights on Showtime.

King said he wanted to bring a world championship fight to Minneapolis and have all of the USSB employees as his guests, Hubbard said. The fight took place not long after.

USSB was sold because it was best for Hubbard’s outside investors. “If it were just the Hubbards, I believe we would still be in that business,” Hubbard said.

DBS challenged the cable monopolies and expanded the pay TV business, with cable subscriber numbers going up even as DirecTV grew, according to analyst Bruce Leichtman, founder and principal analyst of Leichtman Research Group.

Beaming Into Rural America

“Where satellite was most successful in its early days — and is even still today — was in rural America,” Leichtman said.

Cable wasn’t available in many rural areas, and where it was, it had low channel capacity.

“Cable was forced to expand channel capacity,” Leichtman said. “It introduced digital cable and that improved cable.”

One channel cable couldn’t duplicate was NFL Sunday Ticket, which was exclusively available to DirecTV subscribers.

Leichtman said Sunday Ticket never had more than about 2 million subscribers.

“What NFL Sunday Ticket did is set the image for DirecTV as the kind of ‘sexy’ product,” he said. “They were the sports product, compared to Dish, which was more the value product. Between the two of them, DirecTV always did better in the suburban and urban markets.”

Don’t Be Stupid

DirecTV COO Wittrock started out in cable. Back then, Wittrock recalled: “DBS stood for ‘don’t be stupid.’ That was the initial cable position.”

Despite the warning, the Marine Corps reservist switched over to satellite and joined DirecTV in 2005.

“I was impressed by the model just because it had a nationwide footprint and it could truly do pay television,” Wittrock said. “It could combine all of the services that a household would want to watch and and put it in one place all on one user interface."

Jamie Dyckes, now DirecTV’s VP of sports and revenue marketing, joined the company in 2000 after working for the then-Anaheim Angels and Mighty Ducks of Anaheim when the pro-sports teams were owned by The Walt Disney Co.

“I’ve actually been a subscriber of DirecTV since 1995, a year after they launched,” Dyckes said.

Early on, Dyckes worked to get DirecTV distributed in stadiums and arenas. Unlike at Disney, where the corporate atmosphere was very starchy and you had to wear a suit and tie, DirecTV had a younger vibe, he said.

“There was a lot of energy,“ he said. ”We were changing the world. Cable kind of sucked and the picture wasn’t great. And with broadcast, if you didn’t live in the right place, you couldn’t get it at all. It was fun to be part of the solution for a lot of people.”

At first explaining satellite TV to consumers was tough. People were hesitant to put a dish on their roof. And back then, you had to pay for your equipment.

Two game-changers came when DirecTV switched to a leased-equipment model and when it started carrying local stations.

“That was a huge boon because now there was no reason not to get it,” Dyckes said.

Sports was a big part of DirecTV’s identity from the beginning, with NFL Sunday Ticket arriving a few months after the platform launched. DirecTV also had the out-of-market packages for the other major sports leagues.

DirecTV created Red Zone, but the NFL took it over, Dyckes said.

Sports was also a reason why DirecTV converted early to high definition. “It was another step-level function because cable just couldn’t do it,“ he said. “They didn’t have the infrastructure to do it that quickly.”

In those days, the DirecTV offices were a bit like the version of ESPN seen in the network’s long-running commercials, with politicians like Mitch McConnell and business tycoons like Rupert Murdoch (who for a while controlled DirecTV) roaming the corridors, Dyckes said.

DirecTV would have athletes like Randy Moss and Kevin Garnett visit its call centers to thank customer service reps for keeping customer satisfaction high.

DirecTV also had some high profile customers, Dyckes said. It is available on Air Force One and President Bill Clinton called DirecTV’s ads the funniest he’d ever seen. Other VIPs got the DirecTV titanium package. They paid one flat price and got all the services that were available in as many rooms as they wanted.

“It was very exclusive, like the black American Express card used to be back in the day,“ Dyckes said. “If you looked at the list of who was on it, it made sense.”

DirecTV was having success despite its one-way platform being inferior from a technology point of view to cable, former DirecTV exec Dan York said.

“Because of its brand position, it was able to win mindshare on innovations like HD and then 4K, TV Everywhere and whole-home DVRs,” York said.

DTV had NFL Sunday Ticket, which boosted the brand and generated important revenue from bars and restaurants, which were also satisfied customers.

“Content is so important these days. At Hooters, it is the undercurrent of everything we do,” said Bruce Skala, chief marketing officer for Hooters. “DirecTV For Business consistently delivers content to us that creates appointment viewing in our stores and makes us so successful.”

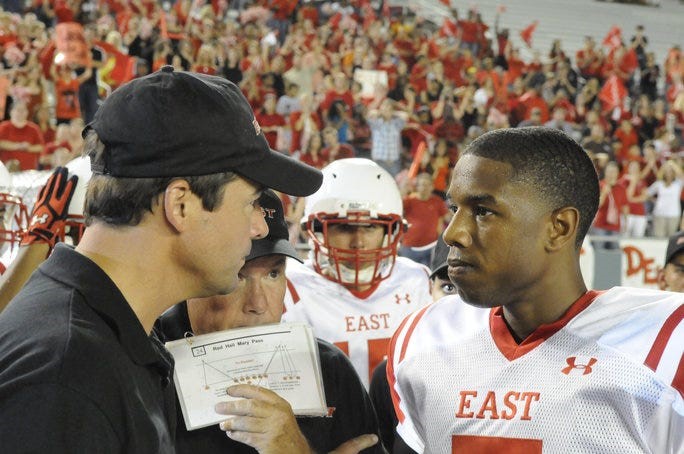

DirecTV also got into original programming with Channel 101, later rebranded as The Audience Channel. DirecTV subscribers got the first look at the last season of NBC’s Friday Night Lights. And it aired other series, including The Dan Patrick Show and Loudermilk, now popular on Netflix.

Then came AT&T, which acquired DirecTV in 2015 for $49.5 billion. AT&T would also acquire Time Warner.

Misguided Strategy

“The approach was to have a scaled national video platform that could be bundled with a national wireless platform and a high-speed internet product in large sections of the country,” York said. “One thing that was said then was ‘the future of wireless is video and the future of video is wireless.’”

At first, the combination of DirecTV and AT&T’s U-verse TV made AT&T's video platforms the largest video provider. “At one point we were about 25 million customers across all platforms reflecting about 25% of the market,” York said.

Acquiring DirecTV gave AT&T and U-verse a much better cost structure, particularly when it came to programming.

But AT&T’s plan didn’t work.

DirecTV’s accelerating losses were less the product of consumer behavior than what Leichtman described as AT&T’s “misguided strategy” in purchasing DirecTV and then Time Warner.

“AT&T really didn't know the business. They didn't know what they bought and I don’t think they really understood what they were running,” he said.

Leichtman said the DBS business had been doing fine by bringing in new subscribers with promotional offers to more than offset the subs that rolled off with those discounts expired.

“What changed that model was AT&T saying we're not going to fund this promotional pricing and keep playing this promotional game,” Leichtman said. “Once you took away those promotional prices, that completely changed the game.”

AT&T spun off DirecTV, AT&T TV and U-verse to a new company headed by investment company TPG in a deal that valued DirecTV at just $15 billion.

Wittrock said DirecTV and the rest of the pay TV business were surprised by how quickly subscribers left pay TV.

“I think everybody in the industry — and even some of the best analysts — missed the projection on how fast it would decline and how fast it would disrupt,” he said. “In the end, I think AT&T recognized that the media properties it bought could produce more on their own, which led to the divestiture.”

What happens now?

Analyst Leichtman says the new owners understand the business, as does management, led by CEO Bill Morrow and Wittrock. But they face a stiff challenge.

“Obviously they can't grow satellite subs. That would not be possible,” Leichtman said.

“They have made their intentions well-known with their advertising, right? They are advertising DirecTV without the dish,” Leichtman said. “Now can DirecTV transition more to a streaming service? They are a TV brand name, but the question is how much does that brand name mean? Is that synonymous with a satellite dish?”

The job for DirecTV now is to manage which subscribers to acquire and try to retain long-term, high-lifetime-value subscribers, he said.

Wittrock said traditional pay TV and DirecTV will be around longer that critics expect.

He said the company is focused on an approach it calls, “We Care. We Challenge. We Deliver.”

“The culture here produces strong scores in surveys,” he said. “It’s probably one of the most resilient cultures I’ve seen in terms of people collaborating, people wanting to fix problems for consumers, people wanting to win.”

Any possible turnaround by DirecTV will take capital for investment in streaming and the cooperation of networks to help pay TV distributors offer more-compelling, better-priced products,” Wittrock said.

“That would increase the price-value relationship, and I do think that as a solely focused pay TV distributor, we can get back to a growth state,” he said.

As for streaming replacing satellites at DirecTV, Wittrock said: “I do see that is coming. But I think it's farther out than a lot of people would predict.”

Stan Hubbard doesn’t see satellite disappearing either.

“For video, DBS still is the single most efficient way to send it ever devised,“ Hubbard said. “There’s still a hell of a lot of people that subscribe. There’s still a hell of a lot of people that watch.”

Hubbard said he still has a dish on his roof.

“I sure do,” he said. “But look, I'm also also in today's world right? I’m bringing in stuff on broadband and I actually have the DirecTV app on my Apple TV box, which ties into my subscription. So everyone evolves.”

These days, Wittrock said, “I spend most of my time on streaming. That's where most of our product development seems to be. But it’s going to take a cruise missile to get a satellite dish off of my home.”