Palantir (PLTR) stock has been on fire over the past month: From the May 4 low to this week’s high, the shares more than doubled (up 135%).

A chunk of those gains stemmed from the data-integration company’s May 8 earnings report, released just a few days after the shares had bottomed.

The top- and bottom-line beat of analyst estimates and the better-than-expected guidance ignited a rally, sending Palantir stock more than 23% higher in a single session.

But over and above Palantir's earnings results, the surge in AI stocks has also played a role in the stock's surge.

Don't Miss: Coinbase Stock: Buy the Dip or Avoid After SEC Lawsuit?

Nvidia (NVDA), C3.ai (AI), Advanced Micro Devices (AMD) and others have enjoyed a surge that has carried other stocks higher — like Palantir — as they too have exposure to artificial intelligence.

With Palantir shares rallying 11% at one point on Wednesday but down 4.3% on the session at last check, one must ask if the stock has run out of steam.

Has Palantir Stock Run Out of Bullish Momentum?

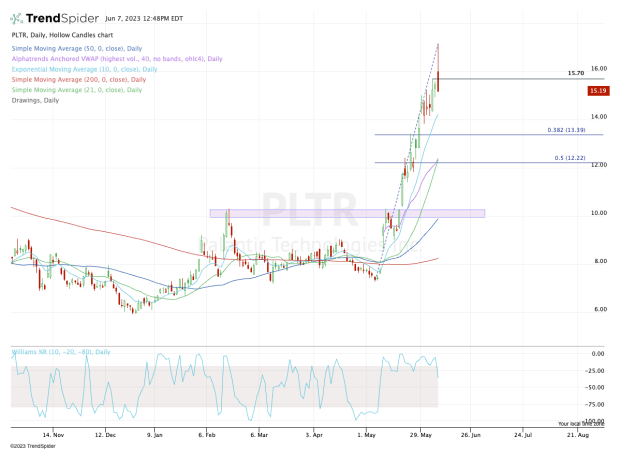

Chart courtesy of TrendSpider.com

Today’s action should give bulls some pause as it suggests that Palantir stock needs a rest.

Real Money's Bruce Kamich impressively called for profit taking earlier this week and that timing was quite good.

The move today in technical-speak is known as a reversal. Palantir stock initially traded higher on the day — quite a bit higher — before reversing back down and breaking below the prior day’s high. Once it lost the $15.70 to $15.50 area and turned red on the day, that put the sellers in control.

The most pessimistic of the bears would argue that the stock has topped. But the control for the past month has been in favor of the bulls.

Specifically, if buyers can remain in control, they will likely try to defend the rising 10-day moving average. That measure is currently near $14.20 but is rising quickly.

If that area falters, then the 21-day moving average and daily VWAP measures are likely the next areas of focus for the bulls. Notably, those measures come into play near the 50% retracement.

Don't Miss: Tee Up Topgolf Callaway Brands or Take Profits?

However, they are also rising quickly, so if a pullback takes a little time, they may rise somewhere closer to the 38.2% retracement (which is at $13.39).

No one knows if Palantir stock just put in some type of notable top. We’ll know that in a few months. Given the run we’ve seen, though, we for now should view Palantir stock as a buy-the-dip opportunity.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.