It’s been a wild couple of years, as we’ve seen explosive rallies and soul-crushing declines in some of the market’s hottest assets.

Those include cryptocurrencies like bitcoin, growth stocks and of course, the money manager that combined them both: Cathie Wood.

Wood rose to notoriety with her large position in Tesla (TSLA). Then being positioned in high-octane growth stocks, she rode the wave of financial fame — and profits — as “risk-on” assets soared following the covid-19 selloff in the first quarter of 2020.

The most well-recognized fund from Wood is the ARK Innovation ETF (ARKK).

Despite the decimation in growth stocks over the last few months, this fund had actually done a pretty good job of avoiding the lows it set in mid-May.

However, recent weakness in its top holdings — including Tesla, Zoom Video (ZM) and Roku (ROKU) — eventually toppled ARKK and sent the ETF to new lows.

Now the question is, has ARKK bottomed for good?

Trading ARKK Stock

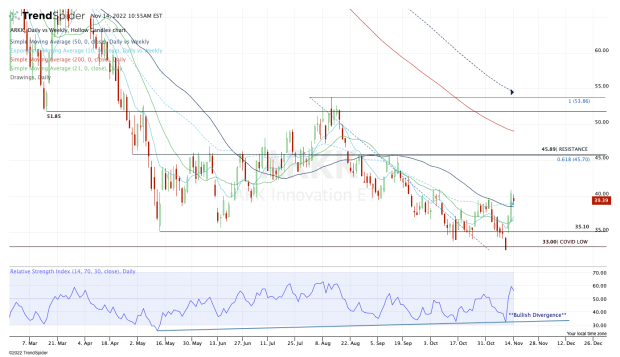

Chart courtesy of TrendSpider.com

The stock market enjoyed a powerful rally on Thursday and Friday, with the S&P 500 and Nasdaq rallying 6.75% and 9.4%, respectively.

ARKK steamrolled higher too, climbing 14.5% and 8.3%, respectively.

The two-day burst came after the ETF made new 2022 lows on Wednesday. However, it sent ARKK above the 10-week and 50-day moving averages, two measures it’s holding despite Monday’s mild dip.

Bulls want to see ARKK stay above these measures going forward. It’s healthy to see a pause today, but investors don’t want to see ARKK give back too much of its gain.

If it loses the 50-day and 10-week moving averages, we could see a test of the 10-day and 21-day moving averages near $37.

As for the upside, keep an eye on $40.93. That’s the high from Friday and last week’s high as well.

If we see a rally above that mark this week, it creates a weekly-up rotation. It would be a big move, but if that scenario were to play out, it would open the door up to the $45.50 to $46 area.

There we have a huge pivot level from the last several quarters, as well as the 61.8% retrace of the current range.

Above that opens the door to $50 and the declining 200-day moving average.

As for whether ARKK has seen the low, I would feel confident with that thesis so long as the stock can stay above $35. While that’s only about 6.5% above the 2022 low, we can always raise that “line in the sand” level if ARKK can push higher.