Analysts' ratings for Aflac (NYSE:AFL) over the last quarter vary from bullish to bearish, as provided by 9 analysts.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 5 | 2 | 0 |

| Last 30D | 0 | 0 | 0 | 1 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 1 | 0 | 3 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 1 | 0 |

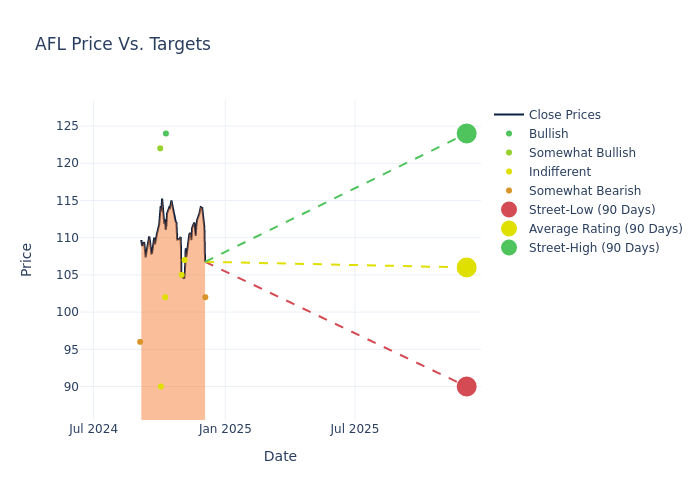

Analysts have recently evaluated Aflac and provided 12-month price targets. The average target is $105.33, accompanied by a high estimate of $124.00 and a low estimate of $90.00. Marking an increase of 5.59%, the current average surpasses the previous average price target of $99.75.

Interpreting Analyst Ratings: A Closer Look

In examining recent analyst actions, we gain insights into how financial experts perceive Aflac. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Thomas Gallagher | Evercore ISI Group | Lowers | Underperform | $102.00 | $104.00 |

| Elyse Greenspan | Wells Fargo | Raises | Equal-Weight | $107.00 | $106.00 |

| Mark Hughes | Truist Securities | Raises | Hold | $105.00 | $100.00 |

| Joshua Shanker | B of A Securities | Raises | Buy | $124.00 | $115.00 |

| Elyse Greenspan | Wells Fargo | Raises | Equal-Weight | $106.00 | $90.00 |

| Andrew Kligerman | TD Cowen | Announces | Hold | $102.00 | - |

| Jimmy Bhullar | JP Morgan | Raises | Neutral | $90.00 | $85.00 |

| John Barnidge | Piper Sandler | Raises | Overweight | $122.00 | $114.00 |

| Thomas Gallagher | Evercore ISI Group | Raises | Underperform | $90.00 | $84.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Aflac. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Aflac compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Aflac's stock. This examination reveals shifts in analysts' expectations over time.

Capture valuable insights into Aflac's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Aflac analyst ratings.

All You Need to Know About Aflac

Aflac Inc offers supplemental health insurance and life insurance in United States and Japan. In addition to its cancer policies, the company has broadened its product offerings to include accident, dental and vision, disability, and long-term-care insurance. It markets its products through independent distributors, selling majority of its policies directly to consumers at their places of work and also reaches out to its customers out of their worksite through digital mediums. The company has two reportable business segments; Aflac Japan which generates the majority of the revenue, and Aflac U.S.

Financial Milestones: Aflac's Journey

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Aflac's revenue growth over a period of 3 months has faced challenges. As of 30 September, 2024, the company experienced a revenue decline of approximately -39.69%. This indicates a decrease in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Aflac's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of -3.06%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -0.37%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Aflac's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -0.07%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Aflac's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.32.

The Core of Analyst Ratings: What Every Investor Should Know

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.