Dell Technologies has strong momentum thanks to demand for AI servers, high-end storage gear and personal computers, a Wall Street analyst said Wednesday. Dell stock is in record-high territory.

"We see a positive setup for Dell heading into calendar 2025," BofA Securities analyst Wamsi Mohan said in a client note. The company has momentum from product launches last week at its Dell Technologies World 2024 conference in Las Vegas, he said.

Mohan reiterated his buy rating on Dell stock and raised his price target to 180 from 130.

On the stock market today, Dell stock jumped 7.9% to close at 179.21. Earlier in the session, Dell hit an all-time high of 179.70 — its fourth record high in as many trading sessions.

Dell Stock Called 'Under-Owned'

"Dell remains an under-owned and underweighted stock and with the potential catalysts of AI and potential inclusion in the S&P," Mohan said.

The Round Rock, Texas-based computer maker plans to report its fiscal first-quarter results after the market close on Thursday.

Dell is benefiting from data centers upgrading their infrastructure for generative AI, Mohan said. The company also should see a tailwind from the PC refresh cycle, fueled by the introduction of AI PCs, he said.

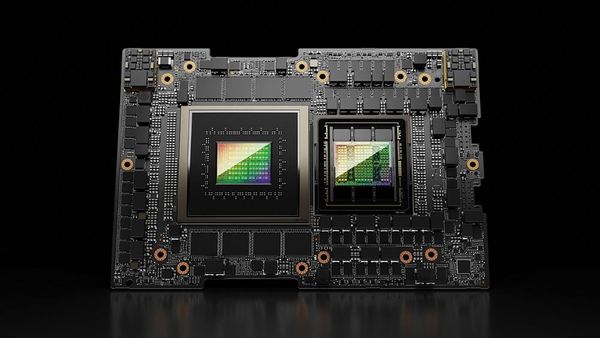

At its Dell Technologies World conference on May 20-23, the company introduced new AI PCs, AI servers, all-flash storage and network architecture. It also announced an expanded collaboration with AI chipmaker Nvidia.

Dell stock ranks third out of 15 stocks in IBD's computer hardware and peripherals industry group, according to IBD Stock Checkup. It has an IBD Composite Rating of 86 out of 99.

IBD's Composite Rating combines five separate proprietary ratings into one easy-to-use rating. The best growth stocks have a Composite Rating of 90 or better.

Follow Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.