Shares of Deere (DE) at last check were off about 4% after the agricultural-equipment stalwart reported earnings.

Despite a selloff in the overall market, the bulls are finding the positives in Deere’s report as they continue to buy the initial dip.

As for the earnings, the headline results were mixed.

Earnings of $6.16 a share missed analysts’ expectations of $6.69 a share. But profit grew more than 17% year over year, a strong growth rate, not only for Deere but also more broadly in the current environment.

Revenue rose 22% year over year to $14.1 billion and beat estimates of $12.8 billion.

Management tweaked its full-year net-income outlook, lowering the top end of the range. The new estimated range is $7 billion to $7.2 billion; the previous one was $7 billion to $7.4 billion.

As RealMoney’s “Sarge” said, the results were “really, really strong, but were they strong enough?”

We’ll find out. Meantime, here are a few key levels to keep an eye on.

Trading Deere Stock on Earnings

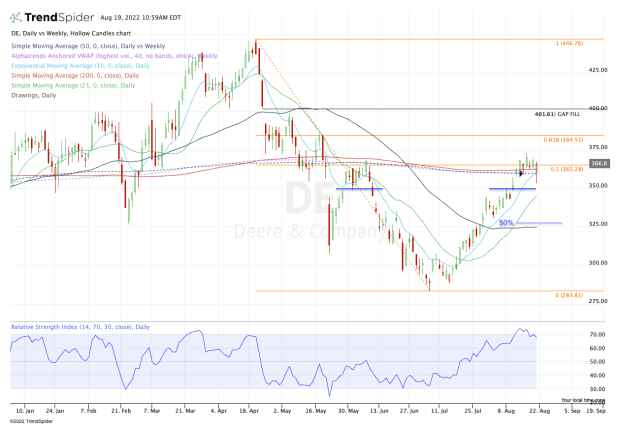

Chart courtesy of TrendSpider.com

Last week, Deere stock broke out over $350 and pushed into the $370 area ahead of today’s earnings report.

Going into the earnings, the stock was holding up over the 50% retracement, the weekly VWAP, and 10-day, 200-day and 50-week moving averages.

If Deere stock can close above $365 — and thus all the levels above — then the bulls can remain in control.

If the shares can push higher from here, watch this week’s high of $373.37. A rotation above that mark could put the 61.8% retracement in play near $385. That’s followed by the $400 area and the gap-fill level at $401.61.

On the downside, watch two key areas.

The first is the $359 level. If Deere stock breaks below this mark, it puts it below all the key measures listed above. If that happens, the second key level to watch is today’s low at $353.38.

A break of this mark puts $350 and the 21-day moving average in play.

If Deere stock breaks below these measures, that opens the door down to the $325 to $330 zone. There we find the 50% retracement of the current rally and the 50-day moving average.

For now, watch $359 on the downside, then $365 and $373.50 on the upside. These are the key levels to know.