In the preceding three months, 9 analysts have released ratings for Hewlett Packard (NYSE:HPE), presenting a wide array of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 5 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 2 | 0 | 0 |

| 3M Ago | 1 | 1 | 2 | 0 | 0 |

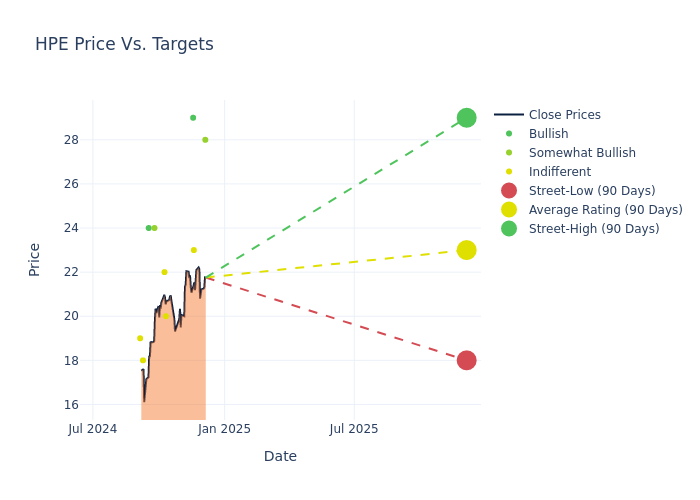

Analysts have recently evaluated Hewlett Packard and provided 12-month price targets. The average target is $23.11, accompanied by a high estimate of $29.00 and a low estimate of $18.00. This current average reflects an increase of 13.12% from the previous average price target of $20.43.

Exploring Analyst Ratings: An In-Depth Overview

In examining recent analyst actions, we gain insights into how financial experts perceive Hewlett Packard. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Meta Marshall | Morgan Stanley | Raises | Overweight | $28.00 | $23.00 |

| Asiya Merchant | Citigroup | Raises | Neutral | $23.00 | $20.00 |

| Simon Leopold | Raymond James | Raises | Strong Buy | $29.00 | $23.00 |

| Mehdi Hosseini | Susquehanna | Maintains | Neutral | $20.00 | $20.00 |

| Matt Niknam | Deutsche Bank | Announces | Hold | $22.00 | - |

| Tim Long | Barclays | Raises | Overweight | $24.00 | $20.00 |

| Asiya Merchant | Citigroup | Announces | Neutral | $20.00 | - |

| Wamsi Mohan | B of A Securities | Raises | Buy | $24.00 | $21.00 |

| Ananda Baruah | Loop Capital | Raises | Hold | $18.00 | $16.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Hewlett Packard. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Hewlett Packard compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Hewlett Packard's stock. This examination reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Hewlett Packard's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Hewlett Packard analyst ratings.

Delving into Hewlett Packard's Background

Hewlett Packard Enterprise is an information technology vendor that provides hardware and software to enterprises. Its primary product lines are compute servers, storage arrays, and networking equipment; it also has a high-performance computing business. HPE's stated goal is to be a complete edge-to-cloud company. Its portfolio enables hybrid clouds and hyperconverged infrastructure. It uses a primarily outsourced manufacturing model and employs 60,000 people worldwide.

Key Indicators: Hewlett Packard's Financial Health

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Hewlett Packard's remarkable performance in 3 months is evident. As of 31 July, 2024, the company achieved an impressive revenue growth rate of 10.11%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Hewlett Packard's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 6.64% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 2.34%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.85%, the company showcases effective utilization of assets.

Debt Management: Hewlett Packard's debt-to-equity ratio is below the industry average. With a ratio of 0.53, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.