Whales with a lot of money to spend have taken a noticeably bullish stance on Meta Platforms.

Looking at options history for Meta Platforms (NASDAQ:META) we detected 97 trades.

If we consider the specifics of each trade, it is accurate to state that 45% of the investors opened trades with bullish expectations and 34% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $269,594 and 90, calls, for a total amount of $11,501,573.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $180.0 to $720.0 for Meta Platforms over the recent three months.

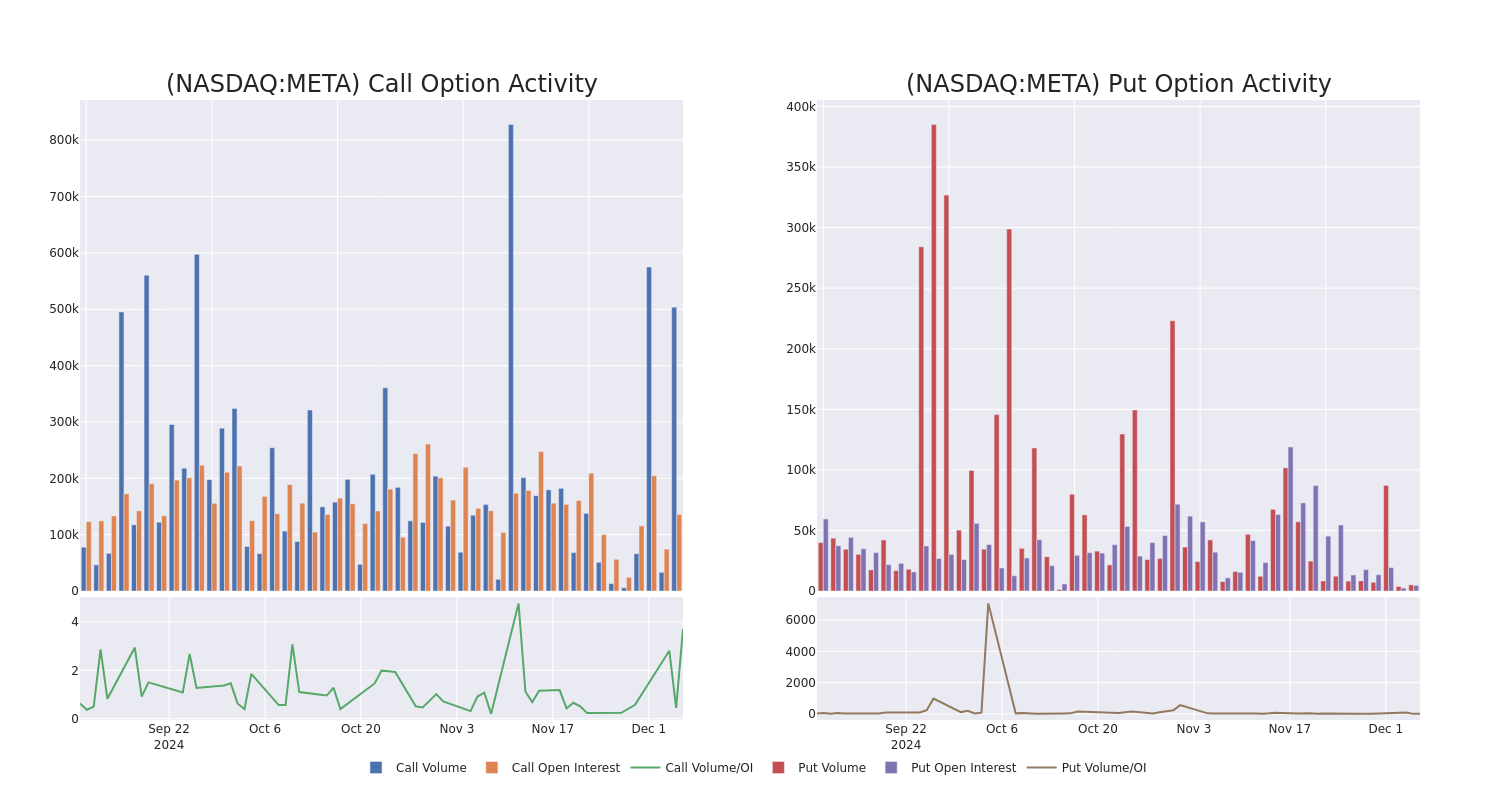

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Meta Platforms's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Meta Platforms's substantial trades, within a strike price spectrum from $180.0 to $720.0 over the preceding 30 days.

Meta Platforms Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| META | CALL | SWEEP | BULLISH | 01/17/25 | $38.0 | $37.8 | $38.0 | $600.00 | $965.2K | 20.2K | 1.0K |

| META | CALL | SWEEP | BULLISH | 01/17/25 | $13.4 | $13.2 | $13.4 | $650.00 | $526.6K | 7.5K | 6.6K |

| META | CALL | SWEEP | BULLISH | 12/20/24 | $25.8 | $25.7 | $25.8 | $600.00 | $516.0K | 14.5K | 722 |

| META | CALL | SWEEP | BEARISH | 12/27/24 | $13.6 | $13.5 | $13.5 | $630.00 | $421.0K | 3.2K | 1.3K |

| META | CALL | SWEEP | BULLISH | 12/13/24 | $8.15 | $7.6 | $8.15 | $630.00 | $207.8K | 2.3K | 4.7K |

About Meta Platforms

Meta is the largest social media company in the world, boasting close to 4 billion monthly active users worldwide. The firm's "Family of Apps," its core business, consists of Facebook, Instagram, Messenger, and WhatsApp. End users can leverage these applications for a variety of different purposes, from keeping in touch with friends to following celebrities and running digital businesses for free. Meta packages customer data, gleaned from its application ecosystem and sells ads to digital advertisers. While the firm has been investing heavily in its Reality Labs business, it remains a very small part of Meta's overall sales.

Where Is Meta Platforms Standing Right Now?

- Trading volume stands at 3,034,886, with META's price up by 1.94%, positioned at $620.73.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 55 days.

Expert Opinions on Meta Platforms

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $675.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Raymond James downgraded its action to Strong Buy with a price target of $675.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Meta Platforms with Benzinga Pro for real-time alerts.