/The%20UiPath%20logo%20on%20a%20corporate%20office%20by%20Ian%20Dewar%20Photography%20via%20Shutterstock.jpg)

UiPath (PATH) made headlines for investors this week when S&P Dow Jones Indices ($INX) announced that the automated software company will become part of the S&P MidCap 400 Index (IJH) ahead of Friday's opening bell on Jan. 2. UiPath will replace Synovus Financial (SNV), which is being acquired by Pinnacle Financial Partners (PNFP).

Index increases may not always be big news, but they are significant nonetheless. Passive funds that follow the MidCap 400 will have to purchase additional shares of the company’s stock, while active managers may choose to readjust their holdings once the company is included in the popular index. For UiPath’s specific situation, this timing is quite interesting, with improved profitability ratios and growing interest in agentic automation.

About UiPath Stock

UiPath is a New York-headquartered company that specializes in enterprise software with its primary business in the realm of robotic process automation software. However, in the past two years, the company has aggressively pushed forward in entering the realm of AI agentic automation. Today, with a market capitalization of about $9 billion, the company has entered its rightful place in the MidCap 400 Index.

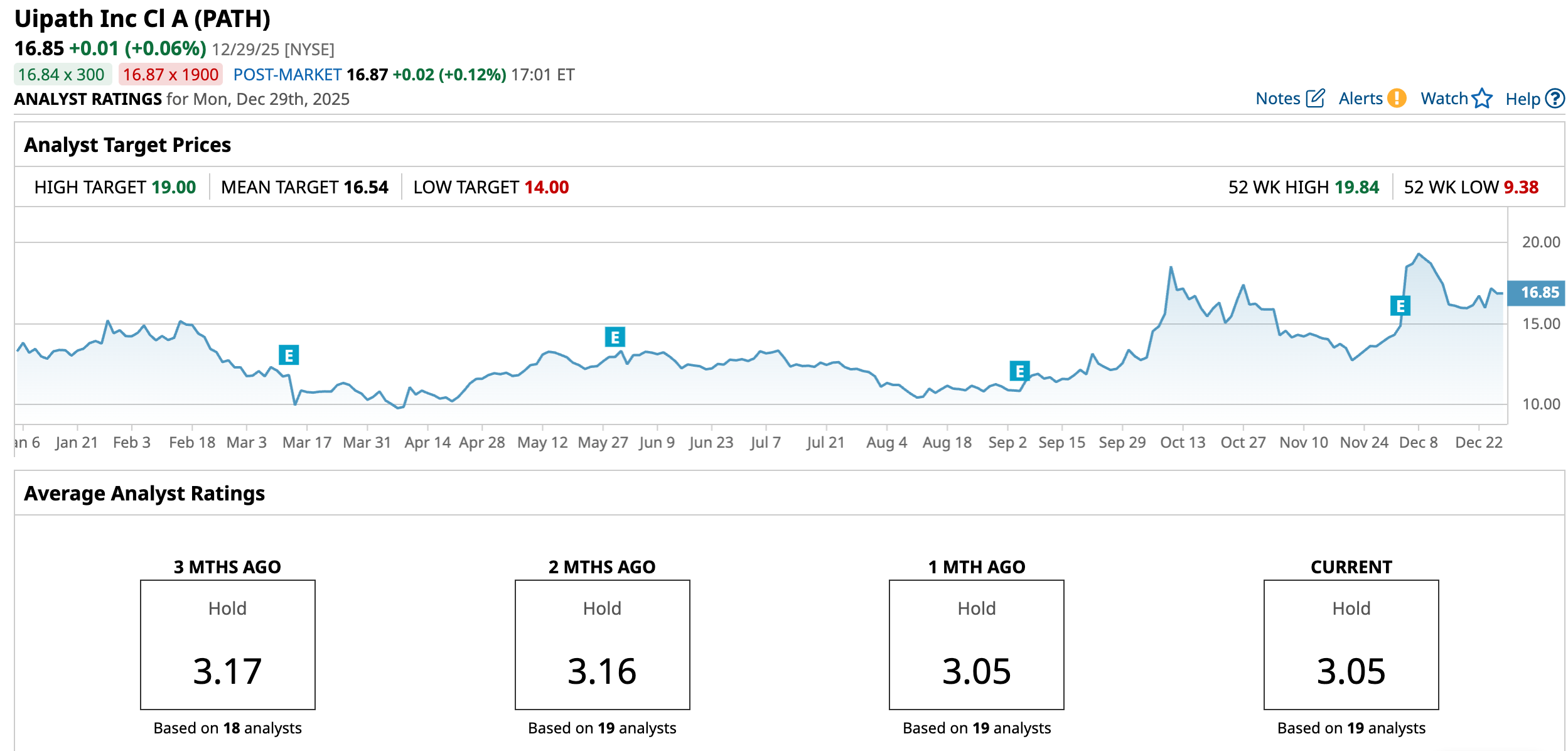

Regarding pricing, the stock has been quite tumultuous but constructive for PATH. The stock has been ranging between $9.38 and $19.84 for the past 52 weeks, but the current level seems to be at the point where the stock is not as highly valued but not as undervalued either, as the Relative Strength is in the mid-50s.

Some investors find the stock’s valuation to be a bit of a concern. Yet the stock’s balance sheet is immaculate, with no debt at all, not to mention that the company possesses over $1.5 billion in cash. From a valuation standpoint, UiPath trades at about 5.65x sales and over 122.57x forward earnings, reflecting high growth expectations. Further, the company does not pay a dividend.

UiPath Delivers a Profitable Quarter

But the latest earnings from UiPath shed some light on why the sentiment is slowly turning positive. Notably, the firm has reported that, for the third consecutive quarter in fiscal 2026, it has registered revenue of $411 million, an increase of 16% from the same period in the previous year, while its annual recurring revenue has climbed to $1.782 billion, a growth of 11%. Moreover, UiPath has recorded its first GAAP profitable third quarter, registering GAAP operating income and adjusted free cash flow of $13 million and $28 million, respectively.

Management’s messaging was one of optimism but also caution. CEO Daniel Dines pointed to increasing enterprise demand for integrated automation platforms that enable deterministic flows as well as AI-driven agents. CFO Ashim Gupta called attention to better execution and cost management, which is now beginning to manifest in financial results. For Q4, UiPath is guiding revenue of up to $467 million and non-GAAP operating income of about $140 million. This constitutes accelerating operating leverage as the fiscal year draws to a close.

What Do Analysts Expect for UiPath Stock?

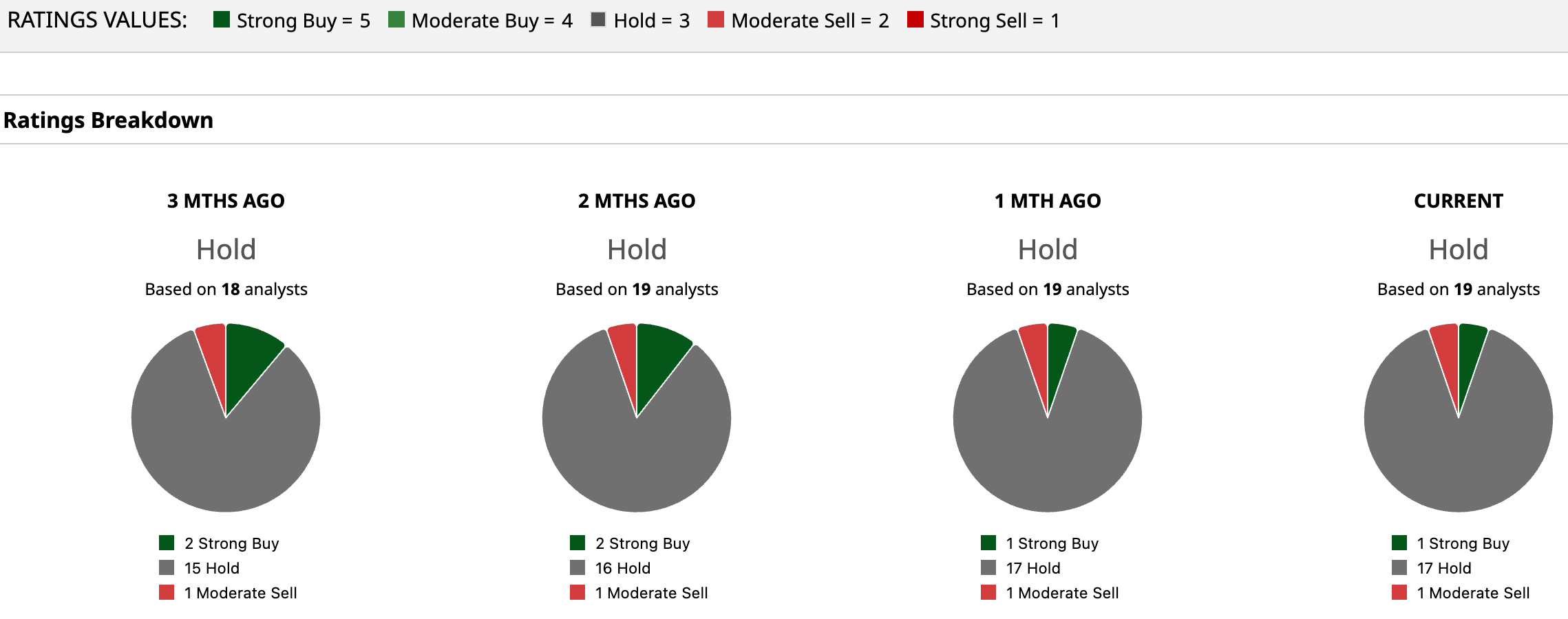

The street remains cautiously neutral. PATH has a “Hold” rating consensus and analysts place the median target price on the company at $16.54. This target price calculates a 1.84% possible loss from the recent price, while the high target of $19 signals considerable gain of 12.76%.

While the S&P MidCap 400 inclusion does not affect the fundamentals of UiPath in the short term, it is reflected in the stock's visibility, as well as the pool of its shareholders. Taking into account its improved profitability, as well as a steady increase in ARR, Jan. 2 might prove a silent turning point. As for a long-term investor, the key question is whether UiPath's agential automation vision will help the company boost its margins.