/Dayforce%20Inc%20app-by%20Premio%20Studio%20via%20Shutterstock.jpg)

With a market cap of $11.1 billion, Dayforce, Inc. (DAY) is a human capital management (HCM) software company operating in the United States, Canada, Australia, and internationally. It offers cloud-based solutions for HR, payroll, workforce management, benefits, and talent intelligence.

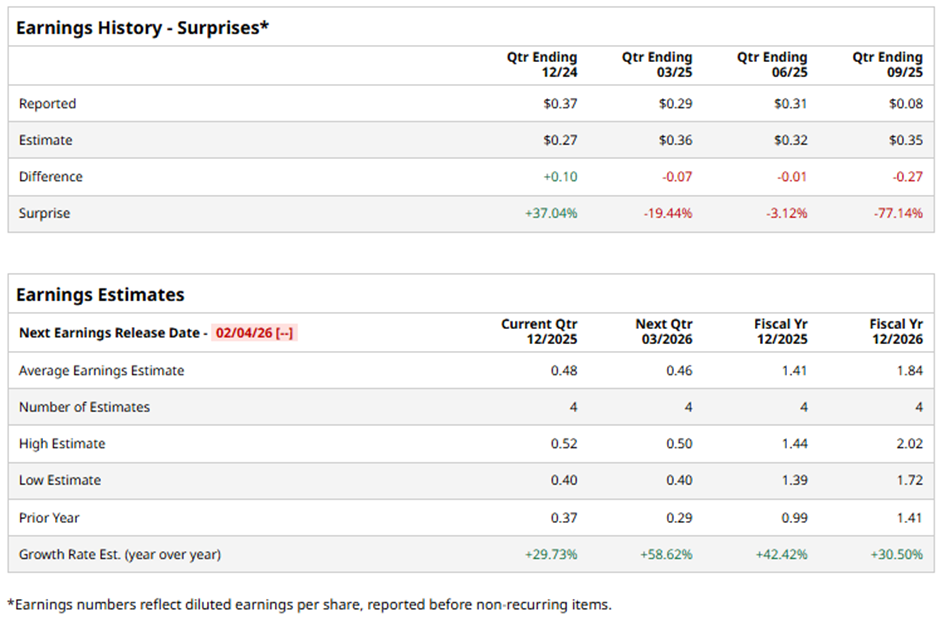

The Minneapolis, Minnesota-based company is expected to release its fiscal Q4 2025 results soon. Ahead of this event, analysts project DAY to report an EPS of $0.48, a 29.7% surge from $0.37 in the year-ago quarter. It has exceeded Wall Street's bottom-line estimates in one of the last four quarters while missing on three other occasions.

For fiscal 2025, analysts forecast the provider of human-resources software and services to report EPS of $1.41, up 42.4% from $0.99 in fiscal 2024.

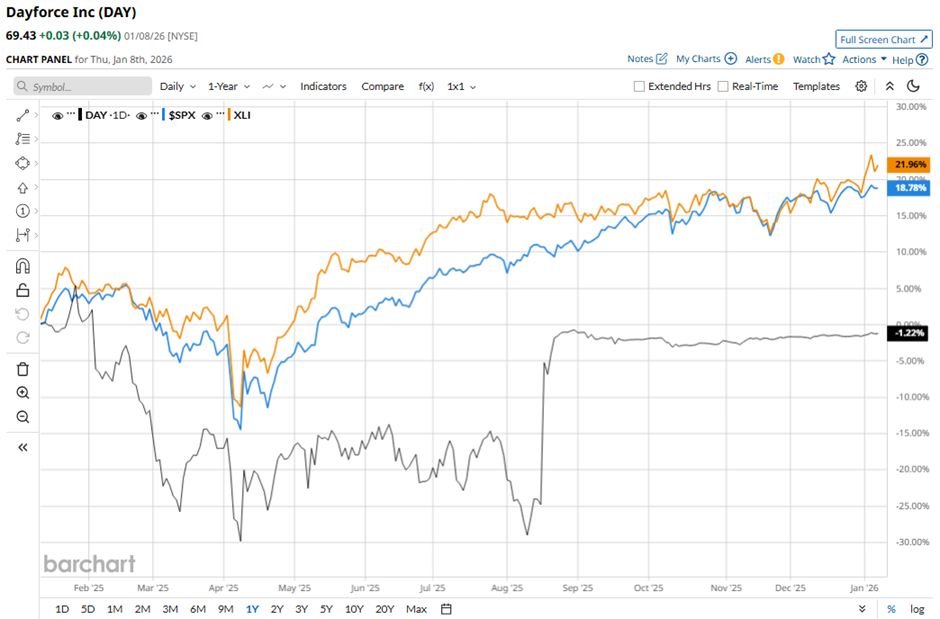

Shares of Dayforce have declined 1% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) nearly 17% return and the State Street Industrial Select Sector SPDR ETF's (XLI) 20.6% gain over the same period.

Despite reporting weaker-than-expected Q3 2025 adjusted EPS of $0.37 on Oct. 29, Dayforce shares recovered marginally the next day. Total revenue met expectations at $481.6 million (up 9.5% YoY), recurring revenue excluding float rose 14% to $333 million, and adjusted EBITDA increased to $147.3 million with a 30.6% margin.

Analysts' consensus view on DAY stock is cautious, with a "Hold" rating overall. Among 16 analysts covering the stock, one suggests a "Strong Buy" and 15 give a "Hold." The average analyst price target for Dayforce is $70, suggesting a marginal potential upside from current levels.