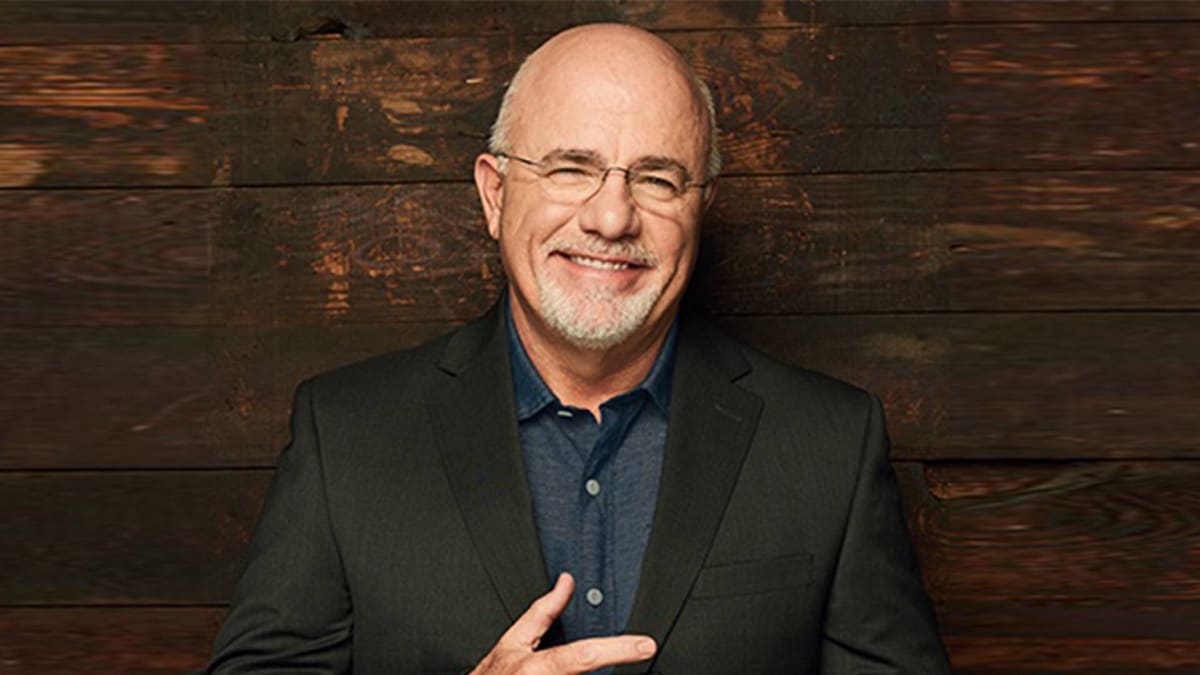

Outspoken author and talk radio host Dave Ramsey has some blunt advice about paying for a home.

These finances can be especially tricky for people who haven't fully and transparently planned their paths to success.

DON'T MISS: Dave Ramsey Has Outspoken View On the 'Lie' About College

In many instances, it's a newly married couple that is learning how to tackle finances as a team for the first time.

This often involves two people with very different financial backgrounds and profiles.

And this can cause some uneasy feelings.

For example, one married man, named Sonny, recently sought Ramsey's advice about his specific situation.

"Dear Dave," Sonny wrote, according to KTAR News in Phoenix. "When my wife and I got married, she had about $70,000 in savings and I had a lot of debt. We bought some property from her parents to build a home on, and she made a 20% down payment on the land from her savings."

"We’ve paid off some debt, and she has more in savings now," he continued. "But I feel guilty, and it seems unfair to ask her to pay on our debt with her savings since most of it is debt I brought into the marriage. How do you feel about this?"

Ramsey sympathized with Sonny's concerns, but clearly had an immediate reaction and wanted to get straight to the point.

"This question tells me you’re a good guy with a good heart," Ramsey wrote. "But let me ask you a thing or two. When your wife gets sick, is it unfair for you to take care of her? You didn’t cause it. It's not your fault. Of course, it's not unfair. I'm not mad at you, buddy. I'm just throwing your own logic right back at you."

The personal finance personality then discussed some principles about the commitment involved when entering a marriage.

"Maybe these next lines will sound familiar: for richer or for poorer, in sickness and in health," Ramsey wrote. "The old 'Book of Common Prayer' continues the vows and says, 'Unto thee, all my worldly goods I pledge.' This is called oneness. It's called unity. And it's what a good marriage should be about."

So building and paying for the real estate the two own will have its rewards, but will also present its challenges.

"Do you get what I’m saying, Sonny?" Ramsey asked. "The two of you are in this together. This is not a business partnership or joint venture. It’s a man and a woman pledging themselves, and all they have and are, to each other."

This is where Ramsey issues a warning about what might happen if these terms and feelings aren't addressed head on.

"I understand your feelings, but if you’re not careful, that kind of guilt will stand in the way of you two creating a successful marriage -- both financially and emotionally," Ramsey wrote.

He closed the conversation with this advice.

When you got married, the “me” and “mine” became “we” and “ours.” You got all her stuff, the good and bad, and she got all of yours. Now it’s time for you to work as a team to make the bad stuff go away and the good things even better. What’s fair (and what’s right) is to combine all of your income, all of your assets and all of your liabilities.

I know it’s uncomfortable, but you’ve got to choose courage. Ask her to go all in on this with you and attack your debt together. Work toward making your dreams come true together as one.

That’s what’s fair, and that’s what’s best when you’re married.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.