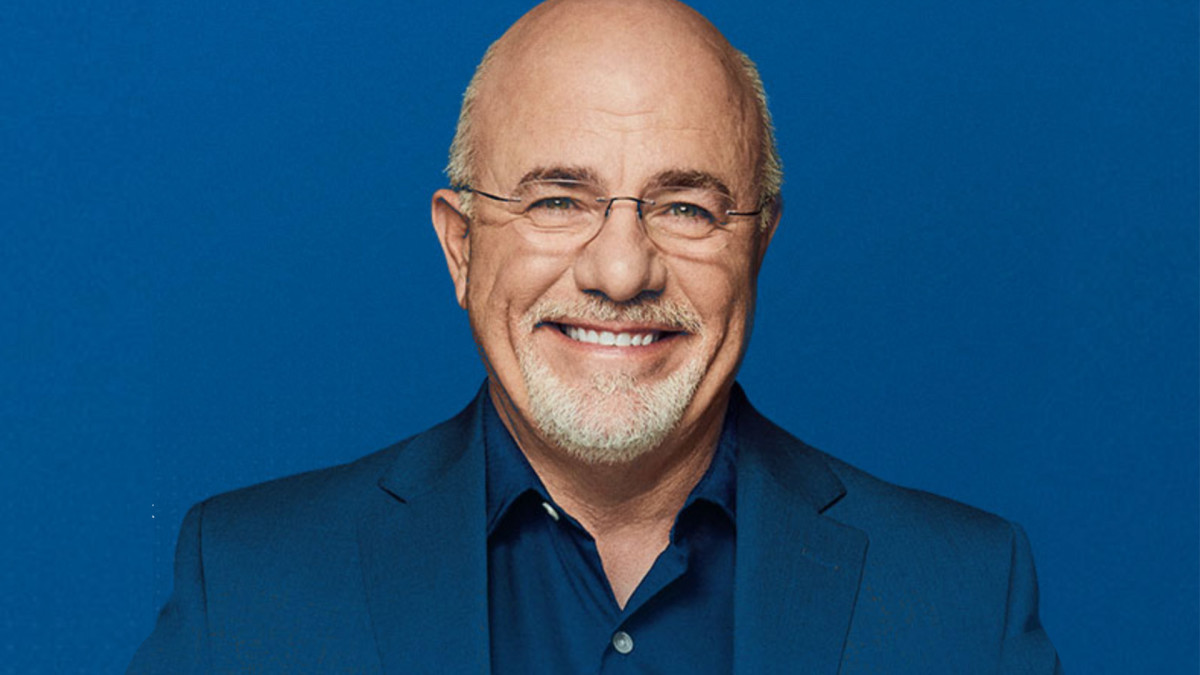

Bestselling personal finance author and radio host Dave Ramsey has a big warning about one way to avoid serious financial trouble.

For people who have already started down this dangerous path, he thankfully offers hope for a way out as well.

Related: Pepsi discontinues 3 soda flavors Coca-Cola doesn't offer

Ramsey says most families have money problems at some point. He references job layoffs and illnesses, for example, that can be financial wrecking balls.

The radio host explained a bit, in an email Ramsey Solutions sent to TheStreet, about his experience as a kid.

"My parents were in the real estate business and were building homes. Then, the economy went sideways and left them in a mess," Ramsey wrote. "Outside forces brought trouble to our house. We never went without food, shelter, or anything else, but the air changed in our home."

A real estate collapse is one example of economic trouble than can adversely affect an individual or a family's finances.

But Ramsey writes about another problem that is, unfortunately, very common and is far too easy with which to tangle.

Shutterstock

Be very wary of falling into credit card debt

An advice seeker asked Ramsey recently about a situation he was witnessing with a family member.

"Dear Dave," wrote a man named Randall, according to the Ramsey Solutions email. "I think my mother-in-law has a serious credit card problem. She can't afford stuff, but she shops anyway, chalks up more and more debt, acquires more credit cards, and thinks she'll pay for it all later somehow."

"Her ex-husband has bailed her out a few times, but he’s unwilling to help anymore," Randall continued. "My wife and I, and my wife's sister, want to address this issue, but we're all worried about her reaction, and we don't know where to start. Do you have any advice?"

Ramsey emphasized the importance of handling any communication with his mother-in-law.

"First, everyone involved should understand they're likely to receive an angry response from this lady if she's confronted over her actions," he said. "Sometimes people get ticked off when they hear the truth, especially when it’s connected to their own misbehavior. It may even be a good idea for your wife and her sister to get some advice from a family counselor beforehand. Really, what we’re talking about here is an intervention."

Ramsey also advised Randall to let his wife's family handle it.

"They need to sit down with her in a quiet setting, one where there are no interruptions, no television and no one else," Ramsey wrote. "Start with the fact that they love her and care about her deeply. That's very important in a situation like this."

"But they also have to walk through what's really going on, and let her know they're tired of watching her destroy herself, and her finances, with her irresponsible behavior," he added.

Ramsey likened a credit card problem to drug and alcohol abuse.

"She basically has a credit card addiction. And it's wreaking havoc on her financial well-being and people who care about her," Ramsey wrote.

"So, show as much love and understanding as possible. But someone needs to say something soon."

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.