Many people doing their best to get their finances in order find that some of the documents involved for various tasks regarding their money during the course of their lives can be intimidating.

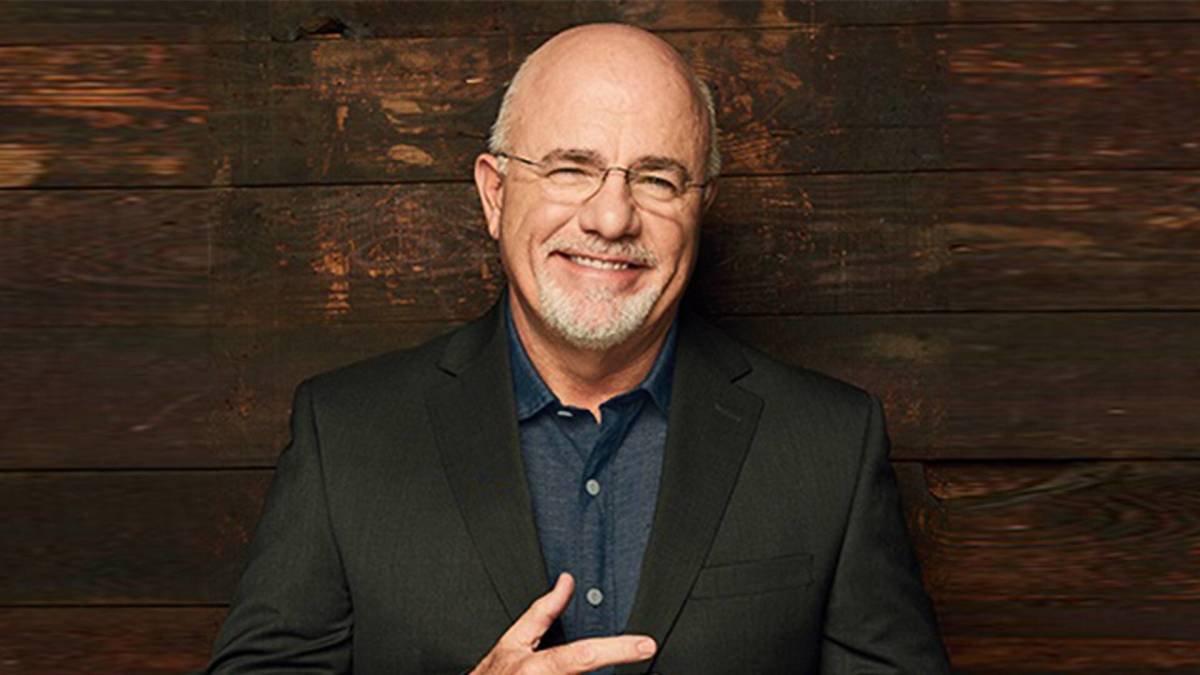

Personal finance author and radio host Dave Ramsey suggests that, with some planning and good advice, the tension that comes with getting a handle on these financial realities can be solved without undue stress.

Related: Dave Ramsey shares strong words on buying a home and real estate now

These include insurance policies, marriage and divorce documents, tax returns, investment records and retirement planning paperwork, as well as others.

But one particular document tends to generate tension, including family stress. People often procrastinate preparing these papers, but when they finally confront them people generally try as hard as they can to prepare them correctly and fairly: their wills.

People create wills to distribute their assets according to their wishes after they die. But Ramsey has a word of warning about wills and how families can sometimes react to them.

Ramsey has some strong words about families and wills

The personal finance coach warns people about how sometimes wills can be hazardous territory for families.

"There’s a little bit of crazy in every family," he wrote in an email to TheStreet from Ramsey Solutions. "You probably know who they are in your family. We all know some families that seem to have more than their fair share of crazy and drama, and wills are best for families that struggle with these issues and tension between family members. Probate court can resolve those problems."

But Ramsey had some encouraging words as well.

"On the other hand, families who can handle healthy conflict, and who trust each other, are better off with a trust, since they don’t need a probate court to babysit them," he added.

An advice-seeker recently asked Ramsey about both wills and trusts, according to the email.

"Dear Dave," wrote a man who identified himself as William. "I was talking to some friends the other day about wills and trusts. They seemed to have a variety of opinions, so can you straighten things out for me? I don’t have a will or a trust, and my financial situation is pretty simple. I just want to make sure I do the right thing."

Ramsey replied with a recommendation about a first step toward tackling this task.

"This is a great question," he wrote. "I’m sure your friends are smart folks, but I’m glad you’re looking for more answers. I’m not a lawyer, so I’m just going to give you a few simple things to think about."

"Also, I’d strongly suggest you talk to an experienced will and trust lawyer, one with the heart of a teacher, who will give you all the facts and put your best interests first," he added.

Shutterstock

Ramsey offers some important details about wills and trusts

The radio host explained some of the differences between wills and trusts.

"Basically, a will is a legal document that explains what you want to happen with your stuff when you die and puts it all in writing," he wrote. "There are many different types of wills, but for most people a simple will is all you need to establish a solid estate plan that protects your family if something happens to you."

"Trusts tend to be geared toward people with more assets and unique or complex estate issues," Ramsey continued. "They also come in lots of different forms like, living trusts, revocable and irrevocable trusts and special needs trusts, just to name a few. In my mind, if you have less than $1 million in assets — and your financial world is pretty simple and straightforward — a will gets the job done just fine."

Ramsey added another significant observation about the contrast between the two.

"One of the most important differences between wills and trusts is the ability to name a guardian for your minor children," he wrote. "You can name a legal guardian in your will, but you can’t in a trust. So, even if you have a trust, you’ll still need a will to make sure your kids are taken care of after you die."

Ramsey also clarified how probate court sometimes plays a role when a will is challenged.

"Another important distinction between the two is that a trust lets you skip probate court — a will doesn’t," he wrote. "Probate court cases can drag on forever. Plus, they can be expensive."

"If your estate gets mixed up in probate court because someone challenges the will, it could mean your family has to spend months in court while grieving," Ramsey explained. "No one wants to go through that."

Ramsey emphasized another point he had addressed earlier.

"If you’re wondering if you can have both a trust and a will, the answer is yes," he wrote. "In fact, most people who have a trust have a will, too."

"I hope this little bit helps!"