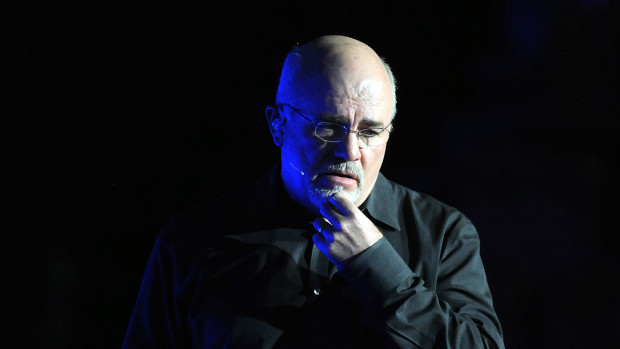

Author and radio host Dave Ramsey has offered advice on finances, debt, homeownership and other similar topics for years.

But there is another important subject he finds a way to relate to financial discussions that are not always expected, and sometimes, regrettably, missed, from experts in these areas.

DON'T MISS: Dave Ramsey Explains 'House Hacking' For Extra Homeowner Cash

Personal finance issues frequently have a lot to do with the key concerns of family and relationships. Some have to do with personality types around work. Others involve decisions about big steps such as buying a home.

And Ramsey is eager to talk about those things as well.

For example, an advice-seeker, identifying herself as Grace, explained a situation she was in.

"Dave," she wrote, according to KTAR News in Phoenix. "My husband is an entrepreneur. He has a very hard-driving, energetic personality and way of doing things, while I’m more laid back and soft spoken."

She explained the questions she had been grappling with on how best to communicate with him.

"How can I support him best in terms of encouraging and communicating with him?" she asked. "I want him to know I care, that I want to help and that I’m proud of him."

Ramsey responded with a recognition that Grace seemed to already be on the right track.

"Grace," he said. "I think you’ve already taken a good first step toward all of that by recognizing and identifying your personality styles. If he's a hard-charging entrepreneur, there's a good chance God sent you into his life to slow him down a little, and help him keep it between the ditches. That’s what my wife does for me, and I'm so thankful she does."

The personal finance personality expanded a bit on what he meant by bringing up his own experiences along these lines.

"Once in a while, I'll get so wrapped up in a project or opportunity that I can’t stop thinking about it or turn it loose -- even after hours or on weekends," Ramsey wrote. "That’s when she knows to step in and say, 'Honey, did you ever think about this possibility?' Sometimes she's a little more straightforward, and I'll hear something like, 'You know, you really need to just slow down and chill.'"

Ramsey turned the conversation back to Grace and her relationship.

"The fact that you two are wired a little differently, and that you can be thoughtful and calm when he's all over the place, is one of the most valuable benefits you bring to your relationship," Ramsey wrote. "Once he understands this, he'll begin to respect it more. And when it happens, you folks are going to win in your relationship and in business."

"It's going to make such a positive impact on your lives, because you'll be making steady progress that's more predictable and reasonable, rather than things launching into the stratosphere and being followed by the inevitable crashes that are bound to happen from time to time," he added.

Ramsey said taking advantage of these natural differences offers an opportunity to create something special.

"As you grow to better understand the other's thinking, and how each is necessary for success, a great thing will be created," Ramsey wrote. "Your quieter, thoughtful side, and his energy and passion to pull things forward, will become the key to you two reaching heights together that you never would've achieved apart from each other."

"I love these discussions about family relationships and business," he continued. "Great question, Grace!"

Choosing a New Home With a Spouse

Ramsey has previously discussed how to make good financial decisions with a spouse. And one very important one is the decision people make when buying a home -- particularly, about which one to buy.

"Home buying can be a stressful process, but when you throw two different opinions in the mix, it can be downright agonizing," wrote his company's website, Ramsey Solutions. "Maybe you’re dying for a cute home in the suburbs, but your spouse loves the idea of lots of land in the country. These disagreements can create roadblocks on your way to arriving at the perfect home."

Ramsey recommends a few tips for couples making decisions about selecting a home.

First, he says, each of the people in the relationship should make separate must-have lists, according to the website. Then you can find areas of common ground and start your search from there.

He also suggests, where possible, to take emotions out of the budget and look at the math alone.

"Your monthly payments should be no more than 25% of your take-home pay," Ramsey Solutions wrote.

Ramsey also says it's important to be willing to postpone the hunt for a new house.

"There will always be new homes for sale, but digging in your heels over a home-purchase disagreement will only create a divide between you and your significant other."

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.