People looking to buy a house generally understand that's it's one of the biggest financial decisions they are ever going to make.

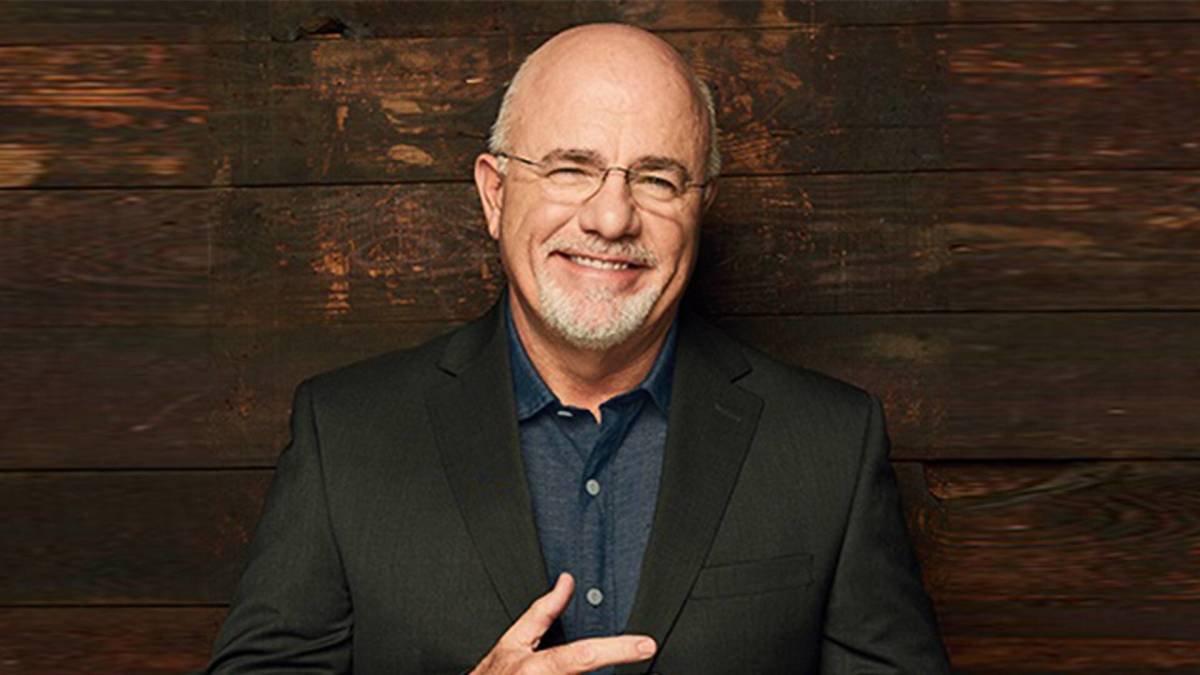

Bestselling personal finance author and radio host Dave Ramsey gives people advice about money regularly — and he says there are some very important ways to make home buying a good experience for the long term.

Related: Dave Ramsey explains how buying a car now can be the right move

Ramsey compares buying a house, particularly if you've never done it before, to the first time you jumped into the deep end of a pool. That is, you might be kind of scared and excited at the same time.

"You're signing up for a new — and big — responsibility, and you want to get things right so your home is a blessing and not a curse," he wrote on Ramsey Solutions.

The first thing Ramsey recommends is that you pay off all debt and build an emergency fund.

When Ramsey says "all debt" he means it. That includes credit cards, car payments and student loans. For an emergency fund to be fully funded it should be enough to cover three to six months of living expenses.

"Buying a house is stressful, but being debt-free will lower your stress level like a day at the beach (assuming no sharks are spotted)." he wrote.

Figuring out how much house you can afford

For starters, Ramsey says a mortgage payment should be no more than 25% of your take-home pay.

"If your payment is more than that, you'll end up being house poor," he wrote. "We want you to own your house, not have a house that owns you."

Another important thing to consider is to be sure you are clear on what your needs are.

"Before you get serious about shopping for a home, you need to get clear on your needs versus wants," Ramsey wrote. "If you're married, sit down with your spouse and make a list of needs and wants. Consider things like neighborhood, number of bedrooms and bathrooms, school district, and lot size."

"Be realistic," he added. "A swimming pool and three-car garage probably won't make the needs column for your first house. And as you look at homes, you might have to compromise on some of your needs and wants based on your budget."

Ramsey also advises people to be strict about sticking to their budgets. For example, if you have a budget for $350,000, you can be sure a $400,000 dream house will beckon. But it's not worth giving in to those kinds of temptations.

Here are some tips for after moving in

Once you have closed on a house and have taken the big step of moving in, there is plenty more to consider.

One important thing to be aware of is that you need to be sure to avoid insurance scams.

"Home transfers are public information, so after you move in, your mailbox might get stuffed with junk mail offering things like home warranties and mortgage life insurance," Ramsey explained. "Toss that stuff in the trash."

Taxes are another item to be prepared for.

"Buying a house could impact your income taxes come April," Ramsey wrote. "You can deduct your mortgage interest, and if you're self-employed and work from home, you might be eligible for the home office tax deduction."

It's also important to update your homeowner's insurance policy after any home improvements you make.

"The homeowner's insurance policy you signed up for when you first bought your home might fall short of protecting you and your property if you do some home improvements," Ramsey wrote. "Updating your home increases its value, so you need to update your policy before trouble comes knocking at your door."

"On the flip side, upgrades like a new roof, HVAC or a security system could actually save you money on coverage," he continued.

And again, it's always important to keep an emergency fund fully loaded. Owning a home means always being prepared for unexpected expenses.

Related: Veteran fund manager picks favorite stocks for 2024