Individuals who are catastrophically unable to pay debts, either because they have unaffordable expenses or not enough income — or both — sometimes choose to file for bankruptcy protection under Chapter 7.

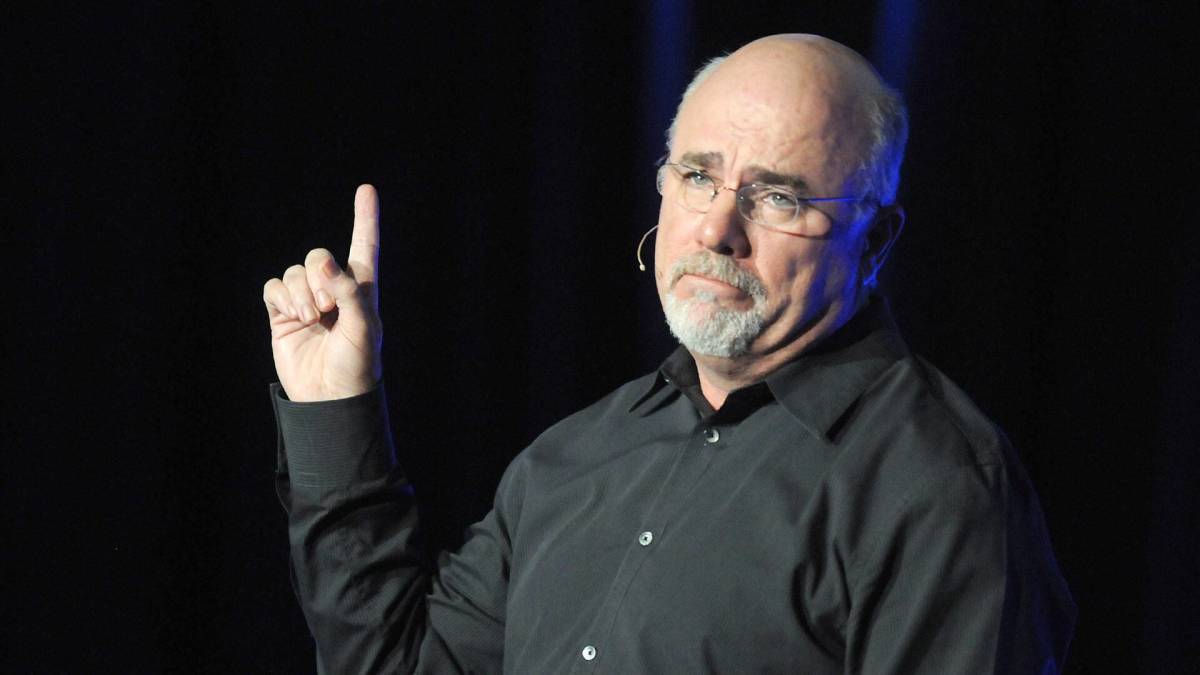

In 1988, personal finance author and radio host Dave Ramsey, at 28 years of age, lost the $4 million he was worth in real estate when banks began aggressively asking for loans to be paid back. He was forced to file for bankruptcy.

Related: Dave Ramsey has blunt words on car payments and retirement savings

He eventually recalibrated, built a multi-million dollar company and even fame as a media personality. He now offers personal finance advice to people interested in improving their financial lives.

Recently, in an exclusive remote interview with TheStreet from the New York Stock Exchange, Ramsey opened up about the experience as a warning to others.

"So you mentioned you hit rock bottom and you had to file for bankruptcy," TheStreet host Conway Gittens said. "What was the first step? Because there's somebody watching this who says, OK, I've hit rock bottom, but they don't know how to move from the bottom to get to where you are."

"Well, it hurts when you hit because it is hard. It's not a soft landing. It's a splat," Ramsey said from his Nashville studio. "You know, one guy said, 'How'd you bounce back?' And I didn't bounce. I splatted. It hurt. You know, it hurts bad. And so if somebody is at rock bottom and they're watching, I'm with you. I understand it hurts."

Dave Ramsey explains regaining financial footing after bankruptcy

The Ramsey Show host bluntly addressed the first step he and his wife took.

"What I had to do is just what Sharon and I did," Ramsey said. "We just took inventory. We said, 'OK, what about us personally and what about our behaviors and our habits and our decisions and our values was wrong that brought us to this moment?'"

"Because we weren't victims," he added. "I mean, we caused it. You know, no one did anything to us that was evil or nefarious. It was us doing so."

More on Dave Ramsey

- Ramsey explains one major key to early retirement

- Dave Ramsey discusses one big money mistake to avoid

- Ramsey shares important advice on mortgages

Ramsey and his wife acted quickly to make changes to their financial behavior.

"So we had to say, all right, what does stupid look like?" he said. "And let's stop doing stupid, you know. And so we said, all right, we don't borrow money anymore. And I've never had a credit card since then. And I don't borrow money."

"And so we were driving an old beat up car. It was awful," Ramsey explained. "It was horrible. But it was so bad that I was highly motivated to save money to get out of that car. So we saved a bunch of money really fast."

Image source: Shutterstock

Dave Ramsey explains other ways he changed his approach to finances

The personal finance coach talked about how he passionately adopted more healthy money habits.

"I worked like an animal," Ramsey said. "And so, yeah, you start writing down where your money's going. You do anything you can to get your income up and keep your outgo down and you get an agreement with your spouse and you lock arms."

"And you say, 'Hey, the rear view mirror is smaller than the windshield for a reason,'" he added. "What happened in the past is in the past, I don't have to live like that anymore."

Related: Restaurant chain closing more locations in Chapter 11 bankruptcy

Ramsey's finances eventually began to improve because of the financial habits he proactively changed.

"I can make a decision to change and go, so we're going to do a budget. We're going to increase our income," he said. "We're going to stay away from the things and the decisions that brought us into this mess in the first place that caused the splat."

"And then when I started doing that, people started asking me, what are you doing?" Ramsey recalled. "Because your life seems to be turning around after that horrible, stupid thing you all did. And I said, well, I'm staying out of debt and I write it down and my wife and I are in agreement and we saved money."

"And they said, 'That's it. You've got to tell somebody that.' And so we spent the next 30 years telling people that."

Related: Veteran fund manager picks favorite stocks for 2024