There has been increasing focus recently on whether the US dollar may be losing its status as the world's reserve currency.

Prominent figures such as Berkshire Hathaway (BRK.A) CEO Warren Buffett have downplayed concerns about the matter.

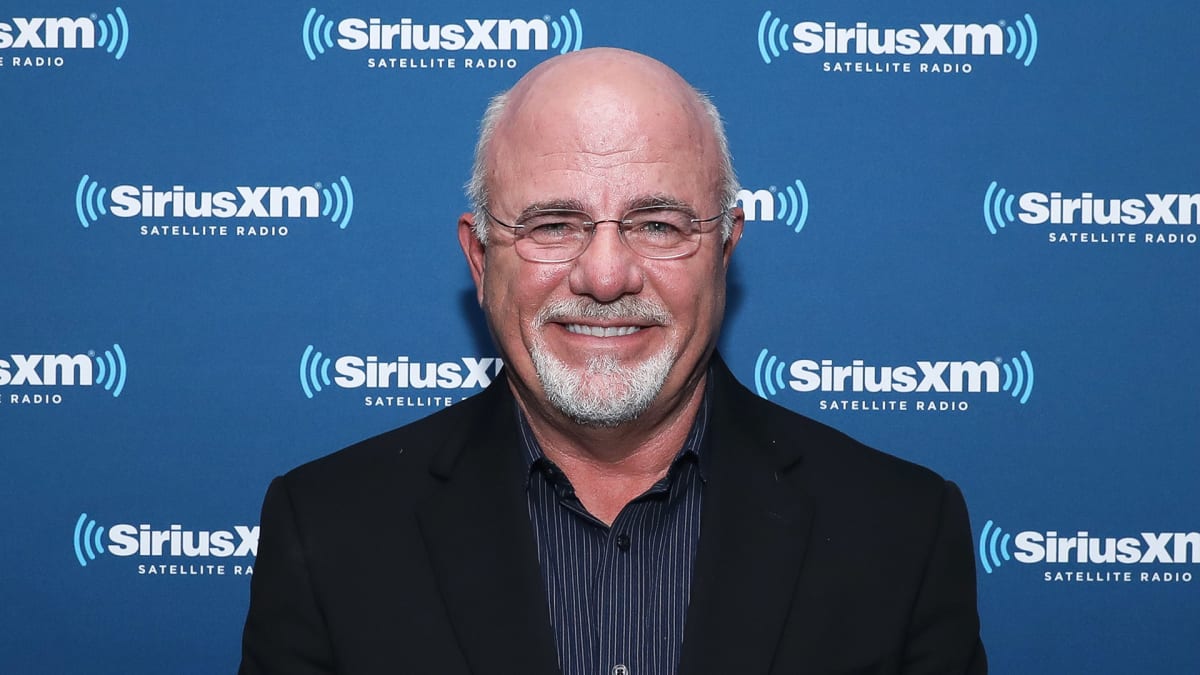

DON'T MISS: Dave Ramsey Offers Straight Talk on One Key Debate Home Buyers Face

In response to a question from someone seeking his advice on the subject, radio host and author Dave Ramsey addressed the issue.

"Dear Dave," wrote a person calling himself Zack, according to KTAR News in Phoenix. "I'm hearing more and more about 'de-dollarization' and how several countries are moving away from the U.S. dollar as their basis of international trade. Will this affect the strength of the dollar, and should I be concerned about how I’m saving and investing because of this?"

"Dear Zack," he wrote. "First and foremost, I care enough about you to say you may be spending way too much time on the internet, buddy. You’re drifting into the realm of conspiracy theories here, so let’s slow down and take a look at some facts."

The personal finance personality provided his view on the background of the issue.

"China, Brazil and Russia are the three main players in all this," he wrote. "They already don’t use the U.S. dollar as their basis of international trade -- all three have their own currency, and there's a conversion rate between all those currencies and the U.S. dollar."

"Those three countries, along with some of the oil-producing countries from the Middle East, they’re trying to get on board with the idea, are talking about developing one currency they all use," he continued. "In international trade, that currency would be converted back and forth to dollars -- much like what Europe did with the euro. Which, by the way, really hasn’t worked out so well."

Ramsey then cut straight to his assessment of the potential effectiveness of such an effort.

"Are those countries going to be able to devalue the dollar by doing that?" Ramsey asked. "No. Why? Because while those countries take up a lot of land mass, they don’t take up a lot of the gross domestic product (GDP) of the world."

"The United States still represents the vast majority of the world’s GDP," he added. "Sure, China's big in that regard. But Russia doesn’t bring much to the table, and Brazil is barely scraping by in a failed economy. Plus, they're tiny as far as economics are concerned. I mean, Texas probably has a larger GDP than Brazil."

Ramsey said he simply does not believe these countries have the power to affect the value of the US dollar.

"In other words, they just don’t have the muscle to take down the dollar, mathematically speaking," he wrote. "Now, if they do manage to put this idea together, it still won’t end in 'de-dollarization.' The dollar will not be done away with. Even if they create their own currency, they’re still going to have to trade with the 800-pound gorilla, which is America. And they’re going to have to trade with us in dollars."

"Am I worried about this, Zack? Not one bit. And you shouldn’t be either."

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.