People often encounter financial advice from a wide range of sources about planning for retirement, maximizing their Social Security benefits and investing in employer-sponsored 401(k)s.

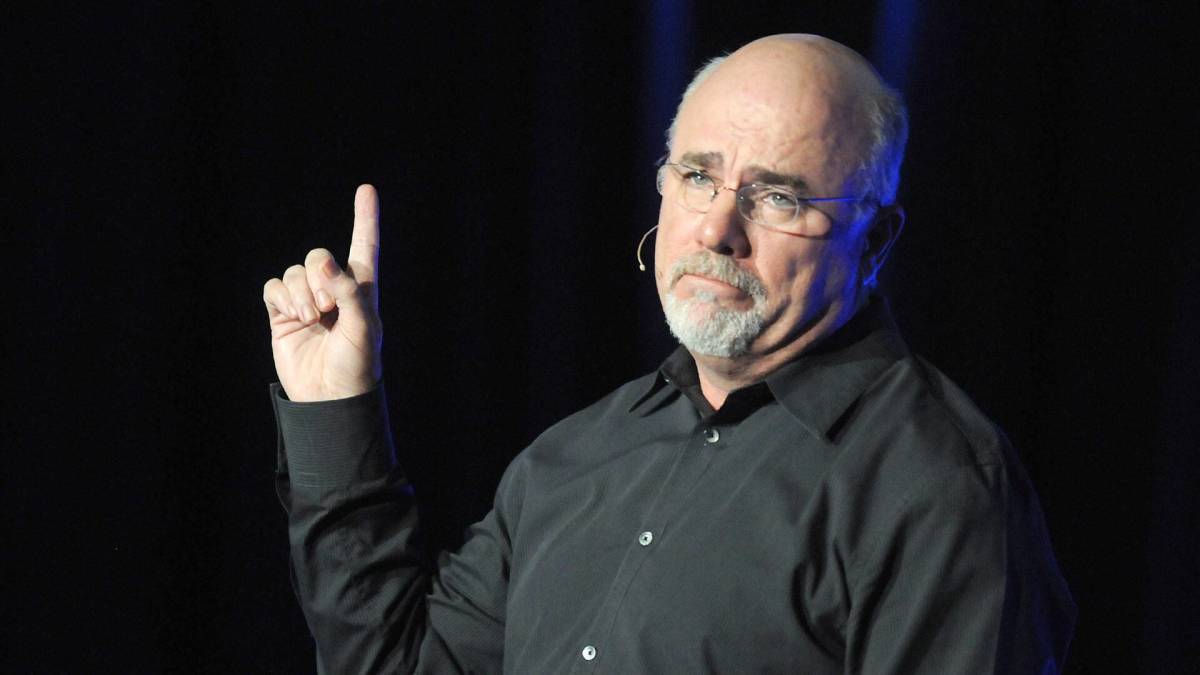

But personal finance author and radio host Dave Ramsey has blunt words about how a lot of the information people get on these topics is not worth paying attention to and sometimes is blatantly misleading.

Related: Another regional airline prepares to file for bankruptcy, cancels all flights

To be sure you are planning smartly and developing a successful strategy, Ramsey suggests learning the difference between fact and fiction when it comes to retirement advice. And he names a number of them.

One involves the question about the role Social Security checks play in a person's retirement income. Many people feel that once they reach retirement age, their government checks will be enough money to live on.

Ramsey explains that people planning to retire in the future often imagine an outsized expectation on how much purchasing power the money they collect from Social Security will have.

And for those who are retiring after 2033 — unless congressional legislation is enacted — the Social Security trust fund's reserves will become depleted and available existing money will only be sufficient to pay 79 percent of scheduled benefits.

Dave Ramsey explains other retirement misinformation people should reject

Another important misunderstanding Ramsey says many people get wrong is how much to invest in their 401(k)s and other holdings. Simply put, investing to your company's match percentage is a great place to start, but it's only the first step.

Ramsey believes 15% of a person's income should be invested in retirement. So that means you should start with your company's 401(k) match amount and then invest even more.

But your retirement investments beyond your 401(k) should be in a Roth IRA, Ramsey says. Those contributions are made with after-tax dollars and the earnings on those grow tax-free. This can help boost your savings, especially if you're in a higher tax bracket when you retire.

More on Dave Ramsey

- Ramsey explains one major key to early retirement

- Dave Ramsey discusses one big money mistake to avoid

- Ramsey shares important advice on mortgages

Another myth people cling to is that they will continue to work during retirement. Ramsey explains that — while the fact is that the vast majority of retirees do not work after retirement age — if you're going to work during retirement, it should be because you want to, not because you have to.

Image source: Shutterstock

Ramsey makes a major point about Medicare

There is good news and bad news for retirees about Medicare. What it does well is give retirees affordable health insurance for doctor visits, medication and hospitalization.

But it does not cover deductible costs, copays or long-term care in an assisted facility that lasts for more than 100 days, Ramsey says.

"This is really important because the biggest health expense in retirement is long-term care," Ramsey wrote.

So Ramsey suggests getting long-term care insurance by age 60 and ramping up retirement savings for this purpose. One tool for this is an insurance policy with a Health Savings Account (HSA). The money invested in those grows tax free — and you don't pay taxes on the money you take out of an HSA in retirement to pay medical costs.

Related: Warren Buffett buys a beautifully cheap stock

Ramsey also clarifies his thoughts about another retirement falsehood many people believe: that it may be too late to save for retirement. By investing a significant percentage of your income toward retirement, even by age 50 or later, you can live a far better life in retirement than if you neglected the opportunity to do so.

"No matter how old you are or how much you’ve saved so far, you can still do something," Ramsey wrote. "Don’t waste another minute by counting on the government to take care of you in your later years."

Related: Veteran fund manager picks favorite stocks for 2024