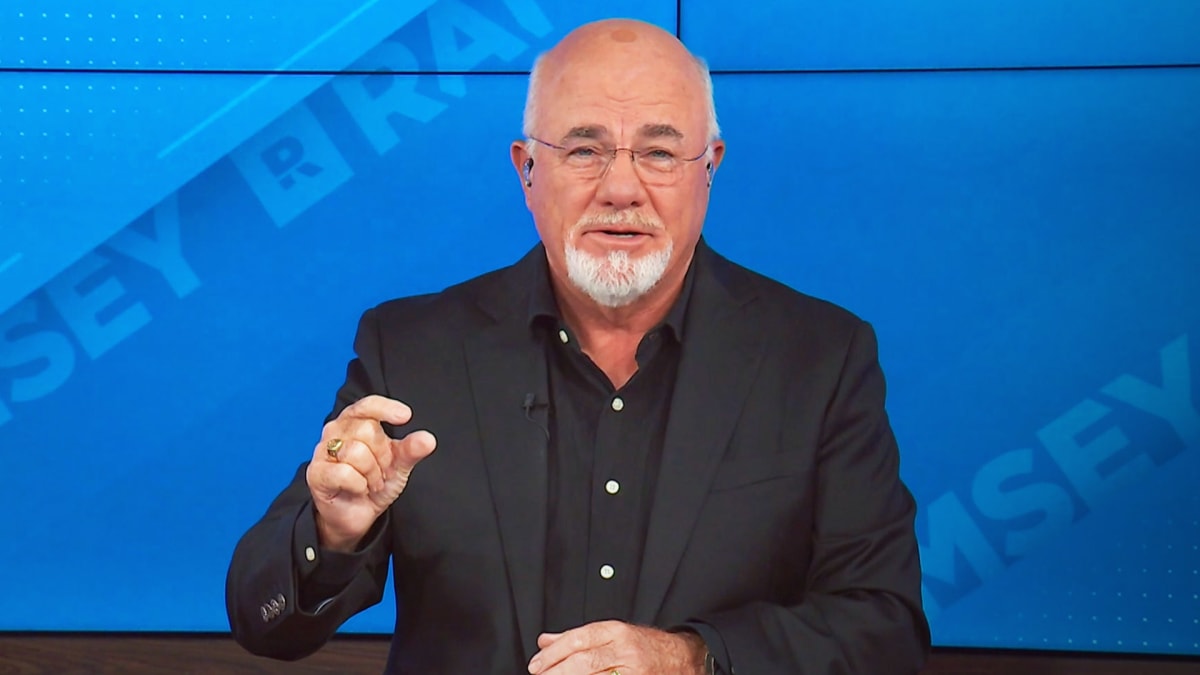

Dave Ramsey has had his fair share of correct and incorrect predictions. But his call on the housing market from this time last year seems to be fairly correct, at least for now.

The financial influence gave his prediction on the future of the housing market during his show “Ramsey Real Estate Reality Check” in July 2022, and said that he doesn’t see the market crashing the way it did in 2008. He said it’s mostly because the data shows that the market is different nowadays.

DON’T MISS: Dave Ramsey Explains Why Now Is a Great Time To Buy a House

Ramsey used the basic economic concept of supply and demand to make this prediction.

“This conclusion I came to is that we’re not going to see house prices crash because supply and demand just won’t allow it,” Ramsey said on show that streamed on July 14, 2022. “There’s too many buyers chasing too few houses and that’s going to hold the market.”

Ramsey compared that housing inventory data from 2007 to 2022, saying that the supply last year was only about a fourth of 2007. He also said that even though the pandemic drove more people to step out and buy houses, there is still a high demand for houses now given the higher population of “prime home buyers” or people in their mid-30s.

More Dave Ramsey:

- Dave Ramsey Has a Blunt Warning On a Key Homeowner Mistake

- Dave Ramsey Has Outspoken View on the ‘Lie’ About College

- This Couple’s Million-Dollar Confession Actually Floored Dave Ramsey

Based on median home prices in the market, Ramsey’s prediction has still held. Realtor.com shows that median housing prices dipped by about 10% from June 2022 to January 2023, but the number is now up about 1% year-on-year in the first five months of 2023.

Some may say that’s not great -- but it isn’t the housing crash many had feared. That’s what Ramsey said last year.

“I do think [the economy] is going to slow down, but that’s a far cry from 2008 that we’re going to see this huge drop that was unprecedented,” Ramsey said. “The only time in the last hundred years or so that we’ve seen house prices go down across the board in the United States was in 2008, and there was a different set of circumstances at that time.”

Of course, there’s still a chance that things change and Ramsey finds himself on the wrong end of the market despite his data deep dive. He also tried to remind his viewers of that last year.

“I’ve messed up plenty of times, so you get to decide as grown ups after you look at this information, whether it’s right or wrong,” Ramsey said.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.