If you have made mistakes with your money in the past, you are not alone.

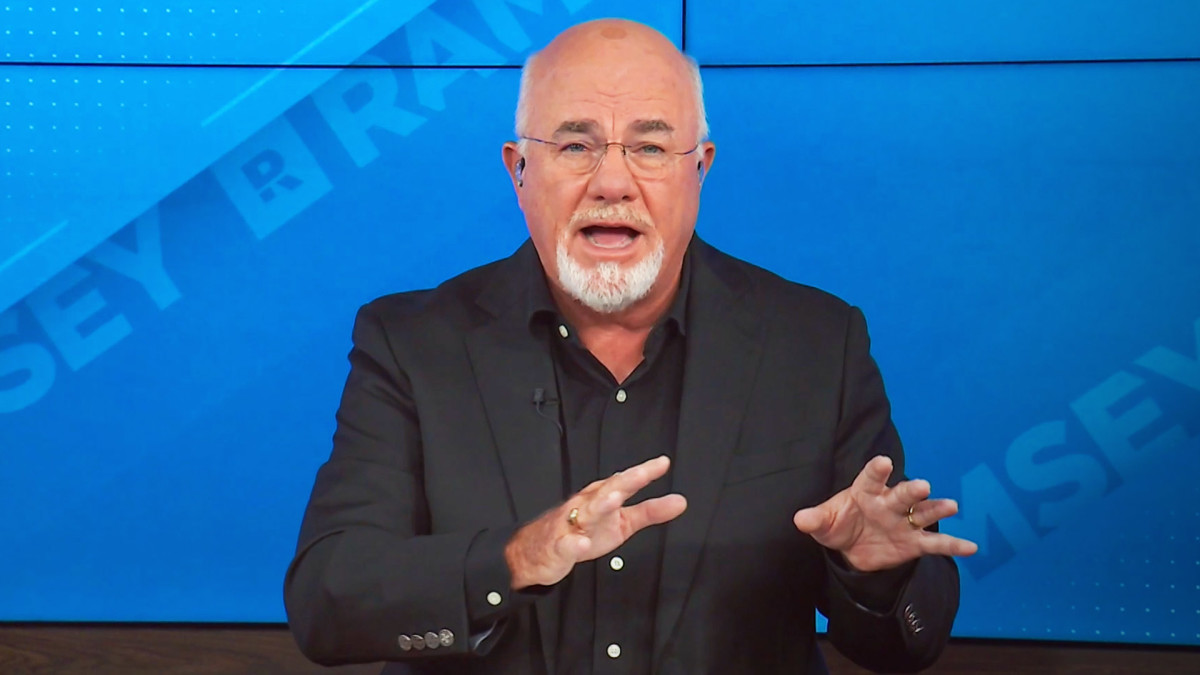

Personal finance author and radio host Dave Ramsey tells his followers not to fret over their previous blunders.

Related: Dave Ramsey has blunt words on car payments and retirement savings

In fact, one recent advice-seeker asked Ramsey about this exact thing, according to an email sent to TheStreet from Ramsey Solutions.

"Dear Dave," wrote a woman who identified herself as Brea. "I've made a lot of stupid money mistakes in the past. Even though I finally paid off six figures in debt a few years ago and am in control of my finances for the first time in my life, I'm having a hard time forgiving myself for all the dumb things I did."

"I have an emergency fund and other savings set aside, and I'm almost ready to buy a house," she continued. "But it seems like there's still a cloud hanging over my head from all my bad decisions. How do I stop obsessing over my past financial mistakes?"

Ramsey offered some advice about how she should approach her future financial aspirations, including buying the home.

"If you've had enough determination to pay off six figures' worth of debt and to build savings on top of that in the last few years, you're doing a phenomenal job," he wrote. "Most people would just make excuses or give up, but you educated yourself, put your head down and stomped out all that debt."

Dave Ramsey says he understands financial concerns

Ramsey was quick to embrace the woman's fears and ambitions.

"I'm very proud of you," he wrote. "What you've done speaks volumes about your character and self-discipline."

He quoted a legendary poet as he began to offer his advice.

"The late Maya Angelou once said, 'Do the best you can until you know better. Then when you know better, do better,'" he wrote. "That's the key for you, I think."

"Doing dumb things doesn't always mean you're a dumb person," he continued. "Sometimes, we just don't have the knowledge or guidance we need to do things the right way."

The Ramsey Show host then focused on what the woman had accomplished already.

"But once you learned a few things and saw there was a better way — a smarter way — you jumped in and made incredible things happen," he wrote. "You cleaned up your finances, and you changed your entire future for the better. I think that's pretty cool."

David McNew/Getty Images

Ramsey encourages forgetting the past and pursuing financial dreams

The personal finance coach had some more words about having a positive approach about her hopes for buying a house.

"And you know what else?" he asked. "It makes you a pretty smart lady. I think part of your struggle may be the fact that you've spent more time making the wrong decisions with money than you've spent making the right ones."

"That's understandable," he added. "But time will help heal that struggle. It'll distance you emotionally from the old you until you're confident in the new you — not just in your actions, but in your heart and mind."

More on Dave Ramsey

- Ramsey explains one major key to early retirement

- Dave Ramsey discusses one big money mistake to avoid

- Ramsey shares important advice on mortgages

Ramsey suggested a different way to think about finances — one that emphasizes overcoming struggles.

"I mean, think about it this way," he wrote. "If you violated trust with a friend, how would you rebuild it? First, it would take time. And second, it would take a series of trustworthy actions."

That's when Ramsey suggested an analogy to another life experience involving overcoming a problem.

"Let's say someone had a drinking problem for a long time, but they've been dry for three months," he wrote. "After three months, their spouse still might not trust them with the checkbook. I totally get that."

"It's a good start, but it's not like they haven't had a drink in three years," he continued. "That's where time comes into play. The more time they demonstrate a solid pattern of not going back to the bottle, the more evidence they create for why others should trust them."

Related: The average American faces one major 401(k) retirement dilemma

Ramsey ended with some more positive words.

"I think you've developed a pretty good track record of being smart with your money, Brea," he wrote. "So cut yourself some slack."

Related: Veteran fund manager picks favorite stocks for 2024