U.S. household debt levels have risen to $17.8 trillion this year, with credit card debt comprising over $1 trillion of the total. Americans are battling untenable levels of debt, and many are facing a shaky financial future.

Experts agree that paying down high-interest debt is the first step in taking control of your finances, but it is often tricky curtailing spending to have extra income to pay down debt.

Related: Dave Ramsey explains how your mortgage is key to early retirement

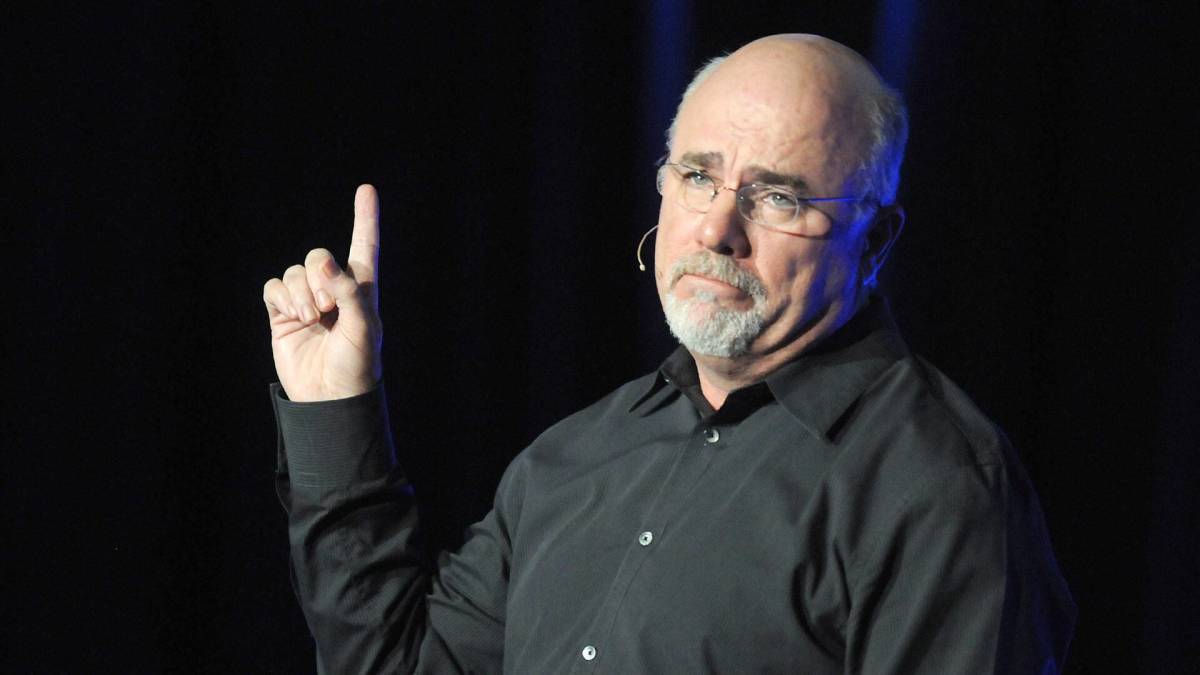

TheStreet spoke with Dave Ramsey about how consumers can realistically cut spending to stay within their budget. He offers a pragmatic approach: Cut out all non-essentials.

The key to reducing debt is reducing nonessential spending

Ramsey provides some tough love when asked about what Americans can do to rid themselves of debt.

“Just cut all the fat,” he said. “The deeper you cut, the more your friends think you're crazy because you're not doing anything, the faster you get out. It's math.”

More on personal finance:

- How your mortgage is key to early retirement

- Social Security benefits report confirms major changes are coming

- The average American faces one major 401(k) retirement dilemma

Visa has found that, barring 2020, consumer spending on leisure has steadily increased since 2013, reaching about 13% of total consumption in 2022. Recreation and leisure have become such a constant in people’s lives that it may feel difficult to completely cut them out of their budgets.

However, Ramsey suggests it’s the most straightforward path to becoming debt-free.

He continues, “Deep sacrifice increases the speed at which you get out of debt and the probability. And that could include working three jobs.”

Image source: Shutterstock

Short-term sacrifice leads to long-term financial freedom

“The typical family that we coach on the Ramsey show or in our classes is able to clear off all of their debt in somewhere around 18 to 24 months. But that 18 to 24 months is hell. It's awful.”

For many people, cutting out recreational spending is the biggest challenge in budgeting.

Related: Dave Ramsey has a warning for people looking to buy a home now

Visa Business and Economic Insights analysis found an interesting paradox. Though time spent on leisure activities has decreased over the past few decades, it has created an inverse effect on consumption.

In 2013, leisure spending comprised 9.5% of total consumption; by 2022, it had risen to 13%. Ramsey suggests that this increase in leisure spending is a big part of the problem.

“You have to just work all the time,” he said. “You don't see the inside of a restaurant unless you're working there. You're not going on vacation.”

He continues, “People will think you're crazy. But those two years are the catalyst that blows the lid off the math and allows you to build wealth the rest of your life.”

Related: Veteran fund manager picks favorite stocks for 2024